[Natural Rubber]: Rubber Daily Journal (October 23)

Analysis of natural rubber market price on October 23

index

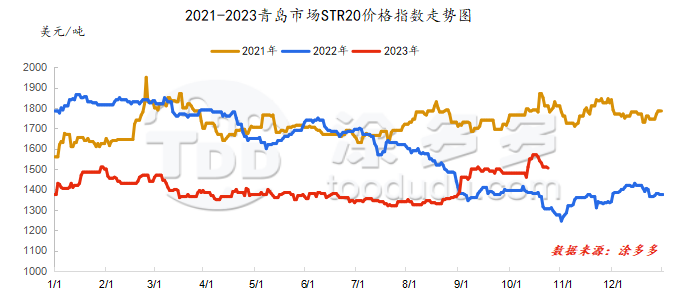

On October 23, the STR20 price index of natural rubber in the Qingdao market was US$1505/ton, down US$5/ton from the previous trading day, or 0.33%.

market analysis

futures market

|

date |

Previous period: RU Futures |

||||||

|

main contract |

closing price |

||||||

|

opening price |

Low-end price |

High-end price |

closing price |

RU01 |

RU05 |

RU09 |

|

|

October 23 |

14500 |

14395 |

14560 |

14480 |

14480 |

14390 |

14345 |

|

October 20 |

14605 |

14375 |

14690 |

14455 |

14455 |

14355 |

14625 |

|

rise and fall |

-105 |

20 |

-130 |

25 |

25 |

35 |

-280 |

|

date |

Previous period energy: NR futures (closing price) |

|||

|

NR main force |

NR01 |

NR05 |

NR09 |

|

|

October 23 |

11025 |

11070 |

11150 |

11055 |

|

October 20 |

11025 |

11040 |

11190 |

11335 |

|

rise and fall |

0 |

30 |

-40 |

-280 |

spot market

Supply:

Foreign: Rainfall weather in foreign production areas has eased, some areas have begun to increase in narrow ranges, and rainfall still exists in a few areas.

China: Rainy weather in Hainan's production area still affects normal rubber tapping operations, supporting raw material prices to remain firm at high levels. Rainfall in Yunnan's production areas has eased, and raw material prices have eased.

|

price type |

October 20 |

October 23 |

rise and fall |

units |

||

|

raw material prices |

Thailand |

glue |

53.5 |

-- |

-- |

baht/kg |

|

cup glue |

49.05 |

-- |

-- |

baht/kg |

||

|

Yunnan |

Glue (into the dry glue factory) |

11800 |

11600 |

-200 |

Yuan/ton |

|

|

rubber block |

9900 |

9800 |

-100 |

Yuan/ton |

||

|

Hainan |

Glue (into the dry glue factory) |

13700 |

13700 |

0 |

Yuan/ton |

|

|

Glue (Jinnong Dairy Factory) |

13700 |

13700 |

0 |

Yuan/ton |

||

Demand: It is understood that due to external factors, some all-steel tire companies are still shutting down, short-term transportation is blocked and output is limited. In addition, the operating rate of some companies has dropped, which has delayed the start of the overall sample. However, overall, the start of all steel tire companies is stable and declining, overall shipments are still acceptable, and the phenomenon of out-of-stock has gradually eased.

Futures spot price list

|

price type |

October 20 |

October 23 |

rise and fall |

units |

||

|

price of finished products |

Shandong |

China All Latex |

13300 |

13100 |

-200 |

Yuan/ton |

|

Qingdao |

Thailand No. 20 standard glue |

1510 |

1505 |

-5 |

us dollars/ton |

|

|

Qingdao |

Thailand No. 20 mixed glue |

12200 |

12200 |

0 |

Yuan/ton |

|

|

Ningbo |

Hainan |

10000 |

10000 |

0 |

Yuan/ton |

|

|

Ningbo |

Thailand Non-Yellow Bulk |

10900 |

10900 |

0 |

Yuan/ton |

|

|

the current price difference |

Main force-Thailand No. 20 mixed glue |

2255 |

2280 |

25 |

Yuan/ton |

|

|

Main force-China All Latex |

1155 |

1380 |

225 |

Yuan/ton |

||

|

relevant exchange rate |

us dollar against the RMB |

7.3354 |

7.3353 |

-0.0001 |

Yuan |

|

|

Thai Baht to RMB |

0.2071 |

0.2039 |

-0.0032 |

Yuan |

||

market outlook

Since last Friday, European and American stock markets have continued to fall significantly, and major commodities have been under significant pressure. China's LPR in October Staying unchanged, in line with market expectations, confidence in China's financial market is still poor. The periodic pressure and fluctuations have brought pressure and fluctuations on rubber prices. Today, the main rubber futures contract showed a downward trend at the opening. As the rainfall in other producing areas in China has eased, the output of raw materials has continued to increase, and the purchase price of raw materials is expected to fall. The positive support on the supply side has begun to weaken. However, the demand for all-steel tires on the demand side is still acceptable, and the semi-steel tires remain prosperous. In September, automobile production and sales hit a record high in the same period. Tire exports were good in September. In the short term, the demand side still has support for rubber prices, and rubber prices are likely to fluctuate in the short term.