Tu Duoduo Gasoline Industry Special Issue-No. 20231019

Gasoline Special issue-20231019 issue

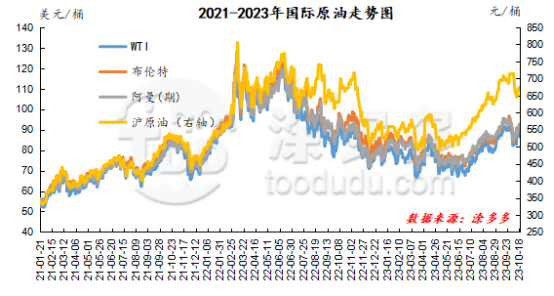

I. International crude oil futures price

|

Date |

WTI |

Brent |

Muerban |

DME Oman |

Shanghai crude oil |

WTI/ Brent spread |

Brent / DME Oman spread |

|

20231012 |

82.91 |

86 |

88.08 |

87.16 |

651.5 |

-3.09 |

-1.16 |

|

20231018 |

88.32 |

91.5 |

94.09 |

92.62 |

673.6 |

-3.18 |

-1.12 |

|

The rate of change compared with last week |

6.53% |

6.40% |

6.82% |

6.26% |

3.39% |

2.91% |

-3.45% |

|

Remarks: 1. Except for Shanghai crude oil, the price units of other oil products in the price list are US dollars per barrel. |

|||||||

II. Summary of gasoline market

This week (20231013-20231019), the wholesale price of gasoline in all regions of China was reduced as a whole, with a reduction of 50-150 yuan per ton. The ex-factory price of the refinery has also been reduced by 50-250 yuan / ton. The main factors of this week's gasoline market: 1. International crude oil: international oil prices have risen mainly under the support of the situation in the Middle East, and the decline in US crude oil commercial inventory has also formed a certain positive support. 2. Chinese market: after the festival, the focus on replenishment ends, the rigid demand in the middle and lower reaches is mainly purchased, the enthusiasm of receiving goods is not high and the mentality is more cautious, and the overall performance of insufficient follow-up of market demand is general. 3. The refinery has more price reduction and promotion operations for catching-up tasks. the center of gravity of the real order transaction has shifted down, and the market trading atmosphere is relatively deadlocked.

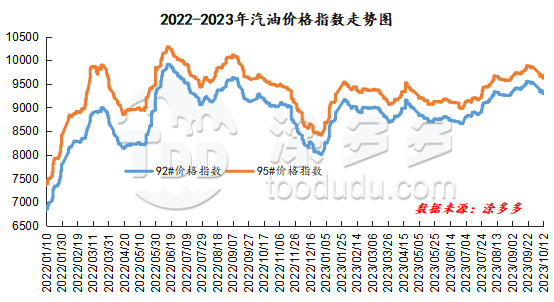

III. Gasoline price index

According to Tudor data, as of October 19, China's gasoline price index was 9199.25, down 92.63 from last week, or 1.00%, down 1.00% from 9530.82, down 85.64 from last week, or 0.89%. The 9-month and 9-month gasoline indices were both downgraded, and the price difference between the 9-month gasoline index and the 9-month gasoline index was 331.57.

