Daily Review of Urea: Good exports are gradually weakening, weak prices are declining (October 26)

China Urea Price Index:

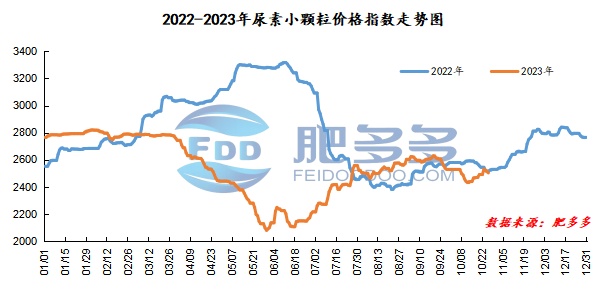

According to Feiduo data, the urea small pellet price index on October 26 was 2,503.00, down 10.45 from yesterday, down 0.42% month-on-month, and down 0.42% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2212, the highest price is 2228, the lowest price is 2190, the settlement price is 2210, and the closing price is 2215. The closing price is down 4 compared with the settlement price of the previous trading day, down 0.18% month-on-month. The daily fluctuation range is 2190-2228, and the spread is 38; the 01 contract has increased its positions by 575 lots today, and so far, it has held 328580 lots.

Spot market analysis:

Today, China's urea market prices continued their downward trend. Most manufacturers lowered their quotations based on their own conditions. Currently, market export news is constantly rumored, and downstream companies are following up cautiously.

Specifically, prices in Northeast China have stabilized at 2,460 - 2,550 yuan/ton. Prices in North China fell to 2,320 - 2,520 yuan/ton. Prices in the northwest region are stable at 2,500 - 2,510 yuan/ton. Prices in Southwest China have stabilized at 2,420 - 2,800 yuan/ton. Prices in East China have been lowered to 2,400 - 2,480 yuan/ton. The price of small and medium-sized particles in Central China has been lowered to 2,420 - 2,640 yuan/ton, and the price of large particles has stabilized at 2,530 - 2,640 yuan/ton. Prices in South China fell to 2,580 - 2,600 yuan/ton.

Market outlook forecast:

In terms of supply, the current supply continues to be sufficient, and factory equipment has been restored one after another. Among them, Kuitun is expected to resume production in the near future, and the capacity utilization rate will continue to be high. In terms of factories, affected by the current low-price sell-off by traders, although the factory has early support, the overall market sentiment is weak and downward, and the signing of new orders by factories has been blocked. Currently, most of them are selling at reduced prices based on their own conditions. On the demand side, the market is currently willing to reserve more purchases, and the downstream are cautious and wait and see, waiting for the price to enter the market to reserve. In addition, due to the decline in real estate, downstream demand for melamine for urea has declined, including vehicle urea related to housing construction. It also fell. In terms of exports, most of the news on the market recently pointed to export restrictions. China is currently facing winter reserves, and export policies may be tightened again. The urea stocks previously gathered in Hong Kong also risk flowing back to China.

On the whole, the current good news on exports in the urea market is gradually weakening, and factories rely mostly on waiting to support the firm quotations. It is expected that the urea market will remain mainly weak and downward in the short term.