PVC: Futures break through the barrier and continue to be strong, technology shows a gold fork trend, and the spot market rises slightly

PVC futures analysis: October 27th V2401 contract opening price: 6070, highest price: 6120, lowest price: 6047, position: 874792, settlement price: 6080, yesterday settlement: 6038, up: 42, daily trading volume: 939335 lots, precipitated capital: 3.743 billion, capital outflow: 75.45 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 10.26 |

Price 10.27 |

Rise and fall |

Remarks |

|

North China |

5750-5790 |

5750-5800 |

0/10 |

Send to cash remittance |

|

East China |

5850-5920 |

5880-5950 |

30/30 |

Cash out of the warehouse |

|

South China |

5900-5950 |

5950-5980 |

50/30 |

Cash out of the warehouse |

|

Northeast China |

5700-5900 |

5700-5900 |

0/0 |

Send to cash remittance |

|

Central China |

5830-5880 |

5850-5900 |

20/20 |

Send to cash remittance |

|

Southwest |

5650-5800 |

5650-5800 |

0/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction price range collation, prices slightly higher in some areas. Compared with the valuation, it rose 10 yuan / ton in North China, 30 yuan / ton in East China, 30 yuan / ton in South China, stable in Northeast China, 20 yuan / ton in Central China, and stable in Southwest China. The ex-factory prices of upstream PVC production enterprises began to increase by 50 yuan / ton one after another, including simultaneous upward prices in remote warehouses. Futures continued to rise slightly, the spot market offer differentiation, the morning price offer has not changed much from yesterday, but the afternoon price pushed up. After the futures shock rose, the basis of each region weakened, including East China basis offer 01 contract-(100-150