92,885

October 12, 2023, 4:37 PM

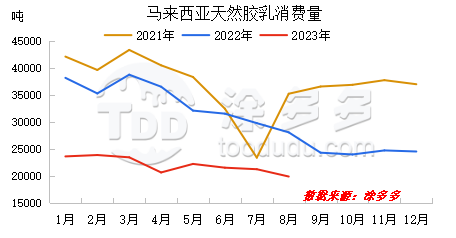

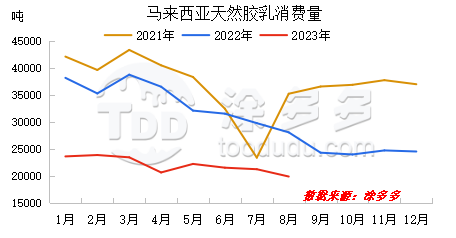

Malaysia's concentrated milk consumption in August 2023 was 19,900 tons, a decrease of 6.37% from July and a sharp decline of 29.13% year-on-year. Judging from the trend of consumption in the past three years, consumption in August this year reached its lowest level in the past three years. The use of gloves, its main downstream consumable product, is also in a state of continuous decline.

Foreign media reported on September 6 that research institute Kenanga Research said that the supply and demand situation of the rubber glove industry will reach 2025

The balance will begin in 2001, when almost no new production capacity will be put into production, and global glove demand will continue to grow by 15% every year driven by increasing health awareness. Later, it gradually improved as companies showed signs of cutting production capacity by selectively decommissioning factories. However, as of now, according to the actual consumer demand in the downstream market, the demand for natural latex gloves is still relatively weak, and the overall production capacity is still relatively surplus. For the glove industry, low prices and low factory utilization will continue to plague the industry in 2023.

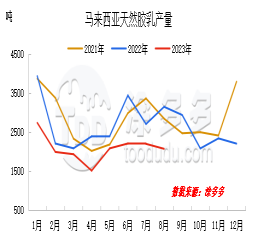

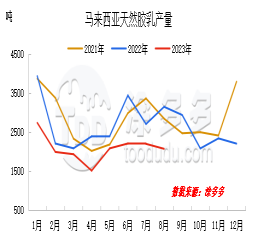

From the supply side: Malaysia's natural latex output in August 2023 was 2065 tons, and the output situation basically remained at around 2,000 tons, with small overall changes. Since July, the rainy season in Malaysia has been more obvious. The rainy weather lasts for a long time, which has a certain impact on rubber tapping operations. The actual yield increase in the peak production season is less than expected.

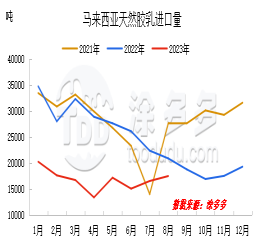

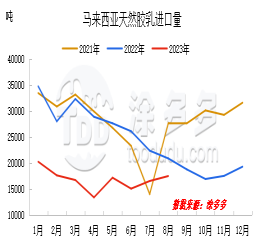

In August 2023, Malaysia's natural latex imports were 17,400 tons, an increase of 5.77% from July. Malaysia's concentrated milk imports have shown a narrow upward trend for two consecutive months, but there has been no obvious support from the demand side. More is the change in its own output.

As a major consumer of natural latex in the world, Malaysia's demand for natural latex remains relatively high. However, this year's heavy rainfall has also affected its own output. Coupled with Malaysia's own natural latex production is difficult to meet its own demand, which in turn is more sensitive to foreign raw materials. The dependence is high, but the weak status of actual demand has also laid the foundation for the overall import of Malay concentrated milk this year to remain relatively weak. Even if it grows in the short term, the overall increase will be relatively limited.

Summarize it: In fact, judging from Malaysia's August data, the demand for gloves remains weak. As another major country consuming concentrated milk, China's glove industry is also in a relatively depressed state. As we all know, under the influence of global public health and security incidents, the glove industry has become the main downstream consumer industry in China and Malaysia. Its pillar industries have weakened, and the demand for concentrated milk is unlikely to increase significantly. To a certain extent, it also suppressed the price of concentrated milk. As the fourth quarter approaches, the downstream situation is basically in a relatively clear state. Without the stimulation of new special demand, the spot price of concentrated milk is expected to remain relatively weak and end, with overall fluctuations relatively limited.