Daily Review of Urea: Good news on exports is not clear yet. Market atmosphere is deadlocked (October 24)

China Urea Price Index:

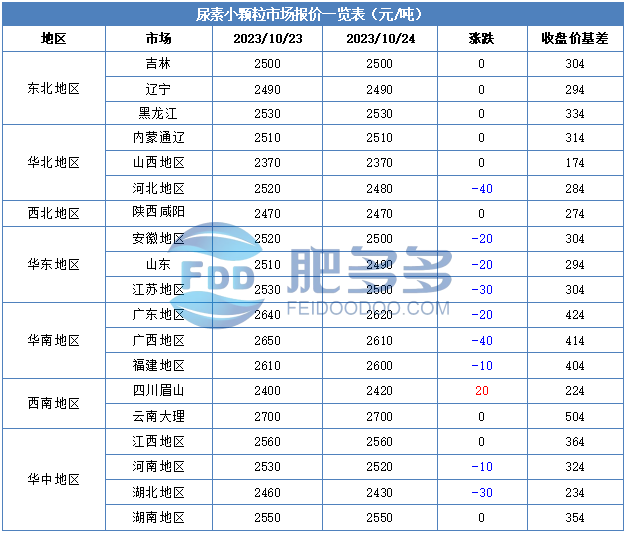

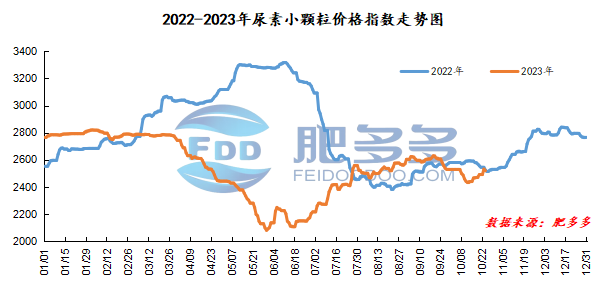

According to Feiduo data, the urea small pellet price index on October 24 was 2,519.36, down 11.36 from yesterday, down 0.45% month-on-month, and down 0.18% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2200, the highest price is 2226, the lowest price is 2174, the settlement price is 2199, and the closing price is 2196. The closing price is down 19 compared with the settlement price of the previous trading day, down 0.86% month-on-month. The daily fluctuation range is 2174-2226, and the price difference is 52; The 01 contract has reduced its position by 9991 lots today, and so far, it has held 319537 lots.

Spot market analysis:

Today, the price of urea in China has been lowered compared with yesterday. Rumors of printed label exports have caused the positive sentiment in the Chinese market to cool down. Companies 'mentality has changed and their willingness to ship is obvious. However, most companies are ready to support, and the current market operation is deadlocked.

Specifically, prices in Northeast China have stabilized at 2,460 - 2,550 yuan/ton. Prices in North China have stabilized at 2,370 - 2,530 yuan/ton. Prices in the northwest region are stable at 2,470 - 2,480 yuan/ton. Prices in Southwest China have been raised to 2,420 - 2,800 yuan/ton. Prices in East China have been lowered to 2,460 - 2,520 yuan/ton. The price of small and medium-sized particles in Central China has been lowered to 2,430 - 2,660 yuan/ton, and the price of large particles has been lowered to 2,530 - 2,660 yuan/ton. Prices in South China have been lowered to 2,580 - 2,640 yuan/ton.

Market outlook forecast:

On the supply side, equipment will continue to be restored this week, and Nissan will continue to maintain high levels. If supply continues to be sufficient, prices may move downward. In terms of manufacturers, the company has a large amount of orders in the early stage, and currently has sufficient orders, which can last for about a week. As the orders to be issued are gradually reduced, prices are expected to be consolidated downward. In terms of inventory, the company's current inventory is low and there is a small intention to accumulate stocks in a short period of time. Currently, it continues to control orders. On the demand side, we are currently in the winter storage stage, and market demand is following up. However, as prices continue to rise, downstream resistance to high transaction prices is gradually emerging. Currently, the transaction of new orders in the market is slowing down, and the market has a strong wait-and-see atmosphere.

On the whole, the urea market is currently in a stalemate, with companies accumulating orders and downstream resistance to high prices. In addition, the current export news is not clear and the market lacks substantial positive factors to support it. It is expected that the price increase in the urea market will slow down.