Phosphate Fertilizer Daily Review: Down! Ammonium phosphate market is weak and downward (May 16)

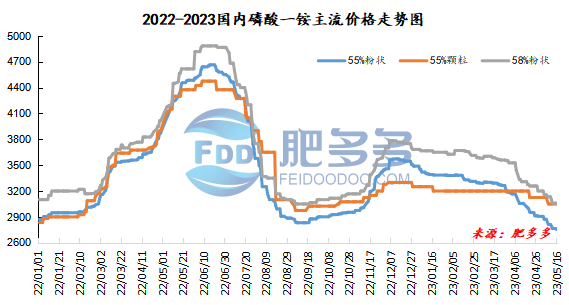

Monoammonium phosphate price index:

According to Feiduo data, on May 16, the 55% powder index of China's monoammonium phosphate was 2,753.13, down; the 55% particle index was 3,050.00, stable; and the 58% powder index was 3,060.00, stable.

Monoammonium phosphate market analysis and forecast:

Today, China's monoammonium phosphate market continues to weaken, and market prices in some regions have been reduced within a narrow range. Currently, the price of 55 powder in Yunnan has dropped to 2,550 - 2,600 yuan/ton, and the price of 55 powder in Hubei has dropped to 2,650 - 2,700 yuan/ton. Some major factories continue to implement bottom-guaranteed policies, with downstream factories purchasing small quantities on demand, and limited transactions of new orders in the market. Currently, the ammonium monoamine industry has a starting capacity of slightly more than 30%, but since demand is also weak, the market can fully maintain a balance between production and sales. Raw material prices fluctuate little, cost support is weak, and the market still holds a bearish mentality. Overall, the monoammonium market will continue to remain weak and move downward in the near future.

Specific market prices in each region are as follows:

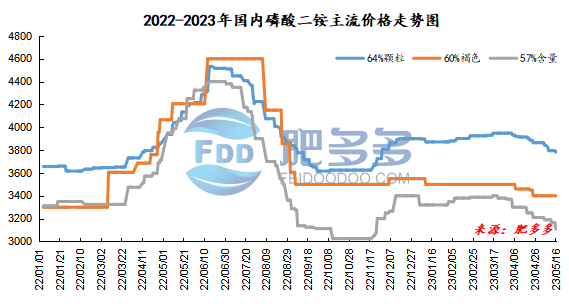

Diammonium phosphate price index:

According to Feiduo data, on May 16, the 64% particle index of China's mainstream diammonium phosphate was 3,781.67, down; the 60% brown index was 3,400.00, stable; and the 57% content index was 3,107.50, down.

Diammonium phosphate market analysis and forecast:

China's diammonium phosphate market also fell today, with market quotes falling by 50-100 yuan/ton. At present, terminal demand for corn manure in North and East China has started slowly, and demand has always been tepid. Downstream compound fertilizer factories have a heavy wait-and-see attitude. Coupled with insufficient cost support, the start of the diammonium industry has dropped to 4.5%. Demand in the export market is also weak, and industry operators are bearish. Diammonium market is expected to continue to fluctuate downward in the short term.

Specific market prices in each region are as follows: