[Hot Focus]: The trend of concentrated milk is developing, and its own supply and demand are the focus of attention

In fact, every time we talk about the relationship between concentrated milk and futures, we generally say that concentrated milk has little to do with futures, and there is a greater relationship between concentrated milk and its own supply and demand, but in fact, thick milk is one of the branches of rubber products. the general trend is still relatively in line with the development trend of the whole rubber, and its own supply and demand problem is to increase the highlights of its special market.

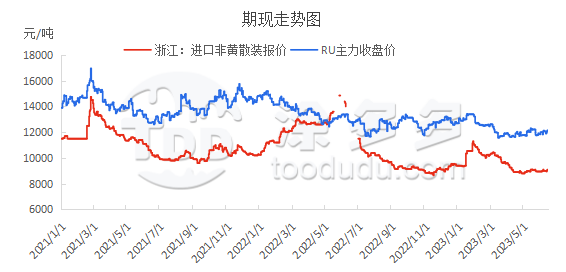

From the current trend chart of the above period, it is not difficult to see that the quotation trend of Zhejiang imports in non-yellow bulk is basically similar to the closing price of the main force of RU, and the change in the general direction of thick milk is obviously related to the fundamentals of the whole rubber. Really because of this correlation, the recent warming of the macro environment and the upward trend of the rubber disk have also led to a rise in bullish sentiment in the thick milk market, but will the strong milk really rise? For thick milk, rubber noodles is only the control of the general trend, but the specific ups and downs should pay more attention to the beauty of thick milk itself, that is, the actual supply and demand situation.

1. Supply side

In the short term, the tapping work is not carried out smoothly in China's non-production areas more or less due to the influence of rainfall, but the matter of rainfall is short-term bullish news, which is actually beneficial to the amount of glue after the end of the rainfall.

On the one hand, Thailand is in the rainy season, and the influence of rainy weather is relatively frequent, but the actual demand for concentrated milk continues to weaken, the replenishment sentiment of traders and downstream factories are all in a relatively weak state, and the spot price is only firm at the low level. there is no obvious improvement, and the theoretical production profit of concentrated milk remains low, resulting in a weak demand for thick milk raw material glue in local processing plants. I heard the news that the glue was converted to cup glue in some areas. At present, the production area of Thailand is still in the early stage of cutting, and the overall quantity is less, but the amount of raw materials is expected to be relatively strong in the later stage.

The production area of Hainan is relatively similar to Thailand recently, and it is basically in a state of rain. The daily rubber yield of the whole island is basically maintained at about 2500 tons, and the daily output can reach about 4000 tons under good weather conditions. At present, due to the problems of concentrated milk sales and profits, the production enthusiasm of the local thick milk processing plant is not high, but compared with the whole latex with the same raw materials, it is supported by the news of storage, macro-stimulation and so on. The glue in the processing plant tends to produce whole latex and the mood of whole latex continues to heat up, and the pattern of large concentrated milk changes in a short period of time. The shunt of raw materials in concentrated dairy plants is relatively weak, and the output of finished products is also expected to be reduced, or there is a positive support for later prices.

two。 Demand side

The start-up of the Wenzhou foaming factory in June was basically maintained at about 40%. At the beginning of the month, the start-up of some factories could still reach a critical value of about 50%, but the start-up slowly declined. Some factories started at 30% in early June, and some factories planned to stop work. It is not difficult to see that this year's downstream off-season is really very light. However, in the first ten days of June, it seems that some large factories began to replenish goods one after another, but the overall replenishment volume is not as good as that of the same period in previous years, mainly because the downstream factories are basically pessimistic about the sales situation in the later period. It is expected that this hoarding will come to an end. When there is no obvious improvement in the start of construction, it will probably be able to use the state of nearly two months. This replenishment can basically be said to have eaten up most of the demand in the third quarter. Unless there is a better-than-expected improvement in demand for the "Golden Nine and Silver Ten", it is expected that demand will improve in the third quarter.

This part of medical gloves still maintains overcapacity, starts at a low level, and does not show a significant improvement. The start-up of Shandong glove factory basically maintained about 40%, and some factories began to stop. For the current sales of processing plants, it is in the off-season, and the overall delivery of goods is lower than that of the same period in previous years. Up to now, some processing plants still ship goods to consume the inventory of pre-finished products, which means that the recent start-up of some factories may be less than the average start-up. Some processing plants say they expect sales to improve around August-September, but there is no shortage of raw material stocks at present, and China's foreign production areas are about to enter the upper stage of replenishment, and a small number of processing plants say that if demand does not improve, according to the current demand for raw materials, there is basically no need for replenishment in the third quarter.

3. Demand is particularly important under the expectation of high supply.

To sum up, the downstream is still in a relatively unoptimistic state for the next demand, so it is difficult for the demand of the three progress to show a significant gap, and the market is rising to support a state of fatigue. If the downstream can really usher in the peak season of "Golden Nine and Silver Ten", it may be able to stimulate a wave of demand, but we also know that the third quarter is also a peak production season in China's foreign production areas, and it is difficult for the cost side to support higher prices. Therefore, from the point of view of the supply and demand of concentrated milk, the driving force of the price increase of concentrated milk in the third quarter is slightly insufficient, but we should also pay attention to whether the whole rubber fundamentals will be obviously positive, and the side will drive the market of concentrated milk to improve.