85,300

September 11, 2023, 4:34 PM

Analysis of natural rubber market price on September 11

index

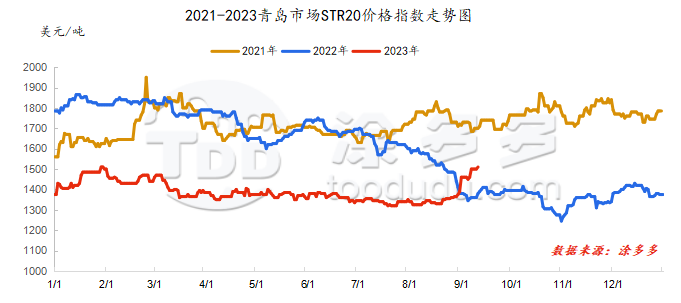

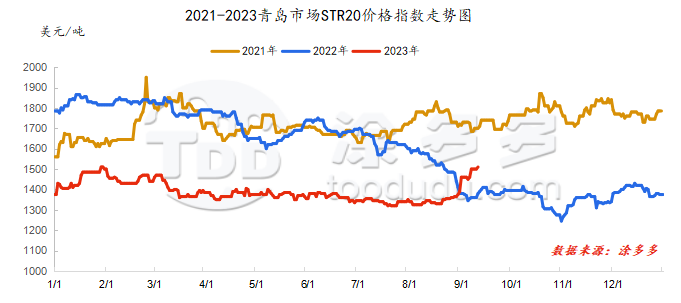

On September 11, the STR20 price index of natural rubber in the Qingdao market was US$1510/ton, up US$10/ton from the previous trading day, or 0.67%.

market analysis

futures market

|

date

|

Previous period: RU Futures

|

|

main contract

|

closing price

|

|

opening price

|

Low-end price

|

High-end price

|

closing price

|

RU01

|

RU05

|

RU09

|

|

September 11

|

14290

|

14150

|

14460

|

14355

|

14355

|

14310

|

12875

|

|

September 8

|

14450

|

14170

|

14680

|

14255

|

14255

|

14215

|

12770

|

|

rise and fall

|

-160

|

-20

|

-220

|

100

|

100

|

95

|

105

|

|

date

|

Previous period energy: NR futures (closing price)

|

|

NR main force

|

NR01

|

NR05

|

NR09

|

|

September 11

|

11160

|

10850

|

10900

|

10640

|

|

September 8

|

10895

|

10695

|

10700

|

10640

|

|

rise and fall

|

265

|

155

|

200

|

0

|

spot market

Supply:

Foreign countries: There are still disturbances in rainfall and weather in foreign production areas, the volume of raw materials has been blocked, and raw material prices have increased within a narrow range.

China: Rainy weather in Hainan's production area still affects normal rubber cutting operations. Spot prices of concentrated milk have improved within a narrow range, promoting a better rubber harvest sentiment in processing plants and supporting raw material prices to remain firm at high levels. Rainfall in Yunnan's production areas eased, but the purchasing sentiment of dry rubber factories was high, driving up raw material prices.

|

price type

|

September 8

|

September 11

|

rise and fall

|

units

|

|

raw material prices

|

Thailand

|

glue

|

46.3

|

47

|

0.7

|

baht/kg

|

|

cup glue

|

41.55

|

41.75

|

0.2

|

baht/kg

|

|

Yunnan

|

Glue (into the dry glue factory)

|

11700

|

11700

|

0

|

Yuan/ton

|

|

rubber block

|

9900

|

9900

|

0

|

Yuan/ton

|

|

Hainan

|

Glue (into the dry glue factory)

|

12600

|

12600

|

0

|

Yuan/ton

|

|

Glue (Jinnong Dairy Factory)

|

12600

|

12600

|

0

|

Yuan/ton

|

On the demand side: The operating rate of tire companies continues to be high, and some companies show signs of price increases, which has slightly boosted company shipments. Most other companies are mainly wait-and-see, and shipments are relatively stable. Overall, production and sales are basically stable.

Futures spot price list

|

price type

|

September 8

|

September 11

|

rise and fall

|

units

|

|

price of finished products

|

Shandong

|

China All Latex

|

12983

|

12983

|

0

|

Yuan/ton

|

|

Qingdao

|

Thailand No. 20 standard glue

|

1500

|

1510

|

10

|

us dollars/ton

|

|

Qingdao

|

Thailand No. 20 mixed glue

|

11670

|

11750

|

80

|

Yuan/ton

|

|

Ningbo

|

Hainan

|

9300

|

9300

|

0

|

Yuan/ton

|

|

Ningbo

|

Thailand Non-Yellow Bulk

|

10200

|

10200

|

0

|

Yuan/ton

|

|

the current price difference

|

Main force-Thailand No. 20 mixed glue

|

2585

|

2605

|

20

|

Yuan/ton

|

|

Main force-China All Latex

|

1272

|

1372

|

100

|

Yuan/ton

|

|

relevant exchange rate

|

us dollar against the RMB

|

7.3659

|

7.3414

|

-0.0245

|

Yuan

|

|

Thai Baht to RMB

|

0.2131

|

0.2124

|

-0.0007

|

Yuan

|

market outlook

In September, the world's major rubber producing areas were in the peak season for rubber tapping, and output is expected to rebound further month-on-month. However, short-term rainfall has affected the development of rubber tapping work, and the output of raw materials has been limited. The narrow rise in raw material prices has brought support to the cost side, superimposed on China's port inventory and social inventories have been slightly removed, and the decline in inventories has eased the pressure on rubber prices. China's traditional peak demand season and strong exports, coupled with limited short-term imports, China will continue to destock in September, and rubber prices may continue to be strong.