Analysis of natural rubber market price on August 2

index

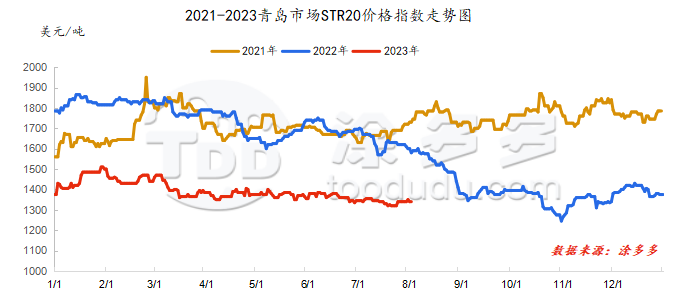

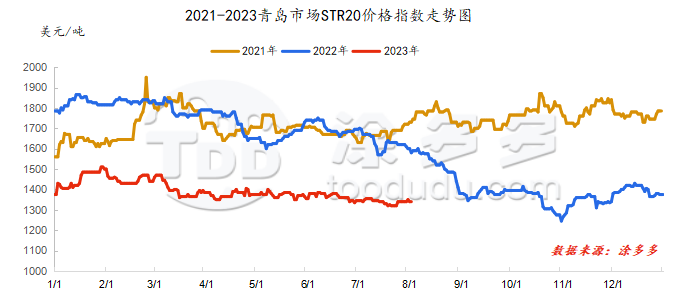

On August 2, the STR20 price index of natural rubber in the Qingdao market was US$1340/ton, which was stable from the previous trading day.

market analysis

futures market

|

date

|

Previous period: RU Futures

|

|

main contract

|

closing price

|

|

opening price

|

Low-end price

|

High-end price

|

closing price

|

RU01

|

RU05

|

RU09

|

|

an 8 - 2

|

12165

|

12110

|

12220

|

12210

|

13175

|

13150

|

12210

|

|

August 1

|

12325

|

12170

|

12330

|

12185

|

13165

|

13165

|

12185

|

|

rise and fall

|

-160

|

-60

|

-110

|

25

|

10

|

-15

|

25

|

|

date

|

Previous period energy: NR futures (closing price)

|

|

NR main force

|

NR01

|

NR05

|

NR09

|

|

an 8 - 2

|

9520

|

9635

|

9700

|

9500

|

|

August 1

|

9505

|

9635

|

9700

|

9490

|

|

rise and fall

|

15

|

0

|

0

|

10

|

spot market

Supply:

Foreign countries: Rainfall and weather in foreign production areas have eased, and raw materials are in a state of high volume, driving raw material prices to fluctuate within a narrow range.

China: Yunnan's production areas in Hainan are basically in a stage of steady increase in production. Among them, Yunnan's production areas have occasionally experienced rainfall recently, but the overall impact is small. Coupled with this, supply in Hainan's production areas has also gradually returned to normal, and raw material prices have fallen within a narrow range.

|

price type

|

August 1

|

an 8 - 2

|

rise and fall

|

units

|

|

raw material prices

|

Thailand

|

glue

|

--

|

--

|

--

|

baht/kg

|

|

cup glue

|

--

|

--

|

--

|

baht/kg

|

|

Yunnan

|

Glue (into the dry glue factory)

|

10900

|

10700

|

-200

|

Yuan/ton

|

|

rubber block

|

9700

|

9500

|

-200

|

Yuan/ton

|

|

Hainan

|

Glue (into the dry glue factory)

|

10600

|

10500

|

-100

|

Yuan/ton

|

|

Glue (Jinnong Dairy Factory)

|

10600

|

10500

|

-100

|

Yuan/ton

|

Demand side: Due to the decline in overall export orders in August, some all-steel tire companies experienced maintenance for about 5 days, which delayed the overall start of construction. It is expected that due to the short-term impact of orders, in order to control inventory growth, the capacity utilization rate of all-steel tire enterprises is still expected to decline. In terms of the market, low-end products currently have low profits. In order to ensure a certain profit margin, the market demand for mid-to-high-end products has increased. The market demand for low-end goods still dominates, and the overall volume has shrunk.

Futures spot price list

|

price type

|

August 1

|

an 8 - 2

|

rise and fall

|

units

|

|

price of finished products

|

Shandong

|

China All Latex

|

12150

|

12050

|

-100

|

Yuan/ton

|

|

Qingdao

|

Thailand No. 20 standard glue

|

1340

|

1340

|

0

|

us dollars/ton

|

|

Qingdao

|

Thailand No. 20 mixed glue

|

10550

|

10550

|

0

|

Yuan/ton

|

|

Ningbo

|

Hainan

|

8050

|

8050

|

0

|

Yuan/ton

|

|

Ningbo

|

Thailand Non-Yellow Bulk

|

9000

|

9000

|

0

|

Yuan/ton

|

|

the current price difference

|

Main force-Thailand No. 20 mixed glue

|

1635

|

1660

|

25

|

Yuan/ton

|

|

Main force-China All Latex

|

35

|

160

|

125

|

Yuan/ton

|

|

relevant exchange rate

|

us dollar against the RMB

|

7.1826

|

7.1826

|

0

|

Yuan

|

|

Thai Baht to RMB

|

0.2168

|

0.2168

|

0.0000

|

Yuan

|

market outlook

The macro sentiment is improving. The news of Tianjiao dumping has slightly interfered with market sentiment. The purchase and storage rules have not yet been fully implemented. In addition, the current rubber price is at a relatively low level, there is still support at the bottom, the seasonal increase in fundamental supply is clear, and China's downstream tires have started to stabilize. The demand side has little effect on boosting rubber prices. There is limited room for upward and downward in the short-term long-short game, and shock adjustment is the main focus.