[Hot Focus]: Port inventories are gradually being removed from warehouses and the contradiction between supply and demand in the market has eased

As a major energy consumer, China's petroleum coke consumption has remained at a high level. Although petroleum coke output has been steadily increasing in recent years, at the same time, downstream demand is also increasing. Therefore, the supply gap will inevitably be in imports. Can be supplemented.

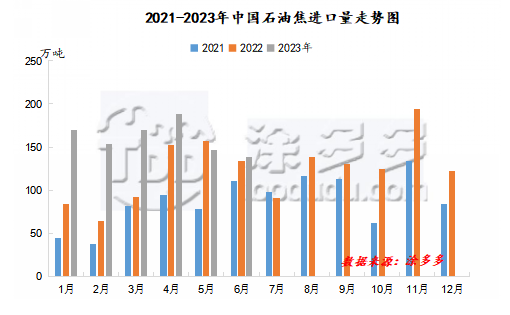

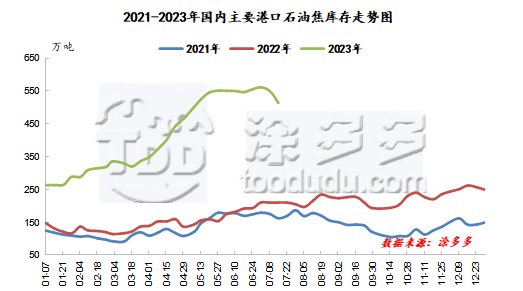

After entering 2023, with the gradual recovery of shipping speed, petroleum coke imports have steadily increased. According to customs data, from January to June 2023, China's cumulative total imports of uncalcined petroleum coke were 9.6854 million tons, an increase of approximately 2.8596 million tons compared with the same period last year., a year-on-year increase of 41.89%. As the volume of imported coke arriving at the port continues to increase, the total port inventory has also hit record highs. As of July 25, 2023, the highest port inventory appeared at the end of June, with the highest inventory of approximately 5.62 million tons.

The social inventory of petroleum coke is mainly represented by port inventory, so the total inventory in port areas continues to increase, which also has a greater impact on market prices. Since April 2023, port inventories have gradually shown an upward trend. During this period, the total port inventories have repeatedly hit new highs, and the contradiction between supply and demand has become increasingly prominent, which has a greater impact on Chinese market prices.

Looking back at the first half of 2023, the overall port inventories are on an increasing trend, resulting in the supply in the Chinese market being always abundant. Looking at the first quarter, as the speed of petroleum coke evacuation from the port is still acceptable, the overall pressure on port inventories is not great, but the overall volume is high in the same period last year. Level; entering the second quarter, the trading atmosphere in the petroleum coke market has weakened, and there is no obvious advantage in imported coke prices. Some traders have a certain reluctance to sell, and port petroleum coke shipments are under pressure, resulting in a continuous increase in port inventories. High inventory, slow consumption, and poor downstream market demand performance, the market has a wait-and-see mood, and the overall transaction atmosphere is light.

After entering July, the inventory in the port area began to show a state of being removed from the warehouse. Currently, the arrival of imported ships and cargo in the port remains at the previous level. However, with the gradual recovery of downstream demand, the overall demand has improved compared with the previous period, and the contradiction between supply and demand is slowly easing. China Market prices have stopped falling and stabilized, and the price of some models of coke have begun to increase, which has benefited the shipment of imported coke in the port to a certain extent. In addition, the number of new contracts signed by traders on external markets has decreased in the second quarter, and petroleum coke inventories have decreased compared with the previous period. Under the combination of many factors, the port's spot petroleum coke shipments are good, and the port's inventories are reduced, which has contributed to the positive market price to a certain extent. In the short term, as downstream demand gradually improves, the contradiction between supply and demand in the market has gradually eased, and the mentality of operators has improved. It is expected that prices in the Chinese market will adjust within a narrow range in the short term, and the possibility of an increase in coke prices for some models is not ruled out. In the later stage, we need to pay close attention to the trend of crude oil, the operation of Chinese units and the follow-up of downstream demand.