IV. Spot market for gasoline

1. Price comparison of gasoline Market in China

|

Comparison of main wholesale price of gasoline (yuan / ton) |

|||||

|

Area |

Gasoline model |

Price 10.12 |

Price 10.19 |

Rise and fall |

Amplitude |

|

North China region |

92# |

8750-9650 |

8680-9600 |

-70/-50 |

-0.80%/-0.52% |

|

95# |

8950-10000 |

8880-10000 |

-70/0 |

-0.78%/0.00% |

|

|

South China |

92# |

9050-9750 |

9000-9700 |

-50/-50 |

-0.55%/-0.51% |

|

95# |

9300-10050 |

9250-10000 |

-50/-50 |

-0.54%/-0.50% |

|

|

Central China |

92# |

8950-9300 |

8900-9200 |

-50/-100 |

-0.56%/-1.08% |

|

95# |

9100-9500 |

9100-9450 |

0/-50 |

0.00%/-0.53% |

|

|

East China region |

92# |

8950-9650 |

8850-9650 |

-100/0 |

-1.12%/0.00% |

|

95# |

9100-10000 |

9050-10000 |

-50/0 |

-0.55%/0.00% |

|

|

Northwestern region |

92# |

8950-10050 |

8830-10050 |

-120/0 |

-1.34%/0.00% |

|

95# |

9150-10450 |

9030-10450 |

-120/0 |

-1.31%/0.00% |

|

|

Southwest China |

92# |

9200-9550 |

9050-9530 |

-150/-20 |

-1.63%/-0.21% |

|

95# |

9450-9950 |

9350-9950 |

-100/0 |

-1.06%/0.00% |

|

|

Northeast China |

92# |

9150-9800 |

8900-9800 |

-250/0 |

-2.73%/0.00% |

|

95# |

9450-10000 |

9200-10000 |

-250/0 |

-2.65%/0.00% |

|

|

Comparison of ex-factory price of gasoline refinery (yuan / ton) |

|||||

|

Area |

Gasoline model |

Price 10.12 |

Price 10.19 |

Rise and fall |

Amplitude |

|

Shandong area |

92# |

8440-8830 |

8400-8670 |

40/-160 |

-0.47%/-1.81% |

|

95# |

8550-8910 |

8480-8860 |

-70/-50 |

-0.82%/-0.56% |

|

|

North China region |

92# |

8590-8600 |

8430-8550 |

-160/-50 |

-1.86%/-0.58% |

|

95# |

8650-8690 |

8530-8600 |

-120/-90 |

-1.39%/-1.04% |

|

|

Central China |

92# |

8810-8810 |

8700-8700 |

-110/-110 |

-1.25%/-1.25% |

|

95# |

9010-9010 |

8900-8900 |

-110/-110 |

-1.22%/-1.22% |

|

|

East China region |

92# |

8580-8660 |

8510-8620 |

-70/-40 |

-0.82%/-0.46% |

|

95# |

8700-8830 |

8630-8790 |

-70/-40 |

-0.80%/-0.45% |

|

|

Northwestern region |

92# |

8750-8950 |

8650-8750 |

-100/-200 |

-1.14%/-2.23% |

|

95# |

8900-9150 |

8750-8950 |

-150/-200 |

-1.69%/-2.19% |

|

|

Northeast China |

92# |

9150-9150 |

8800-8900 |

-350/-250 |

-3.83%/-2.73% |

|

95# |

9350-9350 |

9100-9100 |

-250/-250 |

-2.67%/-2.67% |

|

|

Southwest China |

92# |

9250-9250 |

9150-9150 |

-100/-100 |

-1.08%/-1.08% |

|

95# |

9400-9400 |

9300-9300 |

-100/-100 |

-1.06%/-1.06% |

|

2. Gasoline market price comparison in different regions

(1) Northeast China

|

Province / city |

Model |

Price 10.12 |

Price 10.19 |

Rise and fall |

Amplitude |

|

Jilin |

92# |

9350-9800 |

9250-9800 |

-100/0 |

-1.07%/0.00% |

|

95# |

9950-10150 |

9850-10150 |

-100/0 |

-1.01%/0.00% |

|

|

Liaoning |

92# |

9150-9600 |

8950-9400 |

-200/-200 |

-2.19%/-2.08% |

|

95# |

9450-10100 |

9130-9800 |

-320/-300 |

-3.39%/-2.97% |

|

|

Heilongjiang Province |

92# |

9350-9350 |

9250-9250 |

-100/-100 |

