Analysis of natural rubber market price on June 21

index

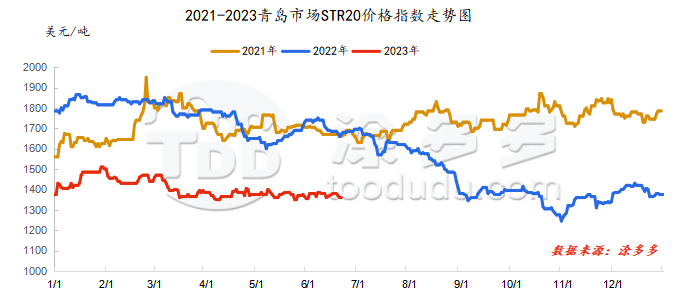

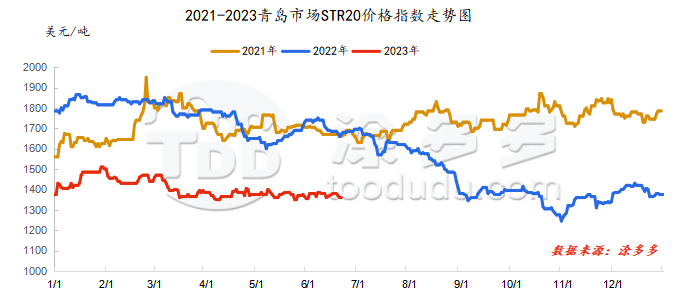

On June 21, the STR20 price index of natural rubber in the Qingdao market was US$1360/ton, which was stable from the previous trading day.

market analysis

futures market

|

date

|

Previous period: RU Futures

|

|

main contract

|

closing price

|

|

opening price

|

Low-end price

|

High-end price

|

closing price

|

RU01

|

RU05

|

RU09

|

|

June 21

|

12065

|

12020

|

12150

|

12035

|

13250

|

13200

|

12035

|

|

June 20

|

12095

|

11975

|

12100

|

12055

|

13285

|

13260

|

12055

|

|

rise and fall

|

-30

|

45

|

50

|

-20

|

-35

|

-60

|

-20

|

|

date

|

Previous period energy: NR futures (closing price)

|

|

NR main force

|

NR01

|

NR05

|

NR09

|

|

June 21

|

9685

|

9760

|

10070

|

9675

|

|

June 20

|

9675

|

9735

|

10070

|

9660

|

|

rise and fall

|

10

|

25

|

0

|

15

|

spot market

Supply:

Foreign: The rainfall in foreign production areas has eased, raw materials are in an increasing state, glue output has improved, but the profits of finished products have not improved, and the purchasing mood of processing plants is not high.

China: China's production areas are basically in the stage of opening and increasing production. The output of raw materials in Yunnan production areas has also gradually improved. Hainan production areas are in the stage of steadily increasing production, with a daily output of nearly 4000.

|

price type

|

June 20

|

June 21

|

rise and fall

|

units

|

|

raw material prices

|

Thailand

|

glue

|

44

|

44.1

|

0.1

|

baht/kg

|

|

cup glue

|

39.55

|

39.35

|

-0.2

|

baht/kg

|

|

Yunnan

|

Glue (into the dry glue factory)

|

11000

|

11200

|

200

|

Yuan/ton

|

|

rubber block

|

11200

|

11200

|

0

|

Yuan/ton

|

|

Hainan

|

Glue (into the dry glue factory)

|

11400

|

11400

|

0

|

Yuan/ton

|

|

Glue (Jinnong Dairy Factory)

|

11400

|

11400

|

0

|

Yuan/ton

|

Demand side: At present, some small-scale semi-steel tire enterprises are affected by external factors, and the operation of their equipment has been blocked. They are currently in the shutdown stage. At present, the company's product supply is relatively sufficient. Due to the limitations of product categories, the company's shipping pressure has not decreased, and the overall inventory is relatively sufficient. Most other semi-steel tire enterprises are still in a situation of high start-ups and a shortage of domestic inventory.

Futures spot price list

|

price type

|

June 20

|

June 21

|

rise and fall

|

units

|

|

price of finished products

|

Shandong

|

China All Latex

|

11900

|

11950

|

50

|

Yuan/ton

|

|

Qingdao

|

Thailand No. 20 standard glue

|

1360

|

1360

|

0

|

us dollars/ton

|

|

Qingdao

|

Thailand No. 20 mixed glue

|

10580

|

10600

|

20

|

Yuan/ton

|

|

Ningbo

|

Hainan

|

8400

|

8400

|

0

|

Yuan/ton

|

|

Ningbo

|

Thailand Non-Yellow Bulk

|

9100

|

9100

|

0

|

Yuan/ton

|

|

the current price difference

|

Main force-Thailand No. 20 mixed glue

|

1475

|

1435

|

-40

|

Yuan/ton

|

|

Main force-China All Latex

|

155

|

85

|

-70

|

Yuan/ton

|

|

relevant exchange rate

|

us dollar against the RMB

|

7.1939

|

7.2109

|

0.017

|

Yuan

|

|

Thai Baht to RMB

|

0.2139

|

0.2139

|

0.0000

|

Yuan

|

market outlook

Recently, the heavy rain weather in China's main foreign producing areas has eased. The early rainfall is relatively conducive to the recent improvement in the pace of raw material output. The supply increase in domestic and foreign producing areas is expected to be stronger. Some small-scale semi-steel tire companies in China's downstream tire industries are affected by external factors. Operation of the equipment is blocked, and the Dragon Boat Festival holiday is approaching. Some processing plants have expressed plans to have a holiday, and the operating rate may fall. The demand side continues to be weak. Inventory in Qingdao remains accumulated month-on-month, forming resistance to the upward trend of rubber prices. The weak pattern of rubber supply and demand continues, and rubber prices fluctuate.