[Hot Focus]: Natural rubber supply in the fourth quarter may become the main disturbance

In the third quarter, natural rubber ushered in a remarkable and strong rebound, stimulated by various good news such as purchasing and storage, reduced supply in production areas, and capital speculation. However, in the end, as the early positive benefits were gradually absorbed, the center of gravity of rubber prices also began to show a correction trend, and in this trend, natural rubber also ushered in the end of the third quarter. With the arrival of the "Mid-Autumn Festival and National Day" festivals, the fourth quarter also arrives as scheduled, but it also means that the final end of the year has officially arrived. What are the disturbing factors in the fourth quarter? Let's simply look at the supply and demand situation.

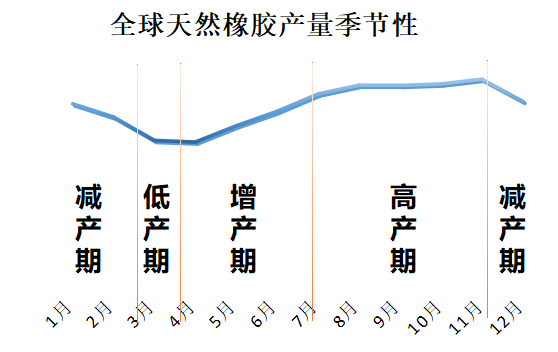

Supply side: As of now, the rainfall in other producing areas in China has not been significantly eased, and raw material prices remain firm. However, it can be seen from the seasonal trend chart of global natural rubber production that the supply side of natural rubber is still in a high-yield period. If the rainfall situation improves, the expected increase in output will increase significantly. To a certain extent, the improvement in output also means that there is an expectation that raw material prices will fall, which in turn drives a decline in support on the cost side. However, the expectation of supply-side production reduction this year has become more obvious, which has also brought bottom support for raw materials. As the end of the year approaches, some traders and downstream product companies will begin to consider the situation of stocking during the Spring Festival, which will be beneficial to imports to a certain extent. In turn, it also ensures the processing plant's demand for raw materials, which in turn brings support to raw material prices.

Demand side: As of now, the start of tire factories has remained at a high level, and export orders for all-steel tires have decreased in the short term, but the peak season of domestic consumption for gold September and silver 10 is still expected to be relatively strong. However, the "Mid-Autumn Festival and National Day" festivals are approaching, and some processing plants are preparing for holidays, which may delay the overall start of the tire factory in the short term. Next, when demand preferences in the first three quarters were in short supply, some specifications in the domestic market were out of stock, and market supply remained tight. After entering the fourth quarter, some companies began to reserve finished product inventories. However, as foreign trade orders were reduced, the peak season for semi-steel snow tire production has passed, and the off-season for domestic demand for all-steel domestic sales was over. In order to control inventory growth, the factory will adjust the production rhythm of maintenance and reduction based on actual conditions. Therefore, from the perspective of demand, There is expectation of marginal improvement.

To sum up, whether the production area can increase normally in the fourth quarter, the overall output situation will also become a new attraction, and the cost disturbance will also be relatively strong. While downstream tire companies have reduced foreign trade orders, and the production season of semi-steel snow tires has passed. Under the off-season demand for domestic sales of all-steel, factory starts and finished product sales are only expected to maintain marginal improvement. From the perspective of overall supply and demand, supply disturbance to the market in the fourth quarter may increase.