-1.07%/-1.07% |

|

95# |

9550-9550 |

9500-9500 |

-50/-50 |

-0.52%/-0.52% |

(2) East China

|

Province / city |

Model |

Price 10.12 |

Price 10.19 |

Rise and fall |

Amplitude |

|

Shanghai |

92# |

8950-9100 |

8850-9000 |

-100/-100 |

-1.12%/-1.10% |

|

95# |

9100-9300 |

9000-9200 |

-100/-100 |

-1.10%/-1.08% |

|

|

Shandong |

92# |

9200-9650 |

9000-9650 |

-200/0 |

-2.17%/0.00% |

|

95# |

9350-10000 |

9150-10000 |

-200/0 |

-2.14%/0.00% |

|

|

Jiangsu Province |

92# |

9100-9150 |

9000-9100 |

-100/-50 |

-1.10%/-0.55% |

|

95# |

9350-9450 |

9250-9400 |

-100/-50 |

-1.07%/-0.53% |

|

|

Zhejiang |

92# |

9050-9350 |

8900-9250 |

-150/-100 |

-1.66%/-1.07% |

|

95# |

9400-9550 |

9250-9500 |

-150/-50 |

-1.60%/-0.52% |

(3) Central China

|

Province / city |

Model |

Price 10.12 |

Price 10.19 |

Rise and fall |

Amplitude |

|

Anhui Province |

92# |

9150-9200 |

9050-9050 |

-100/-150 |

-1.09%/-1.63% |

|

95# |

9300-9400 |

9250-9250 |

-50/-150 |

-0.54%/-1.60% |

|

|

Jiangxi Province |

92# |

9300-9300 |

9100-9200 |

-200/-100 |

-2.15%/-1.08% |

|

95# |

9500-9600 |

9400-9400 |

-100/-200 |

-1.05%/-2.08% |

|

|

Hubei province |

92# |

9000-9300 |

8900-9300 |

-100/0 |

-1.11%/0.00% |

|

95# |

9200-9450 |

9100-9450 |

-100/0 |

-1.09%/0.00% |

|

|

Hunan |

92# |

9100-9150 |

8900-9070 |

-200/-80 |

-2.20%/-0.87% |

|

95# |

9300-9400 |

9100-9300 |

-200/-100 |

-2.15%/-1.06% |

(4) North China

|

Province / city |

Model |

Price 10.12 |

Price 10.19 |

Rise and fall |

Amplitude |

|

Inner Mongolia Autonomous region |

92# |

9000-9100 |

9000-9100 |

0/0 |

0.00%/0.00% |

|

95# |

9200-9300 |

9200-9300 |

0/0 |

0.00%/0.00% |

|

|

Beijing |

92# |

9250-9250 |

9200-9200 |

-50/-50 |

-0.54%/-0.54% |

|

95# |

9450-9500 |

9400-9500 |

-50/0 |

-0.53%/0.00% |

|

|

Tianjin |

92# |

8750-9000 |

8650-8900 |

-100/-100 |

-1.14%/-1.11% |

|

95# |

8950-9300 |

8850-9100 |

-100/-200 |

-1.12%/-2.15% |

|

|

Shanxi Province |

92# |

9010-9650 |

8600-8950 |

-410/-700 |

-4.55%/-7.25% |

|

95# |

9400-10000 |

9250-10000 |

-150/0 |

-1.60%/0.00% |

|

|

Hebei |

92# |

8910-9150 |

8860-8900 |

-50/-250 |

-0.56%/-2.73% |

|

95# |

9160-9400 |

9060-9150 |

-100/-250 |

-1.09%/-2.66% |

|

|

Henan |

92# |

9100-9230 |

8900-9050 |

-200/-180 |

-2.20%/-1.95% |

|

95# |

9420-9470 |

9120-9420 |

-300/-50 |

-3.18%/-0.53% |

(5) South China

|

Province / city |

Model |

Price 10.12 |

Price 10.19 |

Rise and fall |

Amplitude |

|

Guangdong |

92# |

9200-9750 |

9100-9700 |

-100/-50 |

-1.09%/-0.51% |

|

95# |

9500-10050 |

9400-10000 |

-100/-50 |

-1.05%/-0.50% |

|

|

Hainan |

92# |

9400-9450 |

9300-9400 |

-100/-50 |

-1.06%/-0.53% |

|

95# |

9600-9650 |

9500-9600 |

-100/-50 |

-1.04%/-0.52% |

|

|

Fujian |

92# |

9050-9250 |

8970-9200 |

-80/-50 |

-0.88%/-0.54% |

|

95# |

9300-9500 |

9220-9450 |

-80/-50 |

-0.86%/-0.53% |

(6) Northwest China

|

Province / city |

Model |

Price 10.12 |

