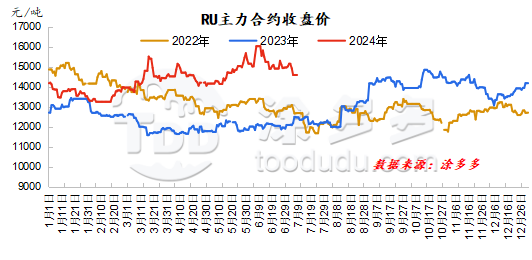

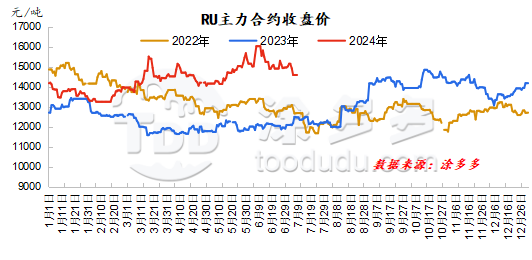

Since natural rubber futures fluctuated and fell last week, the main natural rubber contract has basically remained floating in a narrow range of around 14600 in the near future. The expected increase in supply in the production area has led to a relatively weak upward momentum. However, the trend of inventory dewarehousing still exists, and there is also room for decline. Relatively limited, there is both long and short news coexists in the entire market.

Upstream supply: negative

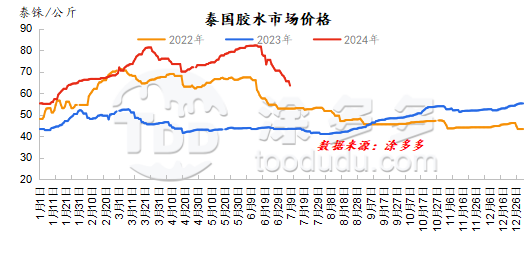

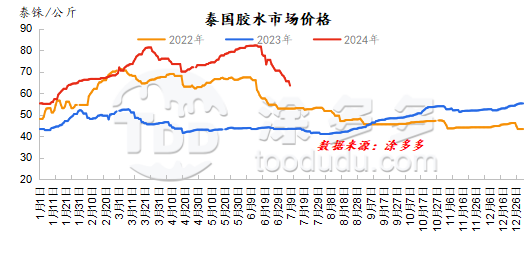

As far as the current Thai production areas are concerned, the rainfall and weather have improved, and the overall output of raw materials has improved significantly compared with the previous period, which in turn stimulated a significant decline in raw material prices. From the perspective of processing plants, with the output of raw materials and the decline in rubber prices, the processing profits of the processing plants have begun to recover. However, judging from the current selling prices in China, the processing profits are still negative, which to a certain extent also affects the enthusiasm of upstream processing plants to collect rubber. Under the expectation of release of raw materials, pressure on the supply side has begun to rise, and there is still room for decline in raw material prices.

Downstream demand: negative

Tires: As of now, tiresstart-up of enterprisesmostcontinued to be stableTrend, some all-steel companies remain at a low level of start-ups。overseas marketsSea freight prices in the Middle East, Africa and other places have fallen,However, there was no significant increase in orders. The domestic market has experienced more rainfall recently, residents 'transportation and travel have been restricted, and infrastructure start-ups have remained weak. Replacement demand is average, and terminal shipments are relatively low.Individual deposit promotion policy support to drive salesHowever, in summary, shipments in the domestic market are slow and corporate sales pressure remains unabated。

Purchasing and storage news: limited impact

It is understood that the news came out in JuneThe purchase and storage plan is 55,000 tons, and the actual transaction is 28,500 tons. It is plannednumberwithactualPurchase and storage quantityare all in oppositionlessexpected,In terms of market expectations, there is a high probability that there will be the next round of purchasing and purchasing plans in the later period. However, as far as this news is concerned, most of them are in short-term stimulation and the long-term impact is relatively limited.

Adjustment of import tariffs and value-added tax: classification of rubber types

On July 4, according to the Import and Export Commodity Tax Rate Inquiry Platform of the General Administration of Customs of China, Chinese Customs made adjustments to the value-added tax and tariffs on natural latex, natural rubber cigarette sheet rubber, and technical classification natural rubber. Among them, the value-added tax on natural latex, tobacco sheet rubber, and technical classification natural rubber has been reduced from the original 13% to 9%, while the mixed rubber remains unchanged at 13%; the tariff expression of natural latex and tobacco sheet rubber has been revised, and the technical classification natural rubber has been deleted. The fixed tariff of 1500 yuan/ton is deleted, and only the 20% ad valorem tax expression is retained.Judging from the overall adjustment, this adjustment is mainly aimed at value-added tax, and the tariff has not changed in essence. Judging from the type of glue, the most obvious impact is concentrated milk. The value-added tax on domestic concentrated milk has always been 9%, while the value-added tax on imported concentrated milk used to be 13%, which means that the price is relatively flat. Under the condition of water, the advantage of imported rubber increases, and the price of concentrated milk will be empty in the short term after the VAT adjustment. However, the impact on other gums is relatively limited.