A word into a poke, thick milk raw materials began to lead the decline

It is not difficult to see from the above chart that in fact, the decline in spot prices at concentrated milk ports is basically a clear trend. Judging from the trend of raw materials prices in Hainan producing areas, in fact, since mid-June, the guidance prices of domestic state-owned raw materials for concentrated dairy mills in Hainan producing areas have begun to show a relatively obvious downward trend. Compared with the end of June, Hainan raw materials prices have dropped from 14500 yuan/ton to 13600 yuan/ton today, a decrease of 6.21%.

It is understood that the prices of raw materials in Hainan have dropped rapidly. On the one hand, the weather conditions in Hainan's production areas have been better recently, and the expected increase in raw material output is relatively obvious. It is heard that the island's daily output has returned to the level of 6000, and the rapid increase in raw materials has dragged on its prices. On the other hand, some processing plants said that the start of sporadic factories has been limited in the near future due to environmental issues. During the period of rapid release of raw materials, the start of processing plants has tightened, and the pressure on glue consumption has increased, further accelerating the decline in glue prices; Three of its traders said that the port currently has a large number of domestically produced rubber in stock, but the actual willingness of the downstream to receive goods is low, which has led to the current obstruction of the port's spot shipment. The risk of some domestically produced rubber being stranded in the port has increased, and the traders 'sentiment in receiving goods has also been affected. Shipments from the processing factory are not smooth, and it is difficult for raw material prices to maintain a continuous upward trend.

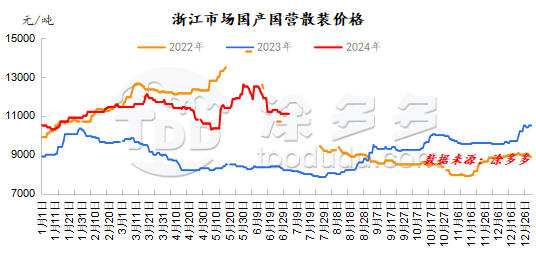

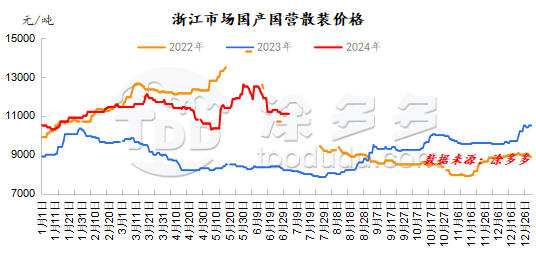

Under the influence of raw material prices, port spot prices have begun to show signs of bearish sentiment since mid-June. As of today,The price of Hainan concentrated milk in the Zhejiang market was 10700 yuan/ton, down 1800 yuan/ton, or 14.4%, compared with 12500 yuan/ton at the beginning of June%; Thailand's bulk price was 13400 yuan/ton, down 300 yuan, or 2.19%, from 13700 yuan/ton in early June. From the perspective of spot prices, domestic rubber led the decline significantly, upstream supply pressure gradually increased, raw material prices led the decline first, and downstream product companies were in the off-season season of seasonal demand. The price increase of finished products orders was sluggish, and they were cautious about spot purchase of high-priced concentrated milk. The transaction was sluggish, and the trend of oversupply became more and more obvious, which was a significant drag on the high-priced spot at the port.

Judging from the current situation, the negative sentiment in the thick milk market is relatively biased. From the supply side, domestic and foreign production areas currently have less rainfall and better weather conditions. They are all in a suitable rubber tapping period. The supply of raw materials is expected to heat up, and there is room for continued decline in raw material cost support. Now the rapid decline in raw material prices is also confirming this trend. On the demand side, clichés are at a low level. Various problems such as slow sales of products and sluggish price increases for finished products have also caused the downstream of concentrated milk to be in a weak state. The actual demand for concentrated milk has always maintained a "on-demand" model, which has a negative impact on the price increase of concentrated milk is relatively weak. Port spot situation: Currently, the port has more domestic goods and Vietnam has more goods, and traders have begun to actively offer offers. This phenomenon is not difficult to see that the port has more spot goods and less demand. This situation also suppresses spot prices. Under the shadow of the bearish factor, the decline in the natural latex market price has become a general trend.