Analysis of natural rubber market price on July 19

index

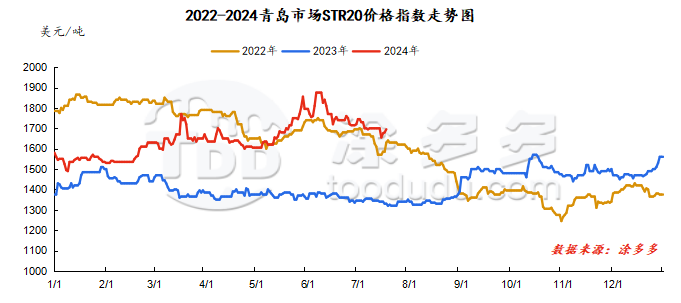

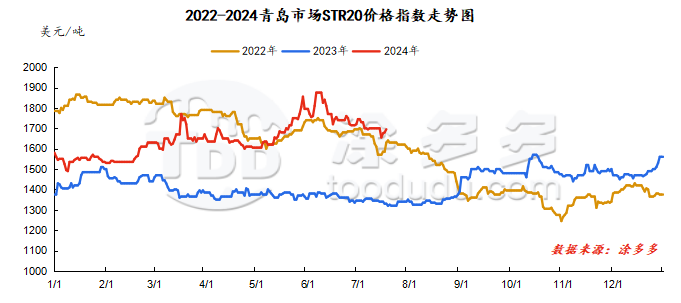

July 19June, Natural Rubber Qingdao Market STR20 Price Index1695 beautifulYuan/ton, compared withStable on the previous trading day.

market analysis

market analysis

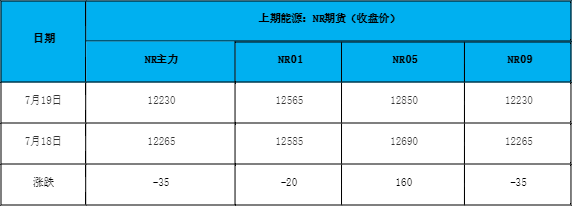

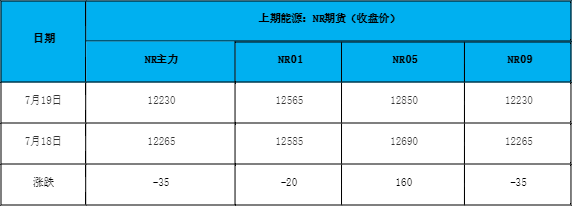

futures market

spot market

Supply:

Foreign countries: There is more rainfall in northeastern Thailand than in the south, and there is still more rainfall overall, which affects the pace of new rubber release. Restocking by secondary suppliers is not smooth, and there is not much room for downside in raw material purchase prices.

Domestic: Currently, Yunnan's production areas are in a state of comprehensive opening cutting, and the amount of glue has been increased in an all-round way. Production starts to maintain a high operating state, and the dry rubber factory can start to reach 90%-100% after the water volume is fully opened.

The overall precipitation and weather in Hainan's production area are too heavy, and the development and advancement of rubber tapping work have been hindered, which supports the price of raw material glue to stop falling and rebound during the week. Under the disturbance of rain, Hainan's raw material output shrank significantly compared with last week. It was heard that the daily rubber harvest of the island at the end of the week is roughly 3000 tons.

Demand side:It is understood that orders are sufficient, semi-steel tire companies are still enthusiastic about starting work, most companies are full of orders to meet order demand, and the overall inventory is still acceptable. The performance of all-steel tire enterprises is differentiated, with some large-scale enterprises starting steadily, while others have stopped and reduced production according to their own conditions. In terms of the market, channel stocks are sufficient, and trading activity in the southern market has slightly improved compared with the previous period. The main reason is that after the rainy season, moderate replenishment is the main reason, and the actual terminal demand boost is limited. The northern market has mostly performed flat and purchased on demand.

Futures spot price list

market outlook

Today, the main rubber contract still maintains a weak consolidation. Recently, the overall fluctuations in rubber futures have been relatively limited. The fundamentals have remained at the previous stage. The seasonal release trend on the supply side remains unchanged. However, due to recent weather disturbances, the decline in raw material prices has slowed down, and the cost side Support is higher. The arrival of domestic ships and cargo in Hong Kong will ease the tight domestic spot circulation. Demand in the downstream market is flat, the pressure on production and sales of tire companies will not decrease, and flexible production control will continue. In the short term, the negative sentiment in the Tianjiao market is relatively heavy, and rubber prices are still expected to weaken under the market game.

market analysis

market analysis