[Hot Focus]: Malaysian demand has improved slightly. Will the concentrated milk market improve?

[Introduction] In April, Malaysia's Financial Times held a dialogue with Dr. Lin Weicai, Executive Chairman of Top Gloves. In an exclusive interview, he mentioned: "I am honored to play a key role in protecting and saving lives around the world. After all these years in the glove industry, I have never doubted its prospects and potential. The challenging period is a short part of the business cycle, and I am convinced that this situation will eventually return to normal."

This year, everyone's demand for concentrated milk is in a relatively pessimistic state, which is also closely related to the changes in the glove industry. The most vivid description of the glove industry is that during the epidemic, it experienced a top-level prosperity from "five mausoleum young people competing for their heads" to the desolation of "the horses in front of the door". The market that once dragged concentrated milk fell. Under the continued downturn, Malaysia's demand for concentrated milk improved slightly in April. Is this the situation that concentrated milk is getting better?

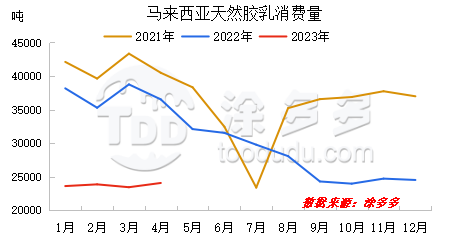

Malaysia's natural latex consumption in April 2023 was 24,100 tons, up 2.98% month-on-month and down 36.06% year-on-year. Judging from the consumption of natural latex in Malaysia, April was still at a relatively low level, but it was slightly improved from March. Among the downstream consumption of natural latex in Malaysia, the consumption of natural latex gloves still ranks first, followed by other latex products such as rubber thread and foam.

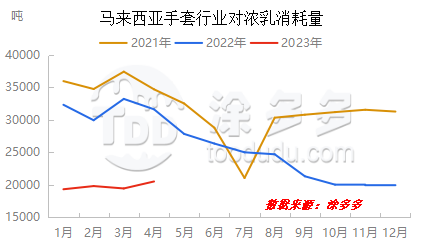

Judging from the demand for concentrated milk in different downstream industries, the improvement in concentrated milk consumption is mainly caused by the growth in demand in the glove industry. Judging from interviews in April, Lin Weicai, who is deeply involved in the glove industry, believes that the reason why the glove industry has strong growth potential is: "Medical gloves are a necessity in the medical care field. As long as the medical care industry still exists, the demand for gloves will increase. The nature of its disposable product determines that scenes of using gloves will appear repeatedly. At the same time, gloves are relatively affordable, accounting for only a small part of medical expenses, and the frequency of repurchase is relatively stable."

In fact, it can be seen from this passage that the demand for gloves is mainly linked to health. With the arrival of new ideas in the new era, more and more people's health is placed at the top of their list. Although after the epidemic, the glove industry has experienced a period of prosperity to decline. The glove market is currently basically in a situation of oversupply and slow-moving inventory, which has directly led to the failure of glove manufacturers 'turnover. In the end, some manufacturers can only temporarily stop work. The start of the global glove industry has dropped by more than 50% compared with the epidemic period. In the short term, without the impact of other special circumstances, it is difficult for the glove industry to have a significant growth point. In most cases, the start of operations remains relatively low, making it difficult to stimulate the demand for concentrated milk. The improvement in demand for concentrated milk in Malaysia in April can basically be regarded as a normal fluctuation.

However, judging from the overall supply and demand pattern, it is not difficult to see that this year is undoubtedly a year for the global glove industry to reshuffle. The demand for concentrated milk is unlikely to improve significantly, which in turn will have a relatively large impact on the production rhythm of countries supplying concentrated milk. Impact, perhaps this year is not only a change in the downstream of gloves, but the upstream supply pattern may also face certain risks of reshuffling.