[Natural Rubber]: Rubber Daily Journal (October 18)

Analysis of natural rubber market price on October 18

index

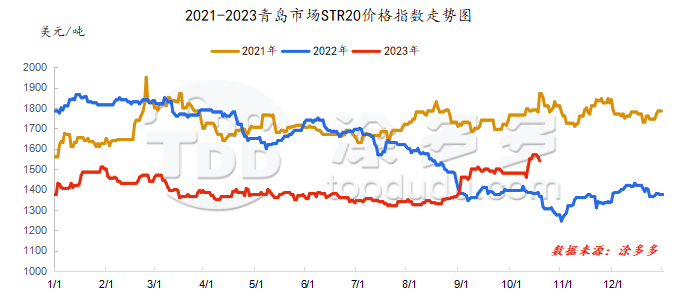

On October 18, the STR20 price index of natural rubber in the Qingdao market was US$1540/ton, down US$20/ton from the previous trading day, or 1.28%.

market analysis

futures market

|

date |

Previous period: RU Futures |

||||||

|

main contract |

closing price |

||||||

|

opening price |

Low-end price |

High-end price |

closing price |

RU01 |

RU05 |

RU09 |

|

|

October 18 |

14770 |

14645 |

14805 |

14665 |

14665 |

14590 |

14545 |

|

October 17 |

14760 |

14660 |

14875 |

14775 |

14775 |

14715 |

14650 |

|

rise and fall |

10 |

-15 |

-70 |

-110 |

-110 |

-125 |

-105 |

|

date |

Previous period energy: NR futures (closing price) |

|||

|

NR main force |

NR01 |

NR05 |

NR09 |

|

|

October 18 |

11265 |

11290 |

11330 |

11335 |

|

October 17 |

11420 |

11405 |

11500 |

11335 |

|

rise and fall |

-155 |

-115 |

-170 |

0 |

spot market

Supply:

Foreign countries: There are still disturbances in rainfall and weather in foreign production areas, the volume of raw materials has been blocked, and raw material prices have increased within a narrow range.

China: Rainy weather in Hainan's production area still affects normal rubber tapping operations, supporting raw material prices to remain firm at high levels. Rainfall in Yunnan's production areas has eased, and raw material prices have remained relatively stable.

|

price type |

October 17 |

October 18 |

rise and fall |

units |

||

|

raw material prices |

Thailand |

glue |

52 |

52.5 |

0.5 |

baht/kg |

|

cup glue |

48.55 |

48.8 |

0.25 |

baht/kg |

||

|

Yunnan |

Glue (into the dry glue factory) |

11800 |

11800 |

0 |

Yuan/ton |

|

|

rubber block |

9900 |

9900 |

0 |

Yuan/ton |

||

|

Hainan |

Glue (into the dry glue factory) |

13300 |

13700 |

400 |

Yuan/ton |

|

|

Glue (Jinnong Dairy Factory) |

13300 |

13700 |

400 |

Yuan/ton |

||

Demand side: It is understood that due to external factors, individual all-steel tire and semi-steel tire enterprises in Shandong have a negative impact, which will cause a certain drag on the overall start of construction. At present, overall company shipments are slow, and inventories are showing an upward trend. In terms of the market, current market transactions are generally normal. After the agent shipment price was increased, shipments have slowed down. Currently, agents are slow to go to the warehouse, and short-term shortages are mainly made up. In addition, the market is seriously involved, market prices are relatively chaotic, and some low-priced stock tires are still flooding the market.

Futures spot price list

|

price type |

October 17 |

October 18 |

rise and fall |

units |

||

|

price of finished products |

Shandong |

China All Latex |

13400 |

13400 |

0 |

Yuan/ton |

|

Qingdao |

Thailand No. 20 standard glue |

1560 |

1540 |

-20 |

us dollars/ton |

|

|

Qingdao |

Thailand No. 20 mixed glue |

12380 |

12300 |

-80 |

Yuan/ton |

|

|

Ningbo |

Hainan |

10000 |

10050 |

50 |

Yuan/ton |

|

|

Ningbo |

Thailand Non-Yellow Bulk |

10750 |

10900 |

150 |

Yuan/ton |

|

|

the current price difference |

Main force-Thailand No. 20 mixed glue |

2370 |

2365 |

-5 |

Yuan/ton |

|

|

Main force-China All Latex |

1350 |

1265 |

-85 |

Yuan/ton |

||

|

relevant exchange rate |

us dollar against the RMB |

7.3304 |

7.3198 |

-0.0106 |

Yuan |

|

|

Thai Baht to RMB |

0.2068 |

0.2071 |

0.0003 |

Yuan |

||

market outlook

In the short term, abnormal weather in foreign production areas will continue, affecting rubber collection. The purchase price of raw materials is expected to continue to rise, and the cost side will support the natural rubber market. Overseas factories have postponed shipping schedules, the quantity of mixed Chinese standard rubber products arriving in Hong Kong is relatively small, and the continued removal of Chinese natural rubber stocks to the warehouse has boosted the confidence of the industry. In September, China's PMI returned to expansion range, downstream start-ups also remained stable, and automobile consumption in the fourth quarter is about to usher in the traditional prime time, which in turn will boost demand for natural rubber to a certain extent. In the short term, the upstream and downstream supply and demand factors in the Tianjiao market are strong, and there is still room for upward driving in rubber prices. Hujiao is expected to maintain a strong and volatile trend.