86,211

September 19, 2023, 4:30 PM

PVC futures analysis: September 19th V2401 contract opening price: 6387, highest price: 6491, lowest price: 6351, position: 813159, settlement price: 6425, yesterday settlement: 6396, up: 29, daily trading volume: 1461527 lots, precipitated capital: 3.693 billion, capital inflow: 138 million.

List of comprehensive prices by region: yuan / ton

|

Area

|

Price 9.18

|

Price 9.19

|

Rise and fall

|

Remarks

|

|

North China

|

6210-6290

|

6250-6300

|

40/10

|

Send to cash remittance

|

|

East China

|

6230-6330

|

6280-6350

|

50/20

|

Cash out of the warehouse

|

|

South China

|

6310-6400

|

6350-6440

|

40/40

|

Cash out of the warehouse

|

|

Northeast China

|

6200-6300

|

6200-6300

|

0/0

|

Send to cash remittance

|

|

Central China

|

6230-6300

|

6230-6250

|

0/-50

|

Send to cash remittance

|

|

Southwest

|

6100-6200

|

6150-6250

|

50/50

|

Send to cash remittance

|

PVC spot market: China PVC market mainstream transaction prices rose slightly, prices rise and fall relatively frequently. Compared with the valuation, it rose 10-40 yuan / ton in North China, 20-50 yuan / ton in East China, 40 yuan / ton in South China, stable in Northeast China, 50 yuan / ton in Central China and 50 yuan / ton in Southwest China. Upstream PVC production enterprises factory price part of the increase of 50 yuan / ton, most stable wait-and-see, coincide with the signing of the contract on Tuesday, but have not heard of large single volume status. The performance of the futures price is on the strong side, and the price offer of traders in various regions is mainly higher than that of yesterday, but the high price is still more difficult to close the deal. Although spot prices have risen slightly, there are still some merchants who ship goods according to the original price. after the futures price goes up, the price advantage of point price sources disappears, and the basis offer does not change much, including the 01 contract in East China-(70-150). South China 01 contract-(0-50-120), North 01 contract-(400-500), Southwest 01 contract-(250). Although the price goes up, the feedback of the spot market is not good, the purchasing enthusiasm of the lower reaches is low, and the trading atmosphere of the spot market is weak.

From the perspective of futures: & the opening of the night price of the nbsp; PVC2401 contract is mainly due to small-range volatility, and the overall price fluctuation direction is not clear. After the start of morning trading, the price rose relatively obviously, but although it fell slightly, the afternoon price still fluctuated first and then rose at the end of the day. 2401 contracts fluctuate in the range of 6351-6491 throughout the day, with a price difference of 140,01.01 contracts with an increase of 18474 positions and 813159 positions so far. The 2405 contract closed at 6488, with 63637 positions.

PVC Future Forecast:

Futures: PVC2401 contract price operation showed a small upward performance, relatively strong and still rose in late trading, the futures price as a whole as we expected to run within the range of 6300-6500, the overall trend in the third quarter is still expected in the case, first of all, PVC futures prices are not good to fall, but sustained high prices also need greater motivation, and the current lack of fundamental support, from the lack of capital trends. Therefore, we believe that even if the futures price rises slightly, the extent of the advantage and the risk will be relatively increased. From the perspective of chlor-alkali balance, today's caustic soda SH405 main contract involves trading. In the short term, the operation of the futures price observes the performance in the range of 6350-6550.

Spot: futures prices in the two cities rose slightly, but did not lead to an improvement in the transaction. On the contrary, after the futures price went up, the supply advantage of the spot price disappeared, and the lower reaches more and more fell into a wait-and-see mentality, while hedgers are not active in taking goods. We mentioned that the current fundamental support of PVC is insufficient. First of all, calcium carbide prices continue to decline 50-100 yuan / ton, followed by Formosa Plastics in Taiwan, China, in October, the pre-sale PVC price is reduced by 30-40 US dollars / ton, India CIF is reduced by 30 in 870 US dollars / ton, China CFR is reduced by 40 in 845 US dollars / ton, Taiwan FOB in China is reduced by 40 in US $800 / ton, and Vietnam FOB in 805 US dollars / ton. Therefore, due to the lack of support from the fundamentals, although the prices of the two markets have strengthened, we think there are certain risks. Oil prices rose in the outer disk, with Brent crude futures trading close to $95 a barrel at the start of the day, as Saudi Arabia and Russia were expected to worsen supply tensions by further extending additional production cuts. On the whole, the PVC spot market will still face frequent small adjustments.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread

|

|

PVC

|

Contract price difference

|

Price 9.18

|

Price 9.19

|

Rate of change

|

|

V2401 collection

|

6390

|

6488

|

98

|

|

Average spot price in East China

|

6280

|

6315

|

35

|

|

Average spot price in South China

|

6355

|

6395

|

40

|

|

PVC2401 basis difference

|

-110

|

-173

|

-63

|

|

V2405 collection

|

6436

|

6530

|

94

|

|

V2401-2405 closed

|

-46

|

-42

|

4

|

|

PP2401 collection

|

7991

|

8073

|

82

|

|

Plastic L2401 collection

|

8430

|

8520

|

90

|

|

V--PP basis difference

|

-1601

|

-1585

|

16

|

|

Vmure-L basis difference of plastics

|

-2040

|

-2032

|

8

|

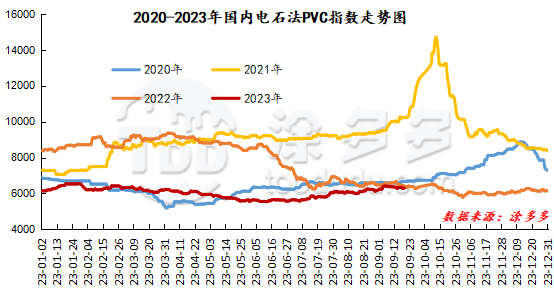

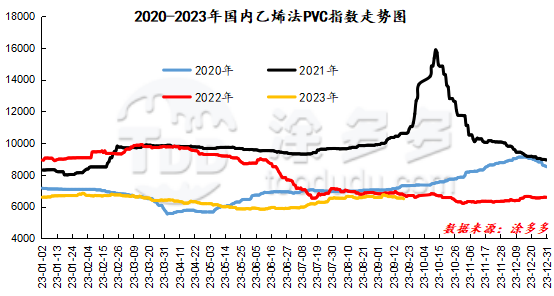

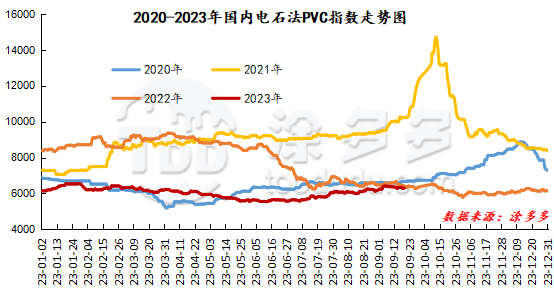

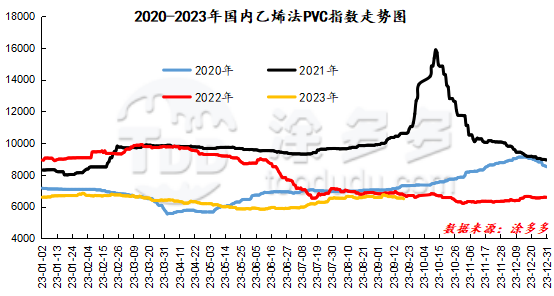

China PVC Index: according to Tudor data, the Chinese calcium carbide PVC spot index rose 25.85, or 0.412%, to 6300.85 on Sept. 19. The ethylene PVC spot index was 6491.42, down 48.9, with a range of 0.748%. The calcium carbide index rose, the ethylene index rose, and the ethylene-calcium carbide index spread was 190.57.

PVC warehouse receipt daily:

|

Variety

|

Warehouse / branch warehouse

|

9.18 warehouse orders

|

9.19 warehouse receipts

|

change

|

|

Polyvinyl chloride

|

China Reserve shares

|

843

|

843

|

0

|

|

|

Guangzhou materials

|

441

|

441

|

0

|

|

|

China Central Reserve Nanjing

|

402

|

402

|

0

|

|

Polyvinyl chloride

|

Cosco sea logistics

|

274

|

274

|

0

|

|

|

Zhenjiang Middle and far Sea

|

274

|

274

|

0

|

|

Polyvinyl chloride

|

Zhejiang International Trade

|

3,417

|

3,417

|

0

|

|

Polyvinyl chloride

|

Peak supply chain

|

1,392

|

1,392

|

0

|

|

Polyvinyl chloride

|

Jiangyin Xiefeng

|

1,329

|

1,329

|

0

|

|

Polyvinyl chloride

|

Benniu Port, Changzhou

|

9,592

|

9,592

|

0

|

|

Polyvinyl chloride

|

Hangzhou port logistics

|

153

|

153

|

0

|

|

Polyvinyl chloride

|

Jiangsu Zhengsheng

|

2,181

|

2,181

|

0

|

|

Polyvinyl chloride

|

Changxing, Zhejiang

|

120

|

120

|

0

|

|

Polyvinyl chloride

|

Jiangsu Yanjin

|

2,582

|

2,582

|

0

|

|

Polyvinyl chloride

|

Xiamen Xiangyu (Benniu Port)

|

300

|

300

|

0

|

|

Polyvinyl chloride

|

Xiamen Xiangyu (Shanghai Xiangyu)

|

230

|

230

|

0

|

|

Polyvinyl chloride

|

Zhejiang tomorrow (Benniu Port)

|

298

|

298

|

0

|

|

Polyvinyl chloride

|

Zhejiang tomorrow (Zhejiang International Trade)

|

149

|

149

|

0

|

|

Polyvinyl chloride

|

Products Zhongda Chemical Industry (Benniu Port)

|

450

|

450

|

0

|

|

Polyvinyl chloride

|

Products Zhongda Chemical Industry (Railway Changxing)

|

300

|

300

|

0

|

|

Polyvinyl chloride

|

Yongan Capital (Benniu Port)

|

1,200

|

1,200

|

0

|

|

Polyvinyl chloride

|

Specialty petrochemical (Benniu Port)

|

2,399

|

2,399

|

0

|

|

Polyvinyl chloride

|

Specialty Petrochemical (Zhejiang International Trade)

|

1,800

|

1,800

|

0

|

|

Polyvinyl chloride

|

Sino-Thai Duojing (Zhejiang International Trade)

|

1,238

|

1,238

|

0

|

|

Polyvinyl chloride

|

Sinotrans East China

|

274

|

274

|

0

|

|

Polyvinyl chloride

|

Tiantai International Trade (Benniu Port)

|

600

|

600

|

0

|

|

Polyvinyl chloride

|

Zhejiang Jiahua

|

30

|

30

|

0

|

|

PVC subtotal

|

|

31,151

|

31,151

|

0

|

|

Total

|

|

31,151

|

31,151

|

0

|

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.