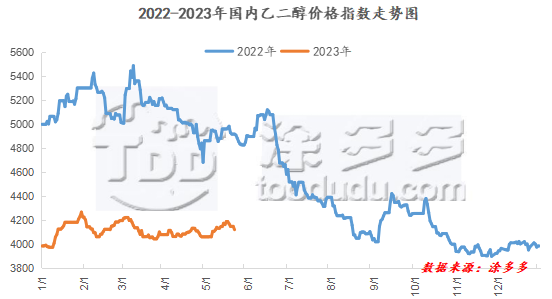

Ethylene glycol: The supply and demand structure is not favorable, supporting spot prices to continue to fall

On May 24, the ethylene glycol market price index was 4,090.70, down 16.7 from yesterday.

Market focus:

1. The peak summer travel peak in the United States is approaching, and the positive support brought by OPEC+ production cuts continues, and international oil prices rise. NYMEX crude oil futures rose US$0.86/barrel or 1.19% for monthly 07 contract 72.91;ICE cloth oil futures 07 contract 76.84 rose US$0.85/barrel or 1.12%.

2. The 300,000-ton synthesis gas-to-synthesis MEG unit in Weihe River, Shaanxi Province began to be shut down for maintenance on May 8, which is expected to last for 15-20 days. In the later stage, close attention will be paid to the operation of the unit.

3. Zhejiang Petrochemical No. 3 plant was stopped first, and the recovery time was to be determined.

Futures dynamics:

On May 24, 2023, the opening price of the EG main contract 2309 of the DSE: 4125, the highest price: 4156, the lowest price: 4065, the settlement price: 4112, the closing price: 4069, and the open position:470409, down 82 from the previous working day, or 1.98%.

Spot market: Today, the price of ethylene glycol market continued to operate in a weak position. The futures market was weak and difficult to change. The trading atmosphere on the market was general, and some players were gradually pessimistic about the future outlook. In the morning, the focus of MEG's internal trading was weak and downward, and market negotiations were weak. At present, the spot basis is around 85-90 yuan/ton for the 2009 contract premium, 4,020 - 4,025 yuan/ton is negotiated, and some transactions are around 4,030 - 4,040 yuan/ton. In the afternoon, MEG's internal market focus was weak, and the market was generally buying. At present, the spot basis is around 85-90 yuan/ton for the 2009 contract premium, and the negotiations are 4000- 4,005 yuan/ton, and some transactions are around 4000 yuan/ton. As of press time, the price for South China is around 4280 yuan/ton, which remains unchanged from yesterday; the price for East China is around 4038 yuan/ton, down 32 yuan/ton from the previous working day.

List of external market prices:

|

market |

price terms |

2023/5/22 |

2023/5/22 |

rise and fall |

units |

|

China |

CFR |

489-491 |

494-496 |

-5 |

us dollars/ton |

|

us Gulf |

FOB |

18-20 |

18-20 |

0 |

cents/lb |

|

Southeast Asia |

CFR |

512-514 |

512-514 |

0 |

us dollars/ton |

|

northwestern Europe |

CIF |

465-472 |

465-472 |

0 |

euros/ton |

Mainstream market price list:

|

areas |

2023/5/24 |

2023/5/23 |

rise and fall |

units |

|

National |

4090.70 |

4118.84 |

-28.14 |

|

|

South China |

4280 |

4280 |

0 |

Yuan/ton |

|

East China |

4038 |

4070 |

-32 |

Yuan/ton |

Company Price List:

Unit: yuan/ton

|

areas |

production enterprises |

2023/5/24 |

2023/5/23 |

rise and fall |

remarks |

|

Northeast China |

Jilin petrochemical |

4150 |

4150 |

0 |

|

|

Fushun petrochemical |

4150 |

4150 |

0 |

|

|

|

northwestern region |

Duzishan Shihua |

4200 |

4200 |

0 |

|

|

Shandong area |

hualu hengsheng |

0 |

0 |

0 |

|

|

in North China |

Tianjin petrochemical |

4250 |

4250 |

0 |

|

|

Yanshan petrochemical |

4250 |

4250 |

0 |

|

|

|

Shanxi Woneng |

3800 |

3800 |

0 |

|

|

|

East China |

Shanghai petrochemical |

4100 |

4150 |

-50 |

|

|

Sinopec |

4275 |

4275 |

0 |

April settlement |

|

|

Sinopec |

4150 |

4150 |

0 |

Listed in May |

|

|

Yangzi Refining |

4100 |

4150 |

-50 |

|

|

|

central China |

China-Korea Petrochemical |

4100 |

4100 |

0 |

|

|

Hubei Sanning |

3950 |

3950 |

0 |

|

|

|

South China |

zhongke refining and chemical |

4150 |

4150 |

0 |

|

|

Maoming petrochemical |

4150 |

4150 |

0 |

|

|

|

southwestern region |

Sichuan petrochemical |

4150 |

4250 |

-100 |

|

Market outlook forecast:

The peak summer travel peak in the United States is approaching, and the positive support brought by OPEC+ production cuts continues. International oil prices are rising and cost support is moderate. Although the construction of downstream markets has increased, the overall transaction has not improved significantly. With the restart of the equipment in the early stage, there is an expectation of an increase in market supply. At present, there is no obvious positive support for the market supply and demand structure, and the futures market is fluctuating downward. It is expected that the price of ethylene glycol market will be weak and volatile in the short term. In the later period, it is necessary to pay close attention to the prices of crude oil and coal and the operation of on-site equipment.