92,833

October 16, 2023, 4:25 PM

Analysis of natural rubber market price on October 16

index

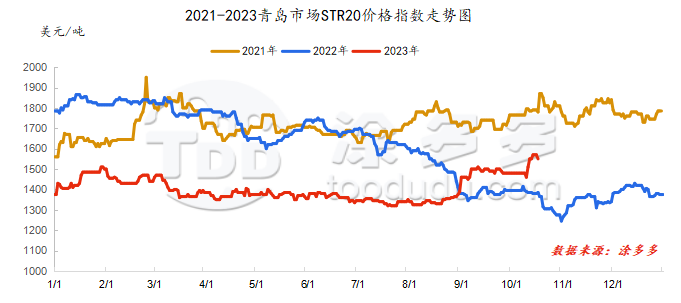

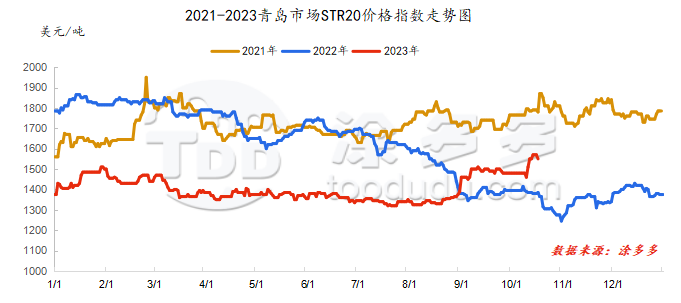

On October 16, the STR20 price index of natural rubber in the Qingdao market was US$1550/ton, down US$20/ton from the previous trading day, or 1.27%.

market analysis

futures market

|

date

|

Previous period: RU Futures

|

|

main contract

|

closing price

|

|

opening price

|

Low-end price

|

High-end price

|

closing price

|

RU01

|

RU05

|

RU09

|

|

October 16

|

14910

|

14725

|

14920

|

14750

|

14750

|

14675

|

14605

|

|

October 13

|

14700

|

14620

|

14890

|

14840

|

14840

|

14765

|

14730

|

|

rise and fall

|

210

|

105

|

30

|

-90

|

-90

|

-90

|

-125

|

|

date

|

Previous period energy: NR futures (closing price)

|

|

NR main force

|

NR01

|

NR05

|

NR09

|

|

October 16

|

11335

|

11335

|

11375

|

11170

|

|

October 13

|

11405

|

11390

|

11400

|

11150

|

|

rise and fall

|

-70

|

-55

|

-25

|

20

|

spot market

Supply:

Foreign countries: There are still disturbances in rainfall and weather in foreign production areas, the volume of raw materials has been blocked, and raw material prices have increased within a narrow range.

China: Rainy weather in Hainan's production area still affects normal rubber tapping operations, supporting raw material prices to remain firm at high levels. Rainfall in Yunnan's production areas has eased, and raw material prices have remained relatively stable.

|

price type

|

October 13

|

October 16

|

rise and fall

|

units

|

|

raw material prices

|

Thailand

|

glue

|

50.6

|

51.5

|

0.9

|

baht/kg

|

|

cup glue

|

46.7

|

47.95

|

1.25

|

baht/kg

|

|

Yunnan

|

Glue (into the dry glue factory)

|

11900

|

11800

|

-100

|

Yuan/ton

|

|

rubber block

|

9900

|

9900

|

0

|

Yuan/ton

|

|

Hainan

|

Glue (into the dry glue factory)

|

12400

|

13300

|

900

|

Yuan/ton

|

|

Glue (Jinnong Dairy Factory)

|

12400

|

13300

|

900

|

Yuan/ton

|

Demand side: It is understood that semi-steel tire enterprises have sufficient domestic export orders and their enthusiasm for starting construction has not diminished. As personnel are gradually in place, there is room for a slight improvement in the operating rate of all-steel tire enterprises.

Futures spot price list

|

price type

|

October 13

|

October 16

|

rise and fall

|

units

|

|

price of finished products

|

Shandong

|

China All Latex

|

13500

|

13500

|

0

|

Yuan/ton

|

|

Qingdao

|

Thailand No. 20 standard glue

|

1570

|

1550

|

-20

|

us dollars/ton

|

|

Qingdao

|

Thailand No. 20 mixed glue

|

12280

|

12280

|

0

|

Yuan/ton

|

|

Ningbo

|

Hainan

|

9650

|

9900

|

250

|

Yuan/ton

|

|

Ningbo

|

Thailand Non-Yellow Bulk

|

10450

|

10600

|

150

|

Yuan/ton

|

|

the current price difference

|

Main force-Thailand No. 20 mixed glue

|

2560

|

2470

|

-90

|

Yuan/ton

|

|

Main force-China All Latex

|

1340

|

1250

|

-90

|

Yuan/ton

|

|

relevant exchange rate

|

us dollar against the RMB

|

7.3238

|

7.3269

|

0.0031

|

Yuan

|

|

Thai Baht to RMB

|

0.2063

|

0.2025

|

-0.0038

|

Yuan

|

market outlook

In the short term, abnormal weather in foreign production areas continues, affecting rubber collection. The purchase price of raw materials is expected to continue to rise, and the cost side will support the natural rubber market. Overseas factories have postponed shipping schedules, the quantity of mixed Chinese standard rubber products arriving in Hong Kong is relatively small, and the continued removal of Chinese natural rubber stocks to the warehouse has boosted the confidence of the industry. During the holidays, the impact of factors such as some logistics outages and high-speed restrictions has basically ended one after another. Coupled with the introduction of automobile consumption and related policies, this has stimulated the trend of consumption to maintain a stable preference to a certain extent. The probability of rubber prices continuing to rise still exists, and in the later period Pay attention to news such as rainfall and storage in the production area.