Price 10.19 |

Rise and fall |

Amplitude |

|

Ningxia Hui Autonomous region |

92# |

9200-10210 |

9200-10210 |

0/0 |

0.00%/0.00% |

|

95# |

9400-10600 |

9400-10600 |

0/0 |

0.00%/0.00% |

|

|

Xinjiang Uygur Autonomous region |

92# |

10350-10350 |

10350-10350 |

0/0 |

0.00%/0.00% |

|

95# |

10950-10950 |

10950-10950 |

0/0 |

0.00%/0.00% |

|

|

Gansu |

92# |

9050-10680 |

8950-10680 |

-100/0 |

-1.10%/0.00% |

|

95# |

9550-11300 |

9550-11300 |

0/0 |

0.00%/0.00% |

|

|

Xizang Autonomous region |

92# |

10050-10080 |

10050-10080 |

0/0 |

0.00%/0.00% |

|

95# |

10450-10480 |

10450-10480 |

0/0 |

0.00%/0.00% |

|

|

Shaanxi |

92# |

9080-10130 |

8750-10130 |

-330/0 |

-3.63%/0.00% |

|

95# |

9280-10520 |

8950-10520 |

-330/0 |

-3.56%/0.00% |

|

|

Qinghai |

92# |

9610-9610 |

9610-9610 |

0/0 |

0.00%/0.00% |

|

95# |

10450-10480 |

10010-10010 |

-440/-470 |

-4.21%/-4.48% |

(7) Southwest China

|

Province / city |

Model |

Price 10.12 |

Price 10.19 |

Rise and fall |

Amplitude |

|

Yunnan |

92# |

9350-9500 |

9280-9500 |

-70/0 |

-0.75%/0.00% |

|

95# |

9770-9950 |

9730-9950 |

-40/0 |

-0.41%/0.00% |

|

|

Sichuan |

92# |

9400-9550 |

9250-9450 |

-150/-100 |

-1.60%/-1.05% |

|

95# |

9700-9850 |

9700-9850 |

0/0 |

0.00%/0.00% |

|

|

Guangxi Zhuang Autonomous region |

92# |

9200-10860 |

9200-10860 |

0/0 |

0.00%/0.00% |

|

95# |

9450-11480 |

9350-11480 |

-100/0 |

-1.06%/0.00% |

|

|

Guizhou |

92# |

9400-9500 |

9300-9400 |

-100/-100 |

-1.06%/-1.05% |

|

95# |

9700-9800 |

9550-9700 |

-150/-100 |

-1.55%/-1.02% |

|

|

Chongqing |

92# |

9300-9900 |

9100-9800 |

-200/-100 |

-2.15%/-1.01% |

|

95# |

9500-10300 |

9350-10200 |

-150/-100 |

-1.58%/-0.97% |

(8) Northeast geochemistry

|

Province / city |

Model |

Price 10.12 |

Price 10.19 |

Rise and fall |

Amplitude |

|

Jilin |

92# |

9150-9150 |

8800-8900 |

-350/-250 |

-3.83%/-2.73% |

|

95# |

9350-9350 |

9100-9100 |

-250/-250 |

-2.67%/-2.67% |

|

|

Liaoning |

92# |

- |

- |

- |

- |

|

95# |

- |

- |

- |

- |

(9) East China geochemistry

|

Province / city |

Model |

Price 10.12 |

Price 10.19 |

Rise and fall |

Amplitude |

|

Jiangsu Province |

92# |

8580-8660 |

8510-8620 |

-70/-40 |

-0.82%/-0.46% |

|

95# |

8700-8830 |

8630-8790 |

-70/-40 |

-0.80%/-0.45% |

(10) Central China Refinery

|

Province / city |

Model |

Price 10.12 |

Price 10.19 |

Rise and fall |

Amplitude |

|

Hubei province |

92# |

8810-8810 |

8700-8700 |

-110/-110 |

-1.25%/-1.25% |

|

95# |

9010-9010 |

8900-8900 |

-110/-110 |

-1.22%/-1.22% |

(11) geochemistry in North China

|

Province / city |

Model |

Price 10.12 |

Price 10.19 |

Rise and fall |

Amplitude |

|

Henan |

92# |

8590-8600 |

8430-8550 |

-160/-50 |

-1.86%/-0.58% |

|

95# |

8650-8690 |

8530-8600 |

-120/-90 |

-1.39%/-1.04% |

(12) Shandong Geolian

|

Province / city |

Model |

Price 10.12 |

Price 10.19 |

Rise and fall |

Amplitude |

|

Shandong |

92# |

