Malaysia's natural latex consumption in June 2023 was 21,500 tons, a decrease of 1,600 tons or 3.59% from the 22,300 tons in May. From the perspective of consumption, Malaysia's concentrated milk consumption in June declined slightly compared with May, but it is basically in the normal situation in the past half a year.

Judging from Malaysia's current consumption situation, the overall fluctuations are small and have not improved significantly, and the upward trend in May has not been maintained. The main consumer product of Malaysia's concentrated milk is the glove industry. Judging from the current situation, the overall demand for the glove market remains weak, and it is unlikely to improve significantly in the short term. As for China, another major consumer of concentrated milk, the spot price of concentrated milk in ports has recently shown a narrow upward trend, and the shipping sentiment of shippers is heating up. Why?

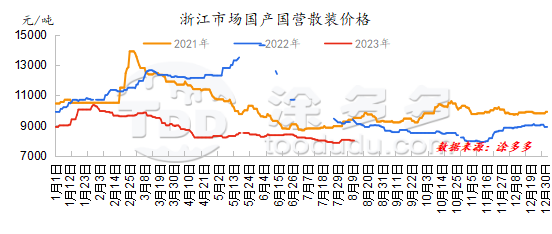

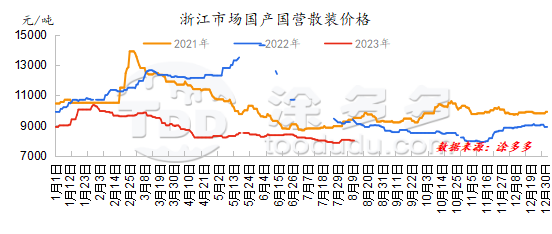

As we all know, the spot price of concentrated milk in the Chinese market has remained low and sideways since the second quarter, and price fluctuations have basically remained within 200 yuan/ton. In early August, the prices of Vietnam and domestic rubber began to rise in a narrow range.

Positive support 1: There is support for increased costs due to weather disturbances in the main natural latex producing areas

After entering July, the rainfall in Thailand's production areas has increased, which has affected the amount of new rubber to a certain extent. Coupled with weak demand for finished products, insufficient rubber cutting profits, low enthusiasm for rubber cutting, and weak enthusiasm for production. Maintaining long-term contract orders, enthusiasm for starting work has been suppressed, and finished product output has also been affected. Yunnan's production areas are basically in a state of frequent rainfall, which has affected factory start-ups and production. Supported by the supply side, the recent performance of natural latex US dollar shipping and cargo offers has been relatively strong. Recent rainfall and weather in China's Hainan production area have also begun to disturb frequently. Raw material prices have also continued to rise this week, and cost support has begun to strengthen in the short term.

Positive support 2: Port Thailand's spot imports have tightened, downstream raw material inventories have shown signs of going to the warehouse

Starting from late July, Southeast Asian production areas have been affected by varying degrees of precipitation and weather. The output of raw material glue has been limited. The shipment of finished products from upstream processing plants has slowed down. Coupled with the obvious problem of upside down inside and outside markets in the early stage, downstream demand has not improved. Under the background, traders 'replenishment sentiment has been relatively weak, which has led to a tightening of the import supply of imported concentrated milk that can be circulated in the sales area since late July, which has relatively led to a narrow upward trend in port spot prices.

Judging from the downstream situation, although the overall downstream start-up has not improved significantly, some processing plants have recently fallen raw material inventories, and their willingness to replenish goods on dips has improved. Moreover, the "Gold September and Silver Ten" is coming soon. A few downstream factories have begun to make inquiries to buy shipments in the distant months of September and October. The inquiry situation has improved in the short term, which in turn has led to a better sentiment of port cargo holders in quoting and shipping.

In the short term, weather disturbances in the main producing areas are obvious, and cost support has begun to strengthen. However, downstream product companies continue to purchase raw materials on demand, and the overall demand has not yet changed significantly. Whether prices in the medium and long term can continue to rise, it still depends on the actual demand.