Analysis of natural rubber market price on August 25

index

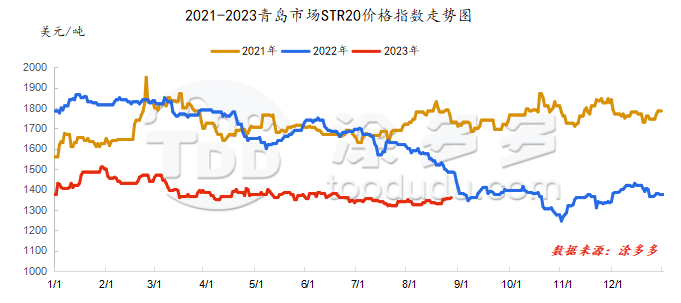

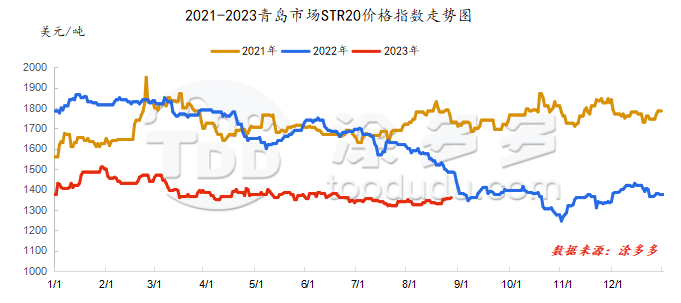

On August 25, the STR20 price index of natural rubber in the Qingdao market was US$1360/ton, up US$5/ton from the previous trading day, or 0.37%.

market analysis

futures market

|

date

|

Previous period: RU Futures

|

|

main contract

|

closing price

|

|

opening price

|

Low-end price

|

High-end price

|

closing price

|

RU01

|

RU05

|

RU09

|

|

August 25

|

13205

|

13190

|

13340

|

13270

|

13270

|

13240

|

12085

|

|

August 24

|

13210

|

13165

|

13270

|

13210

|

13210

|

13190

|

12065

|

|

rise and fall

|

-5

|

25

|

70

|

60

|

60

|

50

|

20

|

|

date

|

Previous period energy: NR futures (closing price)

|

|

NR main force

|

NR01

|

NR05

|

NR09

|

|

August 25

|

9700

|

9855

|

9850

|

9625

|

|

August 24

|

9655

|

9800

|

9780

|

9585

|

|

rise and fall

|

45

|

55

|

70

|

40

|

spot market

Supply:

Foreign countries: There are still disturbances in rainfall and weather in foreign production areas, the volume of raw materials has been blocked, and raw material prices have increased within a narrow range.

China: Yunnan's production areas in Hainan are basically in a stage of steady increase in volume. The rainfall has moderated and raw material prices have remained relatively low. Recently, the rainfall in Hainan production areas has been relatively frequent. It is heard that the actual rubber prices received by processing plants are high.

|

price type

|

August 24

|

August 25

|

rise and fall

|

units

|

|

raw material prices

|

Thailand

|

glue

|

43.2

|

43.4

|

0.2

|

baht/kg

|

|

cup glue

|

39.05

|

39.25

|

0.2

|

baht/kg

|

|

Yunnan

|

Glue (into the dry glue factory)

|

10500

|

10500

|

0

|

Yuan/ton

|

|

rubber block

|

9500

|

9500

|

0

|

Yuan/ton

|

|

Hainan

|

Glue (into the dry glue factory)

|

10600

|

10600

|

0

|

Yuan/ton

|

|

Glue (Jinnong Dairy Factory)

|

10600

|

10800

|

200

|

Yuan/ton

|

Demand: At present, the operating rate of most enterprises remains high, the foreign trade order volume of some enterprises has been slightly loosened, and the domestic sales scheduling has increased. Currently, most all-steel tire enterprises are in a balanced state of production and sales, and some enterprises are still full of orders and lack production capacity., the phenomenon of shortage has not eased yet. In terms of the market, recent market shipments in Hebei, Shanxi, Northeast and other regions have improved slightly. Due to many cyclical factors, during the peak summer replacement period, concentrated replacement is currently needed.

Futures spot price list

|

price type

|

August 23

|

August 25

|

rise and fall

|

units

|

|

price of finished products

|

Shandong

|

China All Latex

|

12000

|

12000

|

0

|

Yuan/ton

|

|

Qingdao

|

Thailand No. 20 standard glue

|

1355

|

1360

|

5

|

us dollars/ton

|

|

Qingdao

|

Thailand No. 20 mixed glue

|

10710

|

10750

|

40

|

Yuan/ton

|

|

Ningbo

|

Hainan

|

8600

|

8600

|

0

|

Yuan/ton

|

|

Ningbo

|

Thailand Non-Yellow Bulk

|

9350

|

9350

|

0

|

Yuan/ton

|

|

the current price difference

|

Main force-Thailand No. 20 mixed glue

|

2500

|

2520

|

20

|

Yuan/ton

|

|

Main force-China All Latex

|

1210

|

1270

|

60

|

Yuan/ton

|

|

relevant exchange rate

|

us dollar against the RMB

|

7.2883

|

7.3023

|

0.014

|

Yuan

|

|

Thai Baht to RMB

|

0.216

|

0.215

|

-0.0010

|

Yuan

|

market outlook

The world is about to enter a seasonal increase in production. However, at present, periodic rainfall has led to a shortage of new rubber supply. Demand for latex products has picked up and pushed up raw material prices. There is a certain support for rubber prices. Downstream tires are scheduled smoothly and just need to be replaced and shipped. The situation has improved slightly. The superimposed dark glue continues to go to the warehouse, or the sentiment of being bullish on the market still exists. Rubber prices may remain strong and volatile, but the increase in supply in the later period is still a normal trend, so beware of falling rubber prices.