8440-8830 |

8400-8670 |

-40/-160 |

-0.47%/-1.81% |

|

95# |

8550-8910 |

8480-8860 |

-70/-50 |

-0.82%/-0.56% |

(13) Northwest Refinery

|

Province / city |

Model |

Price 10.12 |

Price 10.19 |

Rise and fall |

Amplitude |

|

Ningxia Hui Autonomous region |

92# |

8750-8800 |

8500-8600 |

-250/-200 |

-2.86%/-2.27% |

|

95# |

8900-8950 |

8650-8750 |

-250/-200 |

-2.81%/-2.23% |

|

|

Shaanxi |

92# |

8950-8950 |

8750-8750 |

-200/-200 |

-2.23%/-2.23% |

|

95# |

9150-9150 |

8950-8950 |

-200/-200 |

-2.19%/-2.19% |

|

|

Xinjiang Uygur Autonomous region |

92# |

9350-9350 |

9150-9150 |

-200/-200 |

-2.14%/-2.14% |

(14) Southwest Refinery

|

Province / city |

Model |

Price 10.12 |

Price 10.19 |

Rise and fall |

Amplitude |

|

Sichuan Province |

92# |

9250-9250 |

9150-9150 |

-100/-100 |

-1.08%/-1.08% |

|

95# |

9400-9400 |

9300-9300 |

-100/-100 |

-1.06%/-1.06% |

V. Future forecast

From the perspective of international crude oil, Iran called for an oil embargo against Israel, but OPEC did not show support for Iran. And the United States intends to ease sanctions on Venezuela, and crude oil is expected to fall next week. On the supply side, there will be no new refineries for inspection and repair next week, and the maintenance of Sichuan Petrochemical will soon be over. On the demand side, although refineries are willing to raise prices slightly at present, there is a lack of holiday support for gasoline demand, and there are more daily commutes for vehicles, so it is difficult to improve in the short term as a whole, or drag the market down, so the operation of the gasoline market is still relatively weak. Do not rule out the possibility of refineries moderately reducing processing load. From the point of view of the price adjustment mechanism of refined oil, there are downward expectations for the new round of retail price adjustment, and the news is negative. On the whole, it is expected that there is room for downward adjustment in China's gasoline market in the short term.

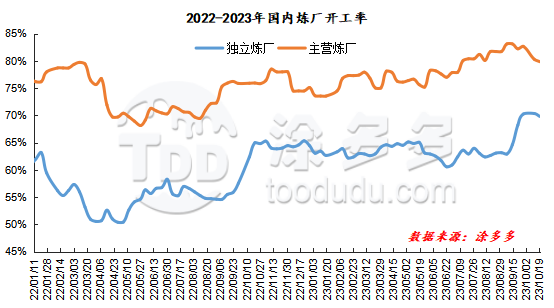

VI. Operating rate

China's overall capacity utilization fell this week (20231013-20231019), of which the capacity utilization rate of the main unit was 79.86%, down 0.44% from last week, and the operating rate of independent refineries was 69.81%, down 0.53% from last week.

Supply and demand & profit

Supply and demand: this week, China's oil product output is 3.2654 million tons, China's main output is 2.2697 million tons, China's independent refineries output 995700 tons, China's independent refinery gasoline sales of 950000 tons, China's commercial inventory of 12.9335 million tons.

Profit: main comprehensive oil refining weekly production gross profit 70.79 yuan / ton, georefining comprehensive oil refining weekly production gross profit 449.77 yuan / ton, atmospheric and vacuum weekly production gross profit 66 yuan / ton, FCC weekly production gross profit-325 yuan / ton, delayed coking weekly production gross profit 589 yuan / ton.

