86,378

September 25, 2023, 4:39 PM

PVC futures analysis: September 25th V2401 contract opening price: 6312, highest price: 6329, lowest price: 3219, position: 824509, settlement price: 6271, yesterday settlement: 6279, down: 8, daily trading volume: 1119693 lots, precipitated capital: 3.605 billion, capital outflow: 64.06 million.

List of comprehensive prices by region: yuan / ton

|

Area

|

Price 9.22

|

Price 9.25

|

Rise and fall

|

Remarks

|

|

North China

|

6080-6150

|

6060-6120

|

-20/-30

|

Send to cash remittance

|

|

East China

|

6090-6190

|

6090-6190

|

0/0

|

Cash out of the warehouse

|

|

South China

|

6170-6260

|

6150-6250

|

-20/-10

|

Cash out of the warehouse

|

|

Northeast China

|

6050-6200

|

6050-6200

|

0/0

|

Send to cash remittance

|

|

Central China

|

6080-6120

|

6080-6120

|

0/0

|

Send to cash remittance

|

|

Southwest

|

6050-6200

|

6050-6200

|

0/0

|

Send to cash remittance

|

PVC spot market: China PVC market mainstream transaction prices in various regions weak finishing, the market atmosphere is not good. Compared with the valuation, it fell 20-30 yuan / ton in North China, stable in East China, 10-20 yuan / ton in South China, and stable in Northeast, Central China and Southwest China. The ex-factory price of upstream PVC production enterprises has been reduced by 50-100 yuan / ton, including synchronous downside of ethylene enterprises and quotations from different places. The trend of the futures price is still weak, the quotation mentality of various regions of the spot market is lacking, and there are still sporadic adjustments in some areas. after the current downward fluctuation of the futures price, the price advantage of the point price source is highlighted, but the basis offer has changed little compared with last Friday. part of the supply base in various regions is tight and even slightly stronger, including East China basis offer 01 contract-(50-130-150), South China 01 contract-(0-50-100). North 01 contract-(350-400-500), Southwest 01 contract-(250). On the whole, it coincides with Monday, the spot market talks more, some merchants have replenishment psychology, but the hanging order point is generally low, so the spot market turnover on Monday is general.

From the perspective of futures: & the night price of the nbsp; PVC2401 contract opened high and low last week, and there was a certain downward trend in the night market. Prices continued to decline after the start of morning trading on Monday, but failed to fall below the 6200 mark, with afternoon lows as low as 6219. 2401 contracts range from 6219 to 6329 throughout the day, with a spread of 110. 01. The contract reduced its position by 7193 positions and has held 824509 positions so far. The 2405 contract closed at 6304, with 72740 positions.

PVC Future Forecast:

Futures: PVC2401 contract price operation compared with the operating range last Friday is almost no different, but the low point is slightly lower, and showed a state of reducing positions, on the one hand, considering the departure in the early National Day holiday, some funds closed positions ahead of time to avoid risk. On the other hand, in the downward part of the futures price, the profit-taking of high short orders and the closing of positions in low hedging policies showed a slight trend of reducing positions on Monday. However, the operating low of the futures price continues to break through the support level of the lower track to show a deep downward trend. The technical level shows that all the openings of the Bollinger belt (13, 13, 2) are downward, and the KD lines and MACD lines at the daily level continue to show a dead-forked trend. In the short term, the operation of futures prices may still hover at low levels, and there is a risk of further downside, so observe the performance of the 6200 front line.

Spot: although the spot market price has certain advantages, but the real order replenishment transaction is better after last Friday's price decline, so although the fluctuation range of the futures price on Monday is little different from that of last Friday, the corresponding transaction turns to light, and product companies tend to hang orders at a lower point. PVC fundamentals, calcium carbide prices began sporadic increase of 50 yuan / ton, some enterprises began to plan October maintenance, currently involved in enterprises are Shandong Xinfa, Tianjin LG, Gansu Yinguang, Shaanxi Beiyuan, Tangshan Sanyou, Xinjiang Zhongtai Shengxiong plant, Ordos and so on. However, at present, the supply and demand level is insufficient for the market, and the spot market may show a situation of 90% cash, and the operating atmosphere of the two cities is slightly empty. At present, we are immediately facing the National Day short holiday, and the spot market has not heard of the emergence of a larger intention to hoard goods. Take-as-you-go and high inventory have become the consensus of the current industrial chain. In addition, there are no positive factors at the current economic and policy level. As a whole, the spot market may still fluctuate within a narrow range in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread

|

|

PVC

|

Contract price difference

|

Price 9.22

|

Price 9.25

|

Rate of change

|

|

V2401 collection

|

6303

|

6247

|

-56

|

|

Average spot price in East China

|

6140

|

6140

|

0

|

|

Average spot price in South China

|

6215

|

6200

|

-15

|

|

PVC2401 basis difference

|

-163

|

-107

|

56

|

|

V2405 collection

|

6363

|

6304

|

-59

|

|

V2401-2405 closed

|

-60

|

-57

|

3

|

|

PP2401 collection

|

7889

|

7789

|

-100

|

|

Plastic L2401 collection

|

8295

|

8258

|

-37

|

|

V--PP basis difference

|

-1586

|

-1542

|

44

|

|

Vmure-L basis difference of plastics

|

-1992

|

-2011

|

-19

|

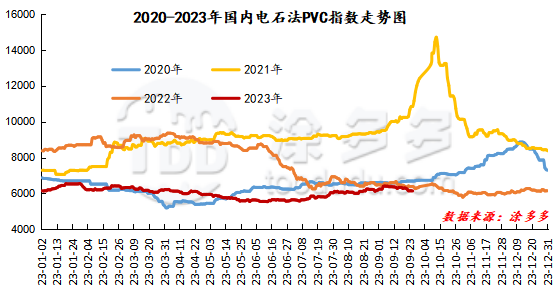

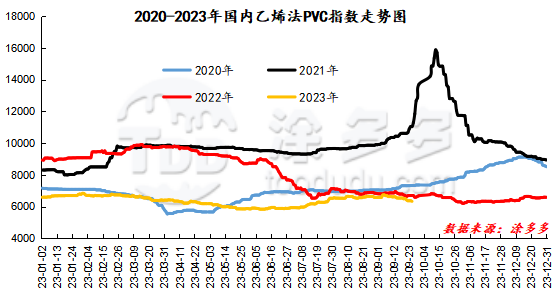

China PVC Index: according to Tuduoduo data, the spot index of China calcium Carbide PVC fell 8.48, or 0.138%, to 6135.7 on September 25. The ethylene PVC spot index was 6330.62, down 37.23, with a range of 0.585%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 194.92.

PVC warehouse receipt daily:

|

Variety

|

Warehouse / branch warehouse

|

9.22 warehouse orders

|

9.25 warehouse orders

|

change

|

|

Polyvinyl chloride

|

China Reserve shares

|

843

|

843

|

0

|

|

|

Guangzhou materials

|

441

|

441

|

0

|

|

|

China Central Reserve Nanjing

|

402

|

402

|

0

|

|

Polyvinyl chloride

|

Cosco sea logistics

|

274

|

274

|

0

|

|

|

Zhenjiang Middle and far Sea

|

274

|

274

|

0

|

|

Polyvinyl chloride

|

Zhejiang International Trade

|

2,417

|

2,417

|

0

|

|

Polyvinyl chloride

|

Peak supply chain

|

1,392

|

1,292

|

-100

|

|

Polyvinyl chloride

|

Jiangyin Xiefeng

|

1,329

|

1,329

|

0

|

|

Polyvinyl chloride

|

Benniu Port, Changzhou

|

9,209

|

9,224

|

15

|

|

Polyvinyl chloride

|

Hangzhou port logistics

|

153

|

153

|

0

|

|

Polyvinyl chloride

|

Jiangsu Zhengsheng

|

1,781

|

1,781

|

0

|

|

Polyvinyl chloride

|

Changxing, Zhejiang

|

120

|

120

|

0

|

|

Polyvinyl chloride

|

Jiangsu Yanjin

|

2,582

|

2,582

|

0

|

|

Polyvinyl chloride

|

Xiamen Xiangyu (Benniu Port)

|

300

|

300

|

0

|

|

Polyvinyl chloride

|

Xiamen Xiangyu (Shanghai Xiangyu)

|

230

|

230

|

0

|

|

Polyvinyl chloride

|

Zhejiang tomorrow (Benniu Port)

|

298

|

298

|

0

|

|

Polyvinyl chloride

|

Zhejiang tomorrow (Zhejiang International Trade)

|

149

|

149

|

0

|

|

Polyvinyl chloride

|

Products Zhongda Chemical Industry (Benniu Port)

|

450

|

450

|

0

|

|

Polyvinyl chloride

|

Products Zhongda Chemical Industry (Railway Changxing)

|

300

|

300

|

0

|

|

Polyvinyl chloride

|

Yongan Capital (Benniu Port)

|

1,200

|

1,200

|

0

|

|

Polyvinyl chloride

|

Specialty petrochemical (Benniu Port)

|

2,399

|

2,399

|

0

|

|

Polyvinyl chloride

|

Specialty Petrochemical (Zhejiang International Trade)

|

1,800

|

1,800

|

0

|

|

Polyvinyl chloride

|

Sino-Thai Duojing (Zhejiang International Trade)

|

1,238

|

1,238

|

0

|

|

Polyvinyl chloride

|

Sinotrans East China

|

274

|

274

|

0

|

|

Polyvinyl chloride

|

Tiantai International Trade (Benniu Port)

|

600

|

600

|

0

|

|

Polyvinyl chloride

|

Zhejiang Jiahua

|

30

|

0

|

-30

|

|

PVC subtotal

|

|

29,368

|

29,253

|

-115

|

|

Total

|

|

29,368

|

29,253

|

-115

|

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.