[Natural Rubber]: Rubber Daily Journal (August 9)

Analysis of natural rubber market price on August 9

index

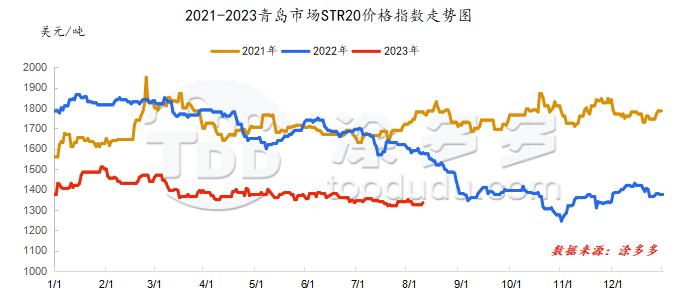

On August 9, the STR20 price index of natural rubber in the Qingdao market was US$1335/ton, up US$10/ton from the previous trading day, or 0.75%.

market analysis

futures market

|

date |

Previous period: RU Futures |

||||||

|

main contract |

closing price |

||||||

|

opening price |

Low-end price |

High-end price |

closing price |

RU01 |

RU05 |

RU09 |

|

|

August 9 |

11950 |

11905 |

12035 |

11995 |

12980 |

12970 |

11995 |

|

on August 8 |

11980 |

11920 |

12025 |

11960 |

12890 |

12895 |

11960 |

|

rise and fall |

-30 |

-15 |

10 |

35 |

90 |

75 |

35 |

|

date |

Previous period energy: NR futures (closing price) |

|||

|

NR main force |

NR01 |

NR05 |

NR09 |

|

|

August 9 |

9470 |

9600 |

9700 |

9415 |

|

on August 8 |

9390 |

9525 |

9700 |

9345 |

|

rise and fall |

80 |

75 |

0 |

70 |

spot market

Supply:

Foreign countries: Rainfall and weather in foreign production areas have eased, and raw materials are in a state of high volume, driving raw material prices to fluctuate within a narrow range.

China: Yunnan's production areas in Hainan are basically in a stage of steady increase in production. Among them, Yunnan's production areas have occasionally experienced rainfall recently, but the overall impact is small. Coupled with this, supply in Hainan's production areas has also gradually returned to normal, and raw material prices have fallen within a narrow range.

|

price type |

on August 8 |

August 9 |

rise and fall |

units |

||

|

raw material prices |

Thailand |

glue |

41.2 |

41.4 |

0.2 |

baht/kg |

|

cup glue |

37.35 |

37.35 |

0 |

baht/kg |

||

|

Yunnan |

Glue (into the dry glue factory) |

10500 |

10500 |

0 |

Yuan/ton |

|

|

rubber block |

9400 |

9400 |

0 |

Yuan/ton |

||

|

Hainan |

Glue (into the dry glue factory) |

10300 |

10400 |

100 |

Yuan/ton |

|

|

Glue (Jinnong Dairy Factory) |

10300 |

10400 |

100 |

Yuan/ton |

||

On the demand side: Semi-steel tire companies started operations to maintain high levels. As snow tire products are gradually scheduled, the supply of domestic products has become more tight. Some companies have experienced purchase restrictions, orders cannot be effectively met, and domestic sales pressure has not decreased. In terms of the market, due to the impact of heavy rainfall, it will still take some time for markets in some regions of Northeast China to recover. Currently, most agents go to inventory and collect money to reserve advance funds for snow tires. There are many market inquiries, mostly based on understanding the current company quotations. Actual transactions are relatively rare.

Futures spot price list

|

price type |

on August 8 |

August 9 |

rise and fall |

units |

||

|

price of finished products |

Shandong |

China All Latex |

11850 |

11900 |

50 |

Yuan/ton |

|

Qingdao |

Thailand No. 20 standard glue |

1325 |

1335 |

10 |

us dollars/ton |

|

|

Qingdao |

Thailand No. 20 mixed glue |

10500 |

10550 |

50 |

Yuan/ton |

|

|

Ningbo |

Hainan |

8000 |

8000 |

0 |

Yuan/ton |

|

|

Ningbo |

Thailand Non-Yellow Bulk |

8900 |

9000 |

100 |

Yuan/ton |

|

|

the current price difference |

Main force-Thailand No. 20 mixed glue |

1460 |

1445 |

-15 |

Yuan/ton |

|

|

Main force-China All Latex |

110 |

95 |

-15 |

Yuan/ton |

||

|

relevant exchange rate |

us dollar against the RMB |

7.2256 |

7.2241 |

-0.0015 |

Yuan |

|

|

Thai Baht to RMB |

0.2137 |

0.2135 |

-0.0002 |

Yuan |

||

market outlook

The seasonally booming natural rubber production season has arrived, and raw materials in various major producing areas have been increasing one after another. Against the background of loose supply, most raw material prices have remained weak. So far, the processing profits of upstream processing plants have remained relatively low, and to a certain extent, it may suppress the output of finished products; China's macro data is improving, which is to a certain extent conducive to the expected improvement in tire replacement and supporting demand, which relatively supports the start of tires to remain high. However, the pressure on high inventories in China's society is difficult to alleviate, and there is still insufficient upward momentum in rubber prices. In the short term, rubber prices are expected to remain mainly volatile.