PVC: Futures 'upside broke through the prefix 6, partial closure of short positions, and slight upward repair of spot positions

PVC futures analysis: October 20 V2401 contract opening price: 5939, highest price: 6027, lowest price: 5927, position: 923266, settlement price: 5980, yesterday settlement: 5904, down: 76, daily trading volume: 1163040 lots, precipitated capital: 3.869 billion, capital outflow: 154 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 10.19 |

Price 10.20 |

Rise and fall |

Remarks |

|

North China |

5680-5730 |

5730-5800 |

50/70 |

Send to cash remittance |

|

East China |

5750-5840 |

5850-5920 |

100/80 |

Cash out of the warehouse |

|

South China |

5850-5900 |

5930-5980 |

80/80 |

Cash out of the warehouse |

|

Northeast China |

5700-5900 |

5700-5900 |

0/0 |

Send to cash remittance |

|

Central China |

5760-5830 |

5800-5830 |

40/0 |

Send to cash remittance |

|

Southwest |

5550-5700 |

5600-5700 |

50/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices have risen, regional prices slightly repaired. Compared with the valuation, North China rose 50-70 yuan / ton, East China 80-100 yuan / ton, South China 80 yuan / ton, Northeast China stable, Central China 40 yuan / ton, Southwest China 50 yuan / ton. The ex-factory prices of upstream PVC production enterprises mainly remained stable, and some enterprises began to tentatively increase by 50 yuan / ton, including a small increase in ethylene enterprises. The price of futures opened low and went higher, showing a certain upward trend. The price of traders in various regions was raised yesterday, but the price advantage of the basis offer gradually disappeared. The downstream purchasing enthusiasm is not high. Among them, East China base offer 01 contract-(50-100-150), South China 01 contract-(0-50-100), North 01 contract-(420-520), Southwest 01 contract-(250). Looking at today's spot market as a whole, some hedgers receive goods, but they still have a general trading atmosphere unilaterally, with a strong wait-and-see mentality downstream, conflicting with high prices and replenishing goods at low prices.

From the perspective of futures: & the night price of nbsp; PVC2401 contract opened low and rose high, and the price began to fluctuate after a slight rise. At the beginning of morning trading, the price further rose to break through the 6-word prefix, fell slightly after the highest point of 6027, and then began to fluctuate in the relative position in the afternoon. 2401 contracts range from 5927 to 6027 throughout the day, with a spread of 100,001 and an increase of 44729 positions, with 923266 hands held so far. The 2405 contract closed at 6088, with 106645 positions.

PVC Future Forecast:

Futures: PVC2401 contract prices showed a small rebound trend, futures prices successfully broke through the prefix 6, but the market appeared to reduce positions, considering part of the short order profit-taking. And the reduction of positions for two consecutive days is relatively large, trading statistics are still slightly better with short opening. On the one hand, the operation of futures prices did not continue to decline on the basis of large volume near Friday, there are some short-term short-term short positions to consider, the small rebound in futures prices is not caused by more than opening. At midday, the main Chinese futures contracts were up and down, with SC crude oil, Hujin, methanol, low-sulfur fuel oil (LU) and polyvinyl chloride (PVC) up more than 1 per cent. On the whole, the short-term operation of futures prices may continue to test the position of the prefix 6, but the range above is expected to narrow, so watch out for the return of short positions.

Spot: recent spot market transactions have always maintained a light atmosphere, today's futures market rose slightly caused some hedgers to take the goods, from the basis point of view of the current point of hedging can lock in part of the profit, but there is hardly optimism to speak of. PVC fundamentals, calcium carbide prices continue to decline 50 yuan / ton, supply and demand still do not see more variables, exports maintain, the current monthly export volume and China's high inventory are consensus. However, today's performance of the two cities is OK, in the weak mood, PVC rarely shows a certain rebound trend, but the trading logic of the two cities is not stable, so it is treated with caution. Prices in the international crude oil futures market rose on the outside as traders remained nervous that Israeli military action in Gaza could escalate into a regional conflict. However, fears of an embargo on Israel have eased and the United States will relax sanctions on Venezuela, limiting the increase. On the whole, the spot market will continue to adjust by a small margin in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 10.19 |

Price 10.20 |

Rate of change |

|

V2401 collection |

5938 |

5987 |

49 |

|

|

Average spot price in East China |

5795 |

5885 |

90 |

|

|

Average spot price in South China |

5875 |

5955 |

80 |

|

|

PVC2401 basis difference |

-143 |

-102 |

41 |

|

|

V2405 collection |

6044 |

6088 |

44 |

|

|

V2401-2405 closed |

-106 |

-101 |

5 |

|

|

PP2401 collection |

7434 |

7441 |

7 |

|

|

Plastic L2401 collection |

7939 |

7954 |

15 |

|

|

V--PP basis difference |

-1496 |

-1454 |

42 |

|

|

Vmure-L basis difference of plastics |

-2001 |

-1967 |

34 |

|

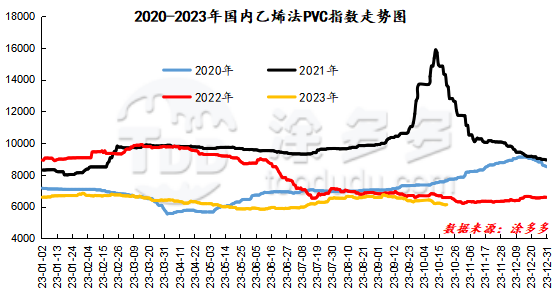

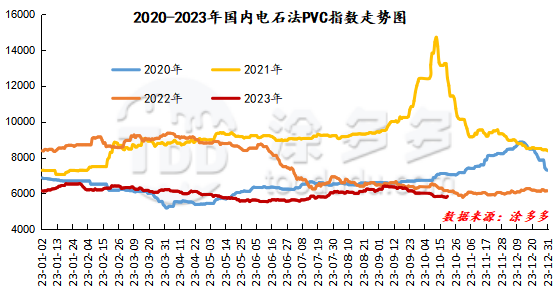

China PVC Index: according to Tuduoduo data, the Chinese calcium carbide PVC spot index was 5840.73, Zhang 61.63, with a range of 1.066%. The ethylene method PVC spot index is 6122.92, Zhang 14.25, the range is 0.233%, the calcium carbide method index rises, the ethylene method index rises, the ethylene method-calcium carbide method index price difference is 282.19.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

10.19 warehouse receipts |

10.20 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

843 |

843 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

402 |

402 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

274 |

274 |

0 |

|

|

Zhenjiang Middle and far Sea |

274 |

274 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,417 |

2,417 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,343 |

1,343 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,329 |

1,329 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

9,269 |

9,269 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,844 |

1,844 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,162 |

3,162 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

274 |

274 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Zhejiang Jianfeng) |

0 |

7 |

7 |

|

PVC subtotal |

|

29,992 |

29,999 |

7 |

|

Total |

|

29,992 |

29,999 |

7 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.