94,528

October 13, 2023, 4:35 PM

Analysis of natural rubber market price on October 13

index

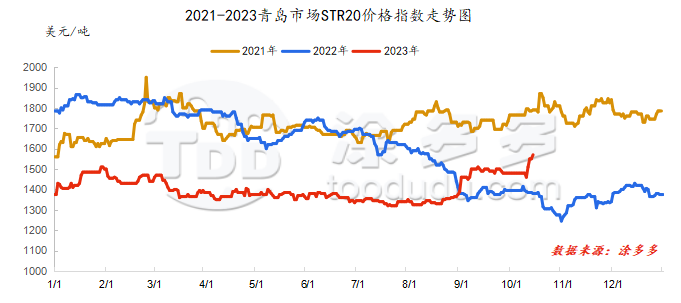

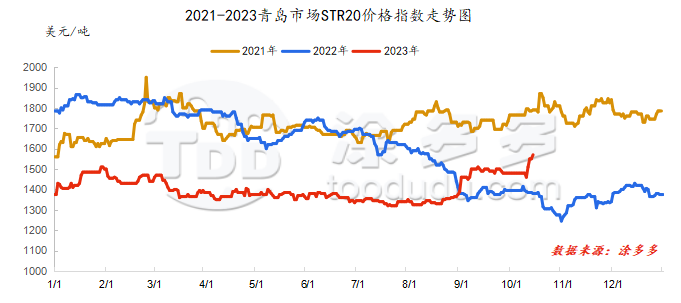

On October 13, the STR20 price index of natural rubber in the Qingdao market was US$1570/ton, up US$20/ton from the previous trading day, or 1.29%.

market analysis

futures market

|

date

|

Previous period: RU Futures

|

|

main contract

|

closing price

|

|

opening price

|

Low-end price

|

High-end price

|

closing price

|

RU01

|

RU05

|

RU09

|

|

October 13

|

14700

|

14620

|

14890

|

14840

|

14840

|

14765

|

14730

|

|

October 12

|

14350

|

14350

|

14725

|

14665

|

14665

|

14610

|

14560

|

|

rise and fall

|

350

|

270

|

165

|

175

|

175

|

155

|

170

|

|

date

|

Previous period energy: NR futures (closing price)

|

|

NR main force

|

NR01

|

NR05

|

NR09

|

|

October 13

|

11405

|

11390

|

11400

|

11150

|

|

October 12

|

11255

|

11255

|

11330

|

11150

|

|

rise and fall

|

150

|

135

|

70

|

0

|

spot market

Supply:

Foreign countries: There are still disturbances in rainfall and weather in foreign production areas, the volume of raw materials has been blocked, and raw material prices have increased within a narrow range.

China: Rainy weather in Hainan's production area still affects normal rubber tapping operations, supporting raw material prices to remain firm at high levels. Rainfall in Yunnan's production areas has eased, and raw material prices have remained relatively stable.

|

price type

|

October 12

|

October 13

|

rise and fall

|

units

|

|

raw material prices

|

Thailand

|

glue

|

50.6

|

--

|

--

|

baht/kg

|

|

cup glue

|

46.7

|

--

|

--

|

baht/kg

|

|

Yunnan

|

Glue (into the dry glue factory)

|

11700

|

11900

|

200

|

Yuan/ton

|

|

rubber block

|

9700

|

9900

|

200

|

Yuan/ton

|

|

Hainan

|

Glue (into the dry glue factory)

|

12300

|

12400

|

100

|

Yuan/ton

|

|

Glue (Jinnong Dairy Factory)

|

12300

|

12400

|

100

|

Yuan/ton

|

Demand: It is understood that the production schedule of maintenance companies has gradually returned to the pre-holiday level. Affected by factors such as some logistics outages and high-speed restrictions during the holidays, companies shipped slowly during the week, and finished product inventory increased slightly. During the week, the prices in the all-steel tire and semi-steel tire market rose. It is expected that the short-term all-steel tire and semi-steel tire market will continue to be dominated by shortages. In addition, with the gradual start of logistics, the trading activity in the all-steel tire replacement market will increase month-on-month. Taking into account the price increase factor, more businesses mainly absorb inventories.

Futures spot price list

|

price type

|

October 12

|

October 13

|

rise and fall

|

units

|

|

price of finished products

|

Shandong

|

China All Latex

|

13317

|

13500

|

183

|

Yuan/ton

|

|

Qingdao

|

Thailand No. 20 standard glue

|

1550

|

1570

|

20

|

us dollars/ton

|

|

Qingdao

|

Thailand No. 20 mixed glue

|

12170

|

12280

|

110

|

Yuan/ton

|

|

Ningbo

|

Hainan

|

9600

|

9650

|

50

|

Yuan/ton

|

|

Ningbo

|

Thailand Non-Yellow Bulk

|

10450

|

10450

|

0

|

Yuan/ton

|

|

the current price difference

|

Main force-Thailand No. 20 mixed glue

|

2495

|

2560

|

65

|

Yuan/ton

|

|

Main force-China All Latex

|

1348

|

1340

|

-8

|

Yuan/ton

|

|

relevant exchange rate

|

us dollar against the RMB

|

7.3168

|

7.3238

|

0.007

|

Yuan

|

|

Thai Baht to RMB

|

0.2069

|

0.2063

|

-0.0006

|

Yuan

|

market outlook

Rainfall weather in Thailand's production areas continues to inhibit the output of raw materials, providing support for raw material prices. Coupled with the fact that factories sold more for months in the early stage, processing factories are still competing for raw materials, and speculation on the cost side continues to heat up. The continuous rainfall in the early period also led to a gap in overseas output and supply in August and September, which in turn promoted the continued trend of removing dark glue in China. On the other hand, the operating rate of downstream tire companies has remained at a high level. However, the overall tire shipment and sales situation have weakened, and factory inventories have increased, which has put a certain pressure on rubber prices. However, so far, the overall spot market has still maintained a positive attitude.