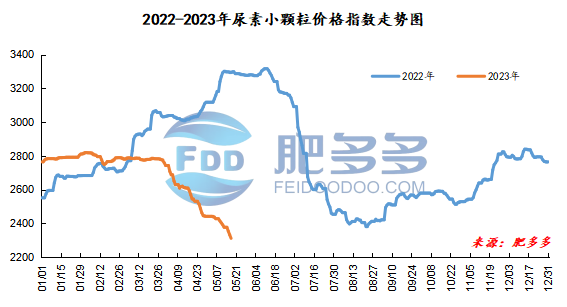

Urea Daily Review: Futures market rebounded slightly and spot prices continued to fall! (May 17)

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on May 17 was 2,311.82, down 20.91 from yesterday, down 0.90% month-on-month, and down 29.86% year-on-year.

Urea futures market:

The price of the urea UR2309 contract fluctuated upward in a narrow range after the opening of early trading today to the intraday high of 1881 and then fluctuated downward. In the afternoon, the futures price fell to the lowest point of 1852 and then fluctuated upward again, closing at 1872 in the late session. The opening price of the Urea UR2309 contract: 1863, the highest price: 1881, the lowest price: 1852, the settlement price: 1867, the closing price: 1872. The closing price increased by 15, or 0.81% compared with the settlement price of the previous trading day. The daily fluctuation range is 1852-1881, and the spread is 29; The 09 contract has increased its position by 2060 lots today, and has held 278180 lots so far.

Spot market analysis:

Today, China's urea spot market prices continued to fall, mainly concentrated in Northeast China, North China and Central China. At present, agricultural demand in Northeast China is gradually ending, and new orders are not satisfactory. In North China and Central China, although urea is still being shipped, downstream buyers are buying up and not buying down, and they have a heavy wait-and-see attitude. Therefore, factories continue to lower their quotations for sale. Specifically, prices in Northeast China fell to 2,250 - 2,330 yuan/ton. Prices in North China fell to 2,090 - 2,320 yuan/ton. Prices in the northwest region are stable at 2,260 - 2,270 yuan/ton. Prices in Southwest China are stable at 2,200 - 2,600 yuan/ton. Prices in East China fell to 2,270 - 2,330 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,230 - 2,480 yuan/ton, and the price of large particles stabilized at 2,370 - 2,440 yuan/ton. Prices in South China fell to 2,380 - 2,420 yuan/ton.

Market outlook forecast:

In terms of futures, futures prices have almost collapsed since April, but spot prices have fallen slightly, and the basis has risen to a high level. Today, futures rebounded slightly and stabilized. We still need to continue to pay attention to the trend of futures. In terms of supply, manufacturers have alternated between equipment maintenance and production resumption. Currently, the daily output has dropped below 170,000 tons, and the overall market supply is relatively sufficient. In terms of inventory, factory inventories in some regions continue to be under pressure, and the overall inventory volume is not large. In terms of demand, corn manure is being shipped in East China and Central China, but the Northeast and Northwest regions are gradually ending. Agricultural demand is relatively deadlocked, and labor demand is also mainly in need of procurement. The overall demand performance is not good, and it is basically difficult to achieve the expected peak demand season. Overall, we maintain yesterday's judgment: in the short term, the urea market will remain bearish and spot prices will show a weak downward trend; in the long run, international urea will also continue to test downward, and it may be difficult for the future to rely on exports to drive the Chinese market.