[Hot Focus]: The upward momentum of rubber prices is slightly insufficient under the background of high inventory

Since the night trading last Friday, Hujiao has begun to show a weakening trend, and rubber prices have continued their downward trend this week. As of yesterday, the RU main contract had basically reversed the increase at the beginning of the month, while the NR main contract had basically reached a new low. However, judging from the recent rubber fundamentals, good news has also continued to emerge, but the upward support is slightly insufficient in the context of high inventories.

1. Good support: Frequent rainfall and weather in China's production areas have hindered rubber tapping operations

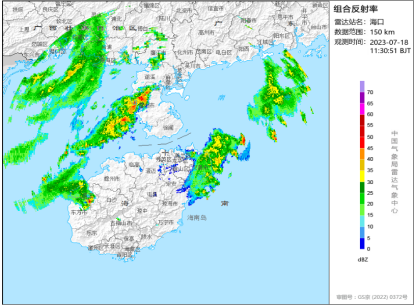

Recently, this year's No. 4 Typhoon "Taili"(Typhoon Level) is traveling westward and northbound. It is expected to land along the coast from Leizhou to Dianbai in Guangdong on the night of July 17. When it makes landfall, the intensity can reach typhoon level or strong typhoon level. According to the forecast, it has been clear that "Taili" will not land on Hainan Island, but some areas of Hainan Island are still affected to varying degrees. Among them, heavy to heavy rains and local heavy rains occur in the northwest half of the region. The rainfall weather will increase, and rubber tapping operations will still have an impact in the short term.

Recent rainfall and weather in Yunnan production areas have been affected more frequently, glue output still has an impact, and raw material release has fallen short of expectations. To a certain extent, this supports that the recent raw material prices in Yunnan are basically at the same level as those in Hainan production areas, and the cost support is strong.

2. Good support: Downstream tires are still starting, and the demand side is slightly stronger

The overall tire start-up situation has been good recently. Among them, the operating rate of semi-steel tires has increased slightly, snow tire orders have performed adequately, and companies have high enthusiasm for scheduling. Most companies are operating smoothly. Some companies have maintained a moderate increase in production in order to complete the production scheduling schedule, which has a negative impact on the overall start-up. The operating rate of all steel tires has basically maintained a slight increase. The production scheduling of enterprises in the early stage of maintenance has gradually returned to normal levels, driving the overall start-up to higher. Judging from the start-up situation alone, the current start-up situation in the downstream is still good, and there is still support for rubber prices.

3. Social inventory accumulation pressure is heating up, good driving force is showing fatigue

As of July 16, 2023, the total inventory of Tianjiao bonded and general trade in Qingdao was 932,100 tons, an increase of 0.54% month-on-month. Both bonded area inventory and general trade inventory show varying degrees of accumulation. After the news such as purchasing and storage did not actually materialize, market speculation also began to fade. The spot price of Tianjiao fell within a narrow range, and the terminal market also began to maintain the need for replenishment in the early stage. Rubber stocks in Qingdao Free Trade Zone once again appeared to be accumulated, hitting a new high for the year. Against the background of high inventories, the support for the upward trend of rubber prices was showing signs of fatigue, and the room for rubber prices to rebound and rise was blocked.

Judging from the current situation, the trend of rubber prices remains weak in the short term, but the overall valuation of China Rubber is still at a low level, and the room for continued exploration is relatively limited. Low-level consolidation is expected to strengthen, and new support points are constantly being sought.