PVC: Futures chose to move sideways between ups and downs, and the spot market continued to organize in a narrow range

PVC futures analysis: October 24th V2401 contract opening price: 6020, highest price: 6038, lowest price: 5946, position: 922397, settlement price: 5989, yesterday settlement: 5985, up: 4, daily trading volume: 1006997 lots, precipitated capital: 3.871 billion, capital outflow: 24.78 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 10.23 |

Price 10.24 |

Rise and fall |

Remarks |

|

North China |

5730-5800 |

5730-5790 |

0/-10 |

Send to cash remittance |

|

East China |

5820-5930 |

5800-5900 |

-20/-30 |

Cash out of the warehouse |

|

South China |

5900-5990 |

5900-5960 |

0/-30 |

Cash out of the warehouse |

|

Northeast China |

5700-5900 |

5700-5900 |

0/0 |

Send to cash remittance |

|

Central China |

5800-5830 |

5800-5830 |

0/0 |

Send to cash remittance |

|

Southwest |

5600-5700 |

5600-5700 |

0/0 |

Send to cash remittance |

PVC spot market: mainstream transaction prices in China's PVC market continue to be sorted out in a narrow range, with prices falling slightly in some areas. Valuation comparison: high-end prices in North China fell by 10 yuan / ton, East China fell by 20-30 yuan / ton, South China high-end prices fell by 30 yuan / ton, and prices in Northeast, Central China and Southwest China were stable. The ex-factory prices of upstream PVC production enterprises still remain stable, with individual enterprises reducing 50 yuan / ton to promote transaction. The futures price continues to fluctuate in the range, and the spot market price is slightly downgraded. At present, both the spot market price offer and the spot price offer are available, and the price base difference offer does not change much. Among them, East China base offer 01 contract-(70-100-150), South China 01 contract-(0-30-80), North 01 contract-(400-520), Southwest 01 contract-(250). Recently, the spot market has maintained a narrow range of arrangement, although the price changes have been adjusted every day, but the range has narrowed, the unilateral downstream wait-and-see mentality is strong, contradictory to the high price, some of the price has been negotiated slightly, and the market transaction is limited.

Futures point of view: PVC2401 contract night trading price opened a high of 6038, slightly weaker. Prices continued to fall slightly after the start of morning trading, but the overall decline did not begin to fluctuate at the 5980 front line. Afternoon prices rose slightly from a low of 5946 in late afternoon trading. 2401 contracts range from 5946 to 6038 throughout the day, with a spread of 92. 01. The contract reduced its position by 3281 positions and has held 922397 positions so far. The 2405 contract closed at 6106, with 106978 positions.

PVC Future Forecast:

Futures: The fluctuation of the futures price of the PVC2401 contract is slightly awkward, and the operation of the overall futures price seems to be obviously rising and falling, but it has chosen to trade sideways for a long time between 5900 and 6050. On the one hand, the funds above 6000 under the current position are not willing to bear the risk of further push up, and the consensus of the industry chain is that the upper pressure level is 6100, so it is relatively anxious even if the price is 100. on the other hand, the futures price is below 5950. Bears also lack enough bearish chips to continue to press down, resulting in the short-term price operation has always been dominated by narrow arrangement, and the feedback on PVC fundamentals and commodity sentiment is not stable. In the short term, futures prices may continue to operate around this range and continue to observe the performance of the 6000 mark.

Spot aspect: recent spot market price adjustment is relatively narrow, no matter up or down has been a small margin, some areas have even been wait-and-see. And the price adjustment participation of upstream enterprises is insufficient, most of them maintain a wait-and-see mentality and the price is stable, and the basic quantity of a generation of contracts is signed. Traders in various regions feedback that the digestion rate of spot is slow, and the actual single-hanging point of downstream products enterprises is generally on the low side. Today, most of the spot market hanging orders are below 5950. In terms of PVC fundamentals, calcium carbide prices began to rise sporadically by 50 yuan / ton, PVC supply rose steadily and slightly, and pre-maintenance enterprises started work one after another, but the current trend from fundamentals has little impact on the prices of the two cities. On the outer disk, oil prices fell more than 2 per cent as diplomatic efforts to contain the conflict between Israel and Hamas intensified, easing investors' concerns about potential supply disruptions. On the whole, spot prices will continue to operate within a narrow range in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 10.23 |

Price 10.24 |

Rate of change |

|

V2401 collection |

6012 |

5995 |

-17 |

|

|

Average spot price in East China |

5875 |

5850 |

-25 |

|

|

Average spot price in South China |

5945 |

5930 |

-15 |

|

|

PVC2401 basis difference |

-137 |

-145 |

-8 |

|

|

V2405 collection |

6110 |

6106 |

-4 |

|

|

V2401-2405 closed |

-98 |

-111 |

-13 |

|

|

PP2401 collection |

7443 |

7465 |

22 |

|

|

Plastic L2401 collection |

7989 |

7993 |

4 |

|

|

V--PP basis difference |

-1431 |

-1470 |

-39 |

|

|

Vmure-L basis difference of plastics |

-1977 |

-1998 |

-21 |

|

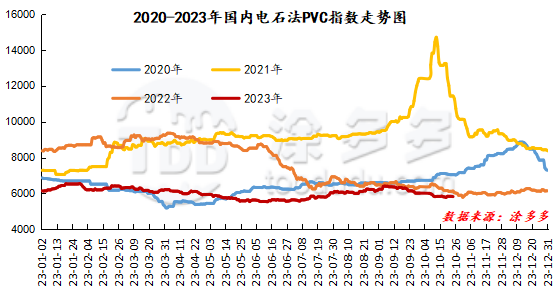

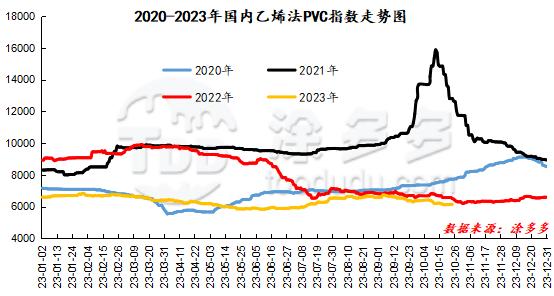

China PVC Index: according to Tuduoduo data, the China calcium Carbide PVC spot Index fell 11.81, or 0.202%, to 5823.73 on October 24. The ethylene PVC spot index was 6133.16, down 5.72, or 0.093%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 309.43.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

10.23 warehouse orders |

10.24 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

843 |

843 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

402 |

402 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

351 |

351 |

0 |

|

|

Zhenjiang Middle and far Sea |

351 |

351 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,417 |

2,417 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,343 |

1,343 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,329 |

1,329 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

9,269 |

9,269 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,844 |

1,844 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,162 |

3,162 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

274 |

274 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Zhejiang Jianfeng) |

7 |

7 |

0 |

|

PVC subtotal |

|

30,076 |

30,076 |

0 |

|

Total |

|

30,076 |

30,076 |

0 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.