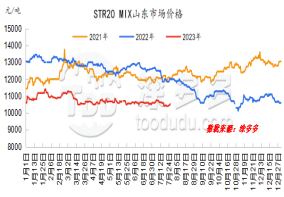

Figure 1: Shandong market price of STR20 MIX

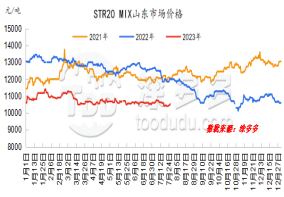

Figure 2: Zhejiang market price of ordinary bulk imported from Thailand

dry rubber

This week, rubber maintained a narrow range of fluctuations, and a narrow range of gains occurred at the end of the week. However, actual support was insufficient, so beware of falling expectations. China's foreign producing areas have successively entered the stage of increasing new rubber. The price of raw materials is expected to fall strongly, and overseas import sources are increasing seasonally. China's total natural rubber stocks are still climbing, which has suppressed rubber prices. The terminal market is weak and stable in summer, domestic shipments are slow, and purchasing raw materials on bargain hunting makes it difficult to significantly boost rubber prices. Fundamental weakness is under pressure.

natural latex

The overall price of natural latex remained relatively stable this week and fell slightly, but the overall room for decline was limited. In July, raw materials in the world's major producing areas entered a seasonal increase in production. The supply increase was expected to be obvious. The increase in supply in Thailand's producing areas was slow, but the total output will be higher than in June, and the pressure on factories 'exports increased. The price difference between the inside and outside of Thailand's imported rubber is still upside down. However, the upside down range has been corrected, which will stimulate traders' sentiment to replenish stocks to a certain extent. However, so far, there has been no significant improvement in actual downstream demand, and the overall trading atmosphere is still in a cold state.

Market outlook forecast:

1、中国外产区降雨天气缓和,原料上量预期升温;

2、预计下周期中国轮胎开工率窄幅波动为主;

3、中国青岛库存量维持累库趋势,高库存压力短期内难以缓和;

4、收储消息、美联储加息等。