95,910

December 7, 2023, 4:13 PM

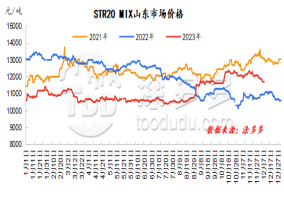

Figure 1: Shandong market price of STR20 MIX

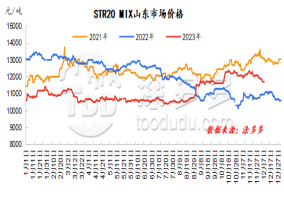

图2:浙江市场泰国进口普通散装价格

dry rubber

Natural rubber market prices fell within a narrow range this week. China's Yunnan production areas have stopped cutting, and glue prices are not yet available. Recent rainfall in Southeast Asian production areas such as Thailand and Vietnam has eased. Overseas supply is in a relatively peak season, and there is a narrow range of room for raw material prices to fall. The overall demand for downstream tires on the demand side is in the seasonal off-season, and the accumulated inventory of finished products still exists. Some companies have adjusted back in starting operations, and their sentiment towards raw material procurement is relatively weak. Qingdao's inventory has continued the trend of destocking, which provides certain support for the continued decline in rubber prices. On the whole, positive factors in the early period were traded on the market, there were no new hype points in the short term, there was insufficient upward driving on the market, and rubber will still be weak in the short term.

natural latex

This week, China's concentrated milk offer remained relatively strong, with limited room for decline. At present, overseas northeastern Thailand is already in a peak period, and the southern rainy season has entered a period of high volume. Raw material support is expected to be loose, and the bearish sentiment remains on the market. However, due to factors such as precipitation for a short time, the speed of glue production has been slowed down, and the inventory level of processing plants is not high., and due to limited profit margins of production and marketing, upstream processing plants are reluctant to sell at prices. There is not much available spot in circulation in the sales area, and the shipping pressure of traders is limited, supporting the relatively strong performance of natural latex prices.

Market outlook forecast:

1、国外产区降雨天气或存缓和预期,季节性上量阶段,原料价格支撑预期走弱,中国产区临近停割期,成本支撑走高;

2、预计下周期轮胎样本企业产能利用率或将下滑;

3、中国青岛库存量或存去库趋势,高库存压力有所缓和;

4、汇率、美联储加息等。