Analysis of natural rubber market price on June 14

index

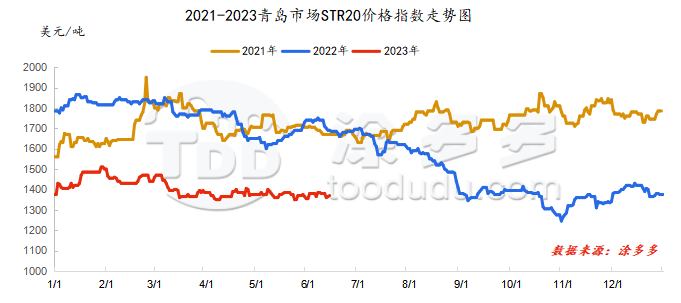

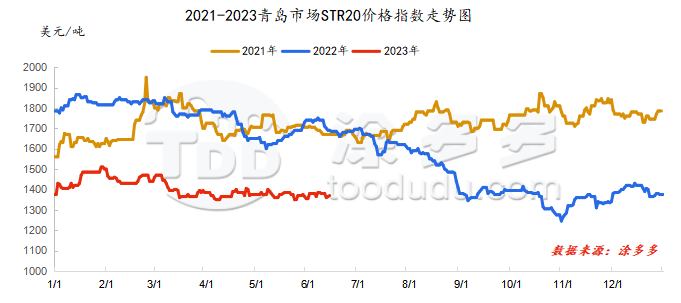

On June 14, the STR20 price index of natural rubber in the Qingdao market was US$1370/ton, up US$5/ton from the previous trading day, or 0.37%.

market analysis

futures market

|

date

|

Previous period: RU Futures

|

|

main contract

|

closing price

|

|

opening price

|

Low-end price

|

High-end price

|

closing price

|

RU01

|

RU05

|

RU09

|

|

June 14

|

11990

|

11990

|

12170

|

12085

|

13325

|

13270

|

12085

|

|

June 13

|

11905

|

11850

|

11970

|

11960

|

13245

|

13170

|

11960

|

|

rise and fall

|

85

|

140

|

200

|

125

|

80

|

100

|

125

|

|

date

|

Previous period energy: NR futures (closing price)

|

|

NR main force

|

NR01

|

NR05

|

NR09

|

|

June 14

|

9715

|

9845

|

10070

|

9720

|

|

June 13

|

9635

|

9765

|

10070

|

9635

|

|

rise and fall

|

80

|

80

|

0

|

85

|

spot market

Supply:

Foreign countries: Thailand's production areas have not yet been fully increased, and the output of raw materials is relatively limited. It is expected that the increase will begin to resume in the middle of the year. As of now, the prices of glue raw materials are low, and rubber farmers are less willing to buy and sell glue.

China: China's production areas are basically in the stage of opening and increasing production. The output of raw materials in Yunnan production areas has also gradually improved. Hainan production areas are in the stage of steadily increasing production, with a daily output of nearly 4000.

|

price type

|

June 13

|

June 14

|

rise and fall

|

units

|

|

raw material prices

|

Thailand

|

glue

|

43.5

|

43.7

|

0.2

|

baht/kg

|

|

cup glue

|

39.5

|

39.4

|

-0.1

|

baht/kg

|

|

Yunnan

|

Glue (into the dry glue factory)

|

10950

|

10950

|

0

|

Yuan/ton

|

|

rubber block

|

11200

|

11200

|

0

|

Yuan/ton

|

|

Hainan

|

Glue (into the dry glue factory)

|

11200

|

11200

|

0

|

Yuan/ton

|

|

Glue (Jinnong Dairy Factory)

|

11200

|

11200

|

0

|

Yuan/ton

|

Demand: It is understood that some semi-steel tire companies are currently full of orders, especially the foreign trade order receipt far exceeds the production capacity of the month. Based on the current order quantity, production may be scheduled until August. In terms of the market, terminal demand performance is relatively flat, downstream customers are not willing to replace, and the market mainly maintains that goods are just needed.

Futures spot price list

|

price type

|

June 13

|

June 14

|

rise and fall

|

units

|

|

price of finished products

|

Shandong

|

China All Latex

|

11700

|

11950

|

250

|

Yuan/ton

|

|

|

Qingdao

|

Thailand No. 20 standard glue

|

1365

|

1370

|

5

|

us dollars/ton

|

|

|

Qingdao

|

Thailand No. 20 mixed glue

|

10550

|

10630

|

80

|

Yuan/ton

|

|

|

Ningbo

|

Hainan

|

8350

|

8350

|

0

|

Yuan/ton

|

|

|

Ningbo

|

Thailand Non-Yellow Bulk

|

8950

|

9050

|

100

|

Yuan/ton

|

|

the current price difference

|

Main force-Thailand No. 20 mixed glue

|

1345

|

1455

|

110

|

Yuan/ton

|

|

|

Main force-China All Latex

|

195

|

135

|

-60

|

Yuan/ton

|

|

relevant exchange rate

|

us dollar against the RMB

|

7.1748

|

7.1823

|

0.0075

|

Yuan

|

|

|

Thai Baht to RMB

|

0.2149

|

0.2142

|

-0.0007

|

Yuan

|

market outlook

Yesterday, Hujiao's night trading rose in a narrow range, and the opening of today's daily trading basically maintained a higher trend. The market's rise was due to the fact that on the one hand, downstream tire starts were at a high level, some factory orders were in good condition, and optimistic expectations on the demand side were stronger. The macro atmosphere of the central bank's cut the 7-day reverse repo operation interest rate has improved, driving optimism in the market, and the sentiment of a higher market during the rubber period has warmed up. The absolute price of rubber in the early stage was low. Stimulated by macro and good demand news, the upward momentum of rubber prices to rebound at a low level was still good. However, China's raw material supply has increased in an all-round way, and supply pressure has not decreased. We are cautious about bullish.