Analysis of natural rubber market price on July 25

index

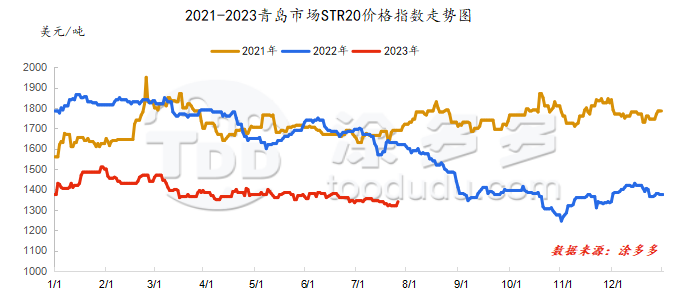

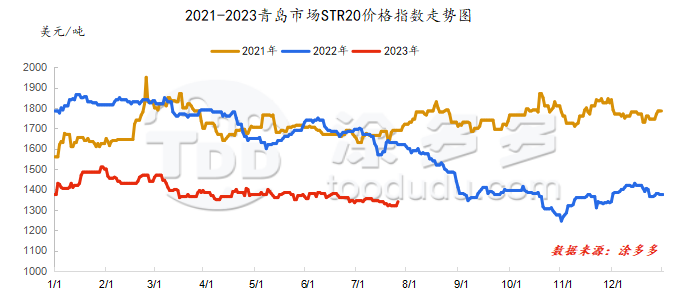

On July 25, the STR20 price index of natural rubber in the Qingdao market was US$1340/ton, up US$20/ton or 1.52 from the previous trading day.

market analysis

futures market

|

date

|

Previous period: RU Futures

|

|

main contract

|

closing price

|

|

opening price

|

Low-end price

|

High-end price

|

closing price

|

RU01

|

RU05

|

RU09

|

|

July 25

|

12050

|

12045

|

12155

|

12140

|

13110

|

13095

|

12140

|

|

July 24

|

12055

|

12020

|

12115

|

12050

|

13010

|

12995

|

12050

|

|

rise and fall

|

-5

|

25

|

40

|

90

|

100

|

100

|

90

|

|

date

|

Previous period energy: NR futures (closing price)

|

|

NR main force

|

NR01

|

NR05

|

NR09

|

|

July 25

|

9480

|

9575

|

9920

|

9480

|

|

July 24

|

9385

|

9505

|

9920

|

9385

|

|

rise and fall

|

95

|

70

|

0

|

95

|

spot market

Supply:

Foreign countries: Rainfall in foreign production areas has eased, and raw materials are in a state of high volume, driving raw material prices to fall within a narrow range.

China: Yunnan's production areas in Hainan are basically in a stage of steady increase in production. Among them, Yunnan's production areas have had occasional rainfall impact recently, but the overall impact is small. Supply in Hainan's production areas has also gradually returned to normal, and raw material prices have remained stable.

|

price type

|

July 24

|

July 25

|

rise and fall

|

units

|

|

raw material prices

|

Thailand

|

glue

|

41.4

|

41.6

|

0.2

|

baht/kg

|

|

cup glue

|

38.2

|

38.2

|

0

|

baht/kg

|

|

Yunnan

|

Glue (into the dry glue factory)

|

10900

|

10900

|

0

|

Yuan/ton

|

|

rubber block

|

9700

|

9700

|

0

|

Yuan/ton

|

|

Hainan

|

Glue (into the dry glue factory)

|

10600

|

10600

|

0

|

Yuan/ton

|

|

Glue (Jinnong Dairy Factory)

|

10600

|

10600

|

0

|

Yuan/ton

|

Demand side: Currently, the enthusiasm of semi-steel tire companies for production remains unchanged. Currently, foreign trade orders for snow tires are being intensively scheduled, and some companies that sell snow tires are currently in small quantities to make up for the problem of centralized downstream replenishment and large order gaps in the later period. At present, there is still an overall inventory gap for four-season tires. For some foreign-trade companies, the domestic order satisfaction rate continues to decline.

Futures spot price list

|

price type

|

July 24

|

July 25

|

rise and fall

|

units

|

|

price of finished products

|

Shandong

|

China All Latex

|

11950

|

11950

|

0

|

Yuan/ton

|

|

Qingdao

|

Thailand No. 20 standard glue

|

1320

|

1340

|

20

|

us dollars/ton

|

|

Qingdao

|

Thailand No. 20 mixed glue

|

10450

|

10480

|

30

|

Yuan/ton

|

|

Ningbo

|

Hainan

|

7900

|

7850

|

-50

|

Yuan/ton

|

|

Ningbo

|

Thailand Non-Yellow Bulk

|

8950

|

8950

|

0

|

Yuan/ton

|

|

the current price difference

|

Main force-Thailand No. 20 mixed glue

|

1600

|

1660

|

60

|

Yuan/ton

|

|

Main force-China All Latex

|

100

|

190

|

90

|

Yuan/ton

|

|

relevant exchange rate

|

us dollar against the RMB

|

7.2046

|

7.1725

|

-0.0321

|

Yuan

|

|

Thai Baht to RMB

|

0.2159

|

0.2149

|

-0.0010

|

Yuan

|

market outlook

China's foreign supply is gradually in a stage of increasing volume. The impact of recent rainfall and weather has weakened, and cost support has begun to decline; from the perspective of finished products, the concentrated milk market remains weak. China's production areas are still mainly converted to full latex, with light-colored glue storage expected; judging from the start-up of downstream processing plants, the overall start-up still remains relatively high, and export demand has improved. However, China's demand is still slowly recovering, and the actual pace of sales and purchasing has not yet changed significantly. Currently, rubber prices are close to the cost line, and there is insufficient room for reduction. Without the guidance of obvious positive news, the natural rubber market may remain low and volatile.