[Hot Focus]: Demand is steadily increasing, the petroleum coke market is high and volatile

In the first half of 2023, the trend of China's petroleum coke market showed a continuous downward trend. Overseas demand was weak. A large amount of foreign petroleum coke flowed into China, resulting in a continuous increase in China's imports. Port inventories hit record highs, which hit Chinese market prices to a certain extent. However, after entering the third quarter, the construction of the downstream market began to increase one after another. Enterprises such as electrolytic aluminum and metal silicon in the southwest region resumed work one after another, and the construction of carbon and anode materials also gradually increased. Demand is slowly increasing, coupled with the recent news of overhauling coking units in the Chinese market, the market transaction atmosphere has begun to improve, and Chinese market quotations have also pushed up.

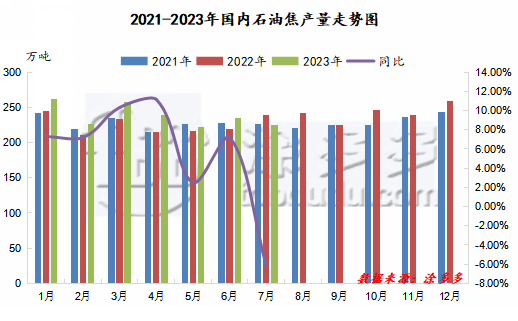

In terms of supply: Since the second quarter, the output in China's market has decreased compared with the previous period, but the overall reduction is relatively limited. Although some of China's refining delay units have been suspended after July, the units for early maintenance have been started one after another, and some units have been put into operation, and the overall supply performance of the market is still abundant. At present, it is estimated that in August, the construction of the Chinese market may still maintain a high level, and petroleum coke output may remain high.

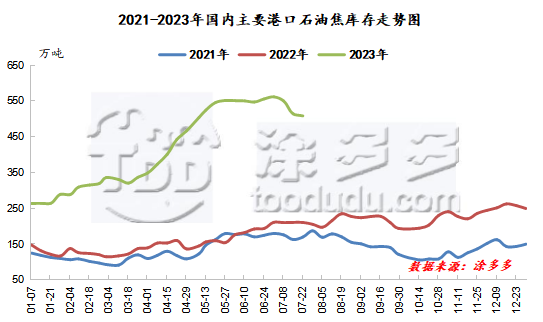

Recently, the total inventory in the port area has decreased due to the decrease in the arrival of imported ships and cargoes. As of July 31, the total inventory of petroleum coke in the port has dropped to about 5 million tons. As downstream demand improves, the overall demand has increased compared with the previous period, and the arrival of imported ships and cargoes in the port has decreased. At present, it is expected that the total inventory of the port may continue to decrease in the short term.

From the perspective of demand: After entering June, with the arrival of the wet season in the south, the start of electrolytic aluminum and metal silicon enterprises in the southwest has gradually increased, which has provided positive and stable support for the carbon market for aluminum, and has driven petroleum coke manufacturers to ship to a certain extent; the anode material market has steadily started, and market demand has also gradually increased. With the continuous release of some new devices, there is certain support for the shipment of manufacturers in some regions; The short-term start-up performance of the graphite electrode market is average, and the demand for petroleum coke is average, which is negative for shipments of low-sulfur coke market; the silicon carbide market is average for production, and demand is still weak in the short term.

At present, although the overall supply performance in the Chinese market was relatively abundant in July, downstream market demand increased steadily, and terminal demand improved, supporting smooth shipments of manufacturers. The quotations of manufacturers in most regions of China pushed up with the support of low inventory pressure. In addition, import traders are more willing to ship, the delivery speed of petroleum coke at the port is accelerating, and the total inventory in the port is significantly higher than that in the previous period. On the whole, as the contradiction between supply and demand eases, it is expected that the market price of petroleum coke may continue to increase within a narrow range in the short term. In the medium and long term, as refinery prices continue to increase, the downstream market may have a certain wait-and-see attitude. By then, the enthusiasm of industry players to enter the market for replenishment may weaken, and it is not ruled out that coke prices for models in some regions will move downward. In the later stage, it is necessary to pay close attention to the operation of equipment on site and the follow-up of downstream demand.