86,834

September 20, 2023, 4:37 PM

Analysis of natural rubber market price on September 20

index

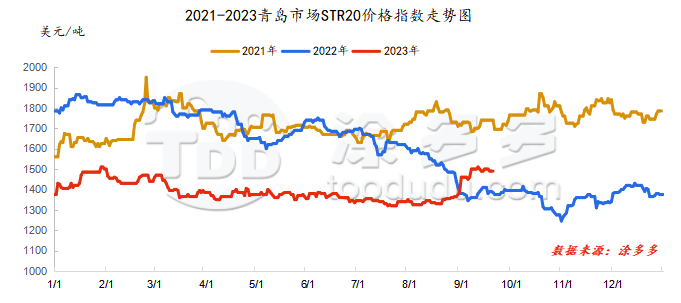

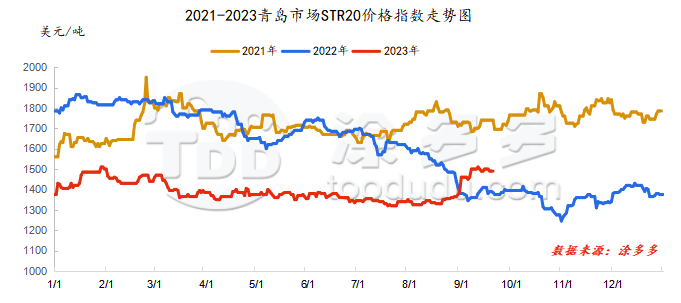

On September 20, the STR20 price index of natural rubber in the Qingdao market was US$1490/ton, which was stable compared with the previous trading day.

market analysis

futures market

|

date

|

Previous period: RU Futures

|

|

main contract

|

closing price

|

|

opening price

|

Low-end price

|

High-end price

|

closing price

|

RU01

|

RU05

|

RU09

|

|

September 20

|

14205

|

14165

|

14320

|

14210

|

14210

|

14120

|

14110

|

|

on September 19

|

14285

|

14235

|

14480

|

14235

|

14235

|

14170

|

14160

|

|

rise and fall

|

-80

|

-70

|

-160

|

-25

|

-25

|

-50

|

-50

|

|

date

|

Previous period energy: NR futures (closing price)

|

|

NR main force

|

NR01

|

NR05

|

NR09

|

|

September 20

|

10830

|

10740

|

10910

|

11065

|

|

on September 19

|

10840

|

10735

|

10890

|

11065

|

|

rise and fall

|

-10

|

5

|

20

|

0

|

spot market

Supply:

Foreign countries: There are still disturbances in rainfall and weather in foreign production areas, the volume of raw materials has been blocked, and raw material prices have increased within a narrow range.

China: Rainy weather in Hainan's production area still affects normal rubber tapping operations, supporting raw material prices to remain firm at high levels. Rainfall in Yunnan's production areas has eased, and raw material prices have remained relatively stable.

|

price type

|

on September 19

|

September 20

|

rise and fall

|

units

|

|

raw material prices

|

Thailand

|

glue

|

48.1

|

48.2

|

0.1

|

baht/kg

|

|

cup glue

|

43

|

43.3

|

0.3

|

baht/kg

|

|

Yunnan

|

Glue (into the dry glue factory)

|

11800

|

11800

|

0

|

Yuan/ton

|

|

rubber block

|

9700

|

9700

|

0

|

Yuan/ton

|

|

Hainan

|

Glue (into the dry glue factory)

|

12600

|

12600

|

0

|

Yuan/ton

|

|

Glue (Jinnong Dairy Factory)

|

12600

|

12600

|

0

|

Yuan/ton

|

On the demand side: The start-up of enterprises remains high, and no company storage, production reduction or maintenance has been found. At present, orders from semi-steel tire companies are still in short supply. Coupled with the recent price increases, the supply of low-cost products in the short term is tight, and the overall inventory of companies is relatively low. Recently, the market has continued to have "speculation", and the increase in downstream demand has been weak. Most channels are bearish on the future outlook. There is no obvious sign of "buying up" in the market. Most of them continue the on-demand strategy, and some are targeted at moderately replenishing low-priced products.

Futures spot price list

|

price type

|

on September 19

|

September 20

|

rise and fall

|

units

|

|

price of finished products

|

Shandong

|

China All Latex

|

13017

|

12967

|

-50

|

Yuan/ton

|

|

Qingdao

|

Thailand No. 20 standard glue

|

1490

|

1490

|

0

|

us dollars/ton

|

|

Qingdao

|

Thailand No. 20 mixed glue

|

11710

|

11730

|

20

|

Yuan/ton

|

|

Ningbo

|

Hainan

|

9400

|

9350

|

-50

|

Yuan/ton

|

|

Ningbo

|

Thailand Non-Yellow Bulk

|

10150

|

10100

|

-50

|

Yuan/ton

|

|

the current price difference

|

Main force-Thailand No. 20 mixed glue

|

2525

|

2480

|

-45

|

Yuan/ton

|

|

Main force-China All Latex

|

1218

|

1243

|

25

|

Yuan/ton

|

|

relevant exchange rate

|

us dollar against the RMB

|

7.3123

|

7.3158

|

0.0035

|

Yuan

|

|

Thai Baht to RMB

|

0.2104

|

0.2074

|

-0.0030

|

Yuan

|

market outlook

The prices of raw materials in various producing areas still maintain varying degrees of rise. In the short term, the cost side still supports rubber prices. Driven by foreign trade and seasonal demand, the sales of downstream tire companies have improved slightly, supporting the relatively stable start-up of their factories. Some companies have begun to raise prices one after another, thereby ensuring that they need to purchase raw materials. China's ports and port inventories and social inventories still maintain a small amount of destocking, and the warehousing situation is still acceptable. Overall, supply and demand in the short term are basically supported by rubber prices, and the market may maintain a volatile trend.