PVC: Futures continued to rally in the late session, with highs approaching the upper track of the Bollinger Band, and the spot market rebounded slightly

PVC futures analysis: October 25th V2401 contract opening price: 6000, highest price: 6056, lowest price: 5992, position: 902024, settlement price: 6022, yesterday settlement: 5989, up: 33, daily trading volume: 972239 lots, precipitated capital: 3.823 billion, capital outflow: 48.24 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 10.24 |

Price 10.25 |

Rise and fall |

Remarks |

|

North China |

5730-5790 |

5730-5790 |

0/0 |

Send to cash remittance |

|

East China |

5800-5900 |

5860-5920 |

60/20 |

Cash out of the warehouse |

|

South China |

5900-5960 |

5930-6000 |

30/40 |

Cash out of the warehouse |

|

Northeast China |

5700-5900 |

5700-5900 |

0/0 |

Send to cash remittance |

|

Central China |

5800-5830 |

5830-5880 |

30/50 |

Send to cash remittance |

|

Southwest |

5600-5700 |

5600-5750 |

0/50 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices rose slightly, especially in the afternoon performance. The comparison of valuation shows that North China is stable, East China is up 20-60 yuan / ton, South China is 30-40 yuan / ton, Northeast China is stable, Central China is up 30-50 yuan / ton, Southwest China is up 50 yuan / ton. Upstream PVC production enterprise factory prices continue to remain stable, there is no obvious adjustment trend, the overall futures market slightly stronger operation, late afternoon upward, but the production enterprise quotes basically in the morning, so today's factory price is still stable wait-and-see-based, heard that some enterprises closed in the afternoon. The spot market has been active, the price offer in the morning has not changed much from yesterday, and even part of the price was lowered in the afternoon to recover the decline and slightly push up. The basis part is weaker, including East China Base offer 01 contract-(100-150), South China 01 contract-(20-50-100), North 01 contract-(450-520), Southwest 01 contract-(250). On the whole, the spot market is relatively active today.

From the perspective of futures: & the night price of nbsp; PVC2401 contract is mainly volatile, and the price rose slightly at the end of the night. The trend of the futures price after the start of the morning trading is not clear, even slightly weaker, but the late afternoon price rose significantly, the late afternoon rally did not stop. 2401 contracts range from 5992 to 6056 throughout the day, with a spread of 64. 01. The contract has reduced its position by 20373 hands, and has held 902024 positions so far. The 2405 contract closed at 6157, with 107137 positions.

PVC Future Forecast:

Futures: & the operation of nbsp; PVC2401 contract futures shows a trend of reducing positions, in which the transaction is 25.7% flat compared to 24.1%, considering the profit settlement of some short orders. In addition, the market showed a slight upward trend at the end of the day, and the high point approached the location of the rail on the Bollinger belt. The technical level shows that the opening of the three tracks of the Bollinger belt (13, 13, 2) shrinks rapidly, the daily MD line and MACD line show an obvious golden fork trend, the slight increase in futures prices comes from more stimulus on the policy news side, and an additional 1 trillion yuan of treasury bonds will be issued in the fourth quarter. In addition, the departure of disk bears also formed a further upward momentum, as a whole, we will observe the performance in the range of 6050-6100 near the upper track in the short term.

Spot: first let's take a look at the news policy. According to Xinhua News Agency, on 24 October, the sixth meeting of the standing Committee of the 14th National people's Congress voted and adopted a resolution of the standing Committee of the National people's Congress on approving the additional issuance of treasury bonds by the State Council and the plan for adjusting the central budget in 2023, making it clear that the central government will issue an additional 1 trillion yuan of treasury bonds in 2023 in the fourth quarter of this year. There was a slight feedback in the two markets, and futures rose in late trading, although the range was small, but the overall trend remained upward, and the spot market followed up slightly synchronously. On the one hand, prices were raised in the afternoon, on the other hand, some production enterprises were closed, and export orders increased slightly. But the spot market also has different voices, that the current increase is not enough to give birth to a better market, spot supply digestion still has greater pressure, PVC fundamentals are not many variables. In the outer disk, oil prices fell for the third day in a row as a series of data from Germany, the euro zone and the UK showed a sluggish economy, which dragged down the outlook for demand in the energy market. In addition, the U. S. economy is relatively strong to push up the dollar. On the whole, the spot market or short-term market shows a slightly stronger operation trend.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 10.24 |

Price 10.25 |

Rate of change |

|

V2401 collection |

5995 |

6054 |

59 |

|

|

Average spot price in East China |

5850 |

5890 |

40 |

|

|

Average spot price in South China |

5930 |

5965 |

35 |

|

|

PVC2401 basis difference |

-145 |

-164 |

-19 |

|

|

V2405 collection |

6106 |

6157 |

51 |

|

|

V2401-2405 closed |

-111 |

-103 |

8 |

|

|

PP2401 collection |

7465 |

7496 |

31 |

|

|

Plastic L2401 collection |

7993 |

8033 |

40 |

|

|

V--PP basis difference |

-1470 |

-1442 |

28 |

|

|

Vmure-L basis difference of plastics |

-1998 |

-1979 |

19 |

|

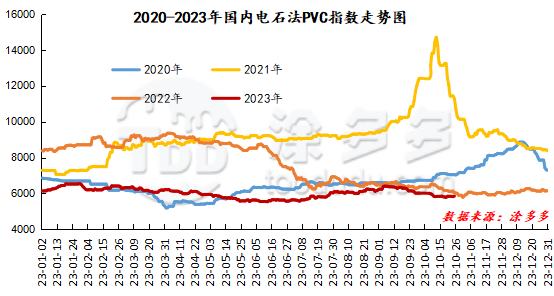

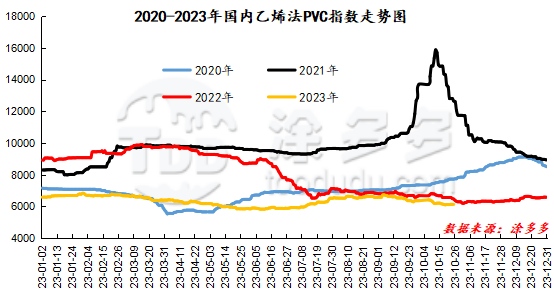

China PVC Index: according to Tuduoduo data, China calcium Carbide PVC spot Index rose 26.82, or 0.461%, to 5850.55 on October 25. The ethylene method PVC spot index is 6133.58, up 0.42, the range is 0.007%, the calcium carbide method index rises, the ethylene method index rises, the ethylene method-calcium carbide method index price difference is 283.03.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

10.24 warehouse orders |

10.25 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

843 |

843 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

402 |

402 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

351 |

351 |

0 |

|

|

Zhenjiang Middle and far Sea |

351 |

351 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,417 |

2,417 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,343 |

1,343 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,329 |

1,329 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

9,269 |

9,269 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,844 |

1,844 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,162 |

3,162 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

274 |

274 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Zhejiang Jianfeng) |

7 |

7 |

0 |

|

PVC subtotal |

|

30,076 |

30,076 |

0 |

|

Total |

|

30,076 |

30,076 |

0 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.