VIII. Plant maintenance schedule

|

Maintenance schedule of main refineries in China |

||||

|

Refinery |

Inspection and repair device |

Maintenance capacity (10,000 tons) |

Start time |

End time |

|

Beihai Refining and Chemical Industry |

Catalytic cracking |

210 |

March 1, 2023 |

March 31, 2023 |

|

Daqing Refining and Chemical Industry |

Whole plant overhaul |

550 |

August 3, 2023 |

September 23, 2023 |

|

Daqing Petrochemical |

Whole plant overhaul |

1000 |

June 15, 2023 |

July 24, 2023 |

|

Guangzhou Petrochemical Corporation |

Atmospheric and vacuum decompression |

500 |

October 15, 2023 |

December 5, 2023 |

|

Harbin Petrochemical |

Whole plant overhaul |

435 |

May 5, 2023 |

June 23, 2023 |

|

Huizhou Refining and Chemical Industry |

The first phase of the whole plant |

1200 |

March 15, 2023 |

Mid-May 2023 |

|

Jinling Petrochemical |

Atmospheric and vacuum decompression |

600 |

April 10, 2023 |

May 26, 2023 |

|

Lanzhou Petrochemical |

Whole plant overhaul |

1050 |

June 11, 2023 |

August 9, 2023 |

|

Liaoyang Petrochemical Company |

Whole plant overhaul |

900 |

April 10, 2023 |

May 24, 2023 |

|

Luoyang Refining and Chemical Industry |

Whole plant overhaul |

1000 |

May 15, 2023 |

July 14, 2023 |

|

Qingdao Refining and Chemical Industry |

Whole plant overhaul |

1200 |

May 16, 2023 |

July 6, 2023 |

|

Sichuan Petrochemical Company |

Whole plant overhaul |

1000 |

September 15, 2023 |

November 20, 2023 |

|

Tahe petrochemical |

Diesel oil hydrogenation |

/ |

March 19, 2023 |

March 31, 2023 |

|

Tianjin Petrochemical Company |

Atmospheric and vacuum decompression |

250 |

September 5, 2023 |

October 31, 2023 |

|

Urumqi petrochemical |

Whole plant overhaul |

850 |

April 15, 2023 |

June 18, 2023 |

|

Dongxing in Zhanjiang |

Whole plant overhaul |

500 |

October 5, 2023 |

December 5, 2023 |

|

Changqing Petrochemical Company |

Whole plant overhaul |

500 |

April 1, 2023 |

May 25, 2023 |

|

Zhenhai Refining and Chemical Industry |

Atmospheric and vacuum decompression |

1000 |

March 10, 2023 |

May 5, 2023 |

|

China National Oil and Gas Taizhou |

Whole plant overhaul |

600 |

May 12, 2023 |

End of June 2023 |

|

Qingdao Petrochemical Company |

Whole plant overhaul |

500 |

October 7, 2023 |

End of November 2023 |

|

Maintenance schedule of local refinery plant |

||||

|

Refinery |

Inspection and repair device |

Maintenance capacity (10,000 tons) |

Start time |

End time |

|

Dalian Hengli |

Hydrogenation of wax oil and residue |

/ |

May 20, 2023 |

Early July 2023 |

|

Dalian Jinyuan |

Whole plant overhaul |

220 |

July 10, 2023 |

August 9, 2023 |

|

Dongying Petrochemical Company |

Whole plant overhaul |

350 |

March 12, 2023 |

May 10, 2023 |

|

Fengli petrochemical |

Whole plant overhaul |

260 |

July 20, 2023 |

August 20, 2023 |

|

Fu Haichuang |

Whole plant overhaul |

700 |

June 16, 2023 |

September 15, 2023 |

|

Kenli Petrochemical |

Whole plant overhaul |

300 |

May 20, 2023 |

June 15, 2023 |

|

Lanqiao Petrochemical |

Whole plant overhaul |

350 |

June 15, 2023 |

August 2, 2023 |

|

Lijin refining and chemical industry |

Whole plant overhaul |

350 |

August 19, 2023 |

September 18, 2023 |

|

United petrochemical |

Whole plant overhaul |

420 |

April 9, 2023 |

May 19, 2023 |

|

Liaoning Baolai |

Catalysis, hydrogenation, etc. |

/ |

January 30, 2023 |

February 23, 2023 |

|

Whole plant overhaul |

2400 |

August 1, 2023 |

September 2023 |

|

|

Liaoning Huajin |

Diesel oil hydrogenation |

/ |

March 8, 2023 |

March 15, 2023 |

|

Ninglu Petrochemical |

Rotation inspection of the whole plant |

120 |

June 15, 2023 |

July 5, 2023 |

|

Panjin Haoye |

Fault shutdown |

650 |

January 15, 2023 |

July 6, 2023 |

|

Qicheng petrochemical |

Rotation inspection |

350 |

August 5, 2023 |

Mid-September 2023 |

|

Shenchi chemical industry |

Catalytic cracking |

120 |

January 22, 2023 |

February 20, 2023 |

|

Wantong Petrochemical |

Whole plant overhaul |

650 |

July 13, 2023 |

August 30, 2023 |

|

Wudi Xinyue |

Whole plant overhaul |

240 |

June 26, 2023 |

Early September 2023 |

|

Xinhai Sinopec |

Whole plant overhaul |

600 |

April 26, 2023 |

August 10, 2023 |

|

Xintai Petrochemical |

Rotation inspection |

220 |

End of February 2023 |

July 22, 2023 |

|

Yatong Petrochemical |

Hydrocracking |

200 |

May 27, 2023 |

July 6, 2023 |

|

Yan'an Refinery |

Whole plant overhaul |

560 |

May 20, 2023 |

June 26, 2023 |

|

Zhonghe petrochemical |

Catalysis |

100 |

March 31, 2023 |

April 15, 2023 |

|

China and overseas |

Whole plant overhaul |

300 |

February 28, 2023 |

April 20, 2023 |

|

Yongping Refinery |

Whole plant overhaul |

460 |

September 4, 2023 |

September 20, 2023 |