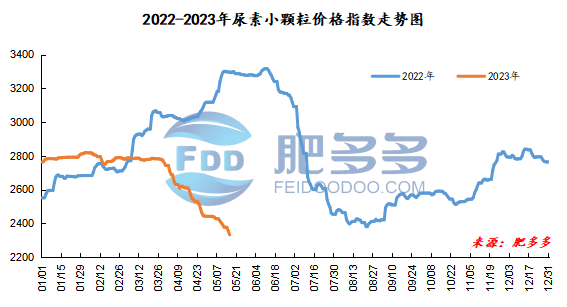

Daily review of urea: The futures market trend is flat and spot prices are falling across the board! (May 16)

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on May 16 was 2,332.73, down 21.59 from yesterday, down 0.92% month-on-month, and down 29.19% year-on-year.

Urea futures market:

The Urea UR2309 contract fluctuated in a narrow upward range after the opening of early trading today. In the afternoon, the intraday futures price fell first and then rose, reaching an intraday high of 1872 in the late session and closing at 1864 in the late session. The opening price of the Urea UR2309 contract: 1849, the highest price: 1872, the lowest price: 1843, the settlement price: 1857, the closing price: 1864. The closing price increased by 15, or 0.81% compared with the settlement price of the previous trading day. The daily fluctuation range is 1843-1872, and the spread is 29; The 09 contract has reduced its position by 5159 lots today, and so far, it has held 276120 lots.

Spot market analysis:

Today, China's urea spot market prices fell across the board, with quotes in various mainstream regions falling by 20-80 yuan/ton. Recently, the focus of urea spot prices has been falling almost day by day, and the difference in quotations in various mainstream regions has gradually narrowed. As of today, prices have dropped by about 100 yuan/ton in a week, but new orders have not improved. Downstream procurement is more cautious and more about maintaining a wait-and-see attitude. Specifically, prices in Northeast China fell to 2,290 - 2,340 yuan/ton. Prices in North China fell to 2,110 - 2,330 yuan/ton. Prices in Northwest China fell to 2,260 - 2,270 yuan/ton. Prices in Southwest China fell to 2,200 - 2,600 yuan/ton. Prices in East China fell to 2,290 - 2,330 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,280 - 2,500 yuan/ton, and the price of large particles fell to 2,370 - 2,440 yuan/ton. Prices in South China fell to 2,420 - 2,520 yuan/ton.

Market outlook forecast:

In terms of futures, futures prices have almost collapsed since April, which is difficult to provide good support for the spot market. On the supply side, manufacturers alternate between equipment maintenance and production resumption, and daily production fluctuates within a narrow range. Currently, it is above 165,000 tons. China's overall supply is still at a high level. In terms of inventory, factory inventories in some regions continue to be under pressure. In terms of demand, corn manure is shipped in East China and Central China, but the Northeast and Northwest regions are gradually withdrawing from the market. Agricultural demand is relatively deadlocked, and labor demand is also mainly in need of procurement. Overall, in the short term, the urea market is still dominated by negative trends, and spot prices are showing a weak downward trend. In the long run, international urea is also continuing to test downward, and it may be difficult for the future to rely on exports to drive the Chinese market.