index

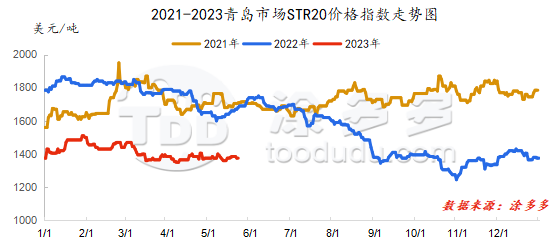

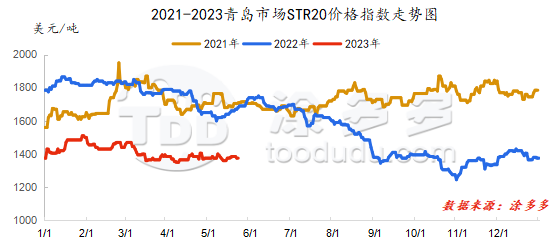

On May 23, the STR20 price index of natural rubber in the Qingdao market was US$1375/ton, which was stable from the previous trading day.

market analysis

Futures market: On May 23, the opening price of RU2309 contract: 12185 yuan/ton, the highest price: 12270 yuan/ton, the lowest price: 11950 yuan/ton, and the closing price was 11975 yuan/ton, down 165 yuan/ton from the previous trading day; The opening price of NR2307 contract: 9730 yuan/ton, the highest price: 9785 yuan/ton, the lowest price: 9585 yuan/ton, and the closing price was 9590 yuan/ton, down 100 yuan/ton from the previous trading day.

spot market

Supply:

Foreign countries: The production areas of Thailand and Vietnam are basically in the early stages of cutting, and have not been fully increased, and the output of raw materials is relatively limited.

China: China's production areas have recently resumed harvesting. Hainan's harvesting situation is still better than Yunnan, and the price difference between raw materials between the two regions is large.

|

price type

|

May 22

|

May 23

|

rise and fall

|

units

|

|

raw material prices

|

Thailand

|

glue

|

43.7

|

43.8

|

0.1

|

baht/kg

|

|

cup glue

|

39.95

|

39.9

|

-0.05

|

baht/kg

|

|

Yunnan

|

Glue (into the dry glue factory)

|

10600

|

10600

|

0

|

Yuan/ton

|

|

rubber block

|

10700

|

10700

|

0

|

Yuan/ton

|

|

Hainan

|

Glue (into the dry glue factory)

|

12000

|

12200

|

200

|

Yuan/ton

|

|

Glue (Jinnong Dairy Factory)

|

12000

|

12200

|

200

|

Yuan/ton

|

Demand: Currently, the start-up of most all-steel tire enterprises remains stable. For some manufacturers with maintenance plans, maintenance incidents have been postponed, or will be postponed until the middle and late of the following month. Most enterprises start operations in the short term will maintain stable operation. After mid-May, the brand price policy has been slightly loosened, and downstream buying sentiment has been slightly driven. Considering the slow delivery of goods at the terminal and insufficient inventory digestion capacity, it is currently mostly the process of downward transfer of manufacturers 'inventory.

Futures spot price list

|

price type

|

May 22

|

May 23

|

rise and fall

|

units

|

|

price of finished products

|

Shandong

|

China All Latex

|

11850

|

11850

|

0

|

Yuan/ton

|

|

Qingdao

|

Thailand No. 20 standard glue

|

1375

|

1375

|

0

|

us dollars/ton

|

|

Qingdao

|

Thailand No. 20 mixed glue

|

10700

|

10650

|

-50

|

Yuan/ton

|

|

Ningbo

|

Hainan

|

8500

|

8500

|

0

|

Yuan/ton

|

|

Ningbo

|

Thailand Non-Yellow Bulk

|

9100

|

9100

|

0

|

Yuan/ton

|

|

futures prices

|

SHFE

|

RU main contract closing price

|

12175

|

11975

|

-200

|

Yuan/ton

|

|

INE

|

NR main contract closing price

|

9725

|

9590

|

-135

|

Yuan/ton

|

|

the current price difference

|

Main force-Thailand No. 20 mixed glue

|

1475

|

1325

|

-150

|

Yuan/ton

|

|

Main force-China All Latex

|

325

|

125

|

-200

|

Yuan/ton

|

|

relevant exchange rate

|

us dollar against the RMB

|

7.039

|

7.0671

|

0.0281

|

Yuan

|

|

Thai Baht to RMB

|

0.2111

|

0.2109

|

-0.0002

|

Yuan

|

market outlook

The output of raw materials in the main production areas of Thailand and Vietnam abroad was limited in the early stage of cutting. The production areas of Yunnan in China had not yet been fully cut due to the influence of powdery mildew. Hainan's output is in a narrow range of increasing quantities, and there is still support on the cost side. Judging from the rubber production, the supply of new rubber is relatively limited, and the insufficient supply of self-produced products is to a certain extent the growth rate of full latex warehouse receipts; On the demand side, foreign trade orders are supported, and tire starts have rebounded. However, terminal demand is approaching the seasonal off-season in the Chinese market. There is accumulated pressure on the finished product inventory of tire factories. Recently, the market has strong short sentiment, and rubber prices continue to rebound in the short term. There is insufficient motivation to be cautious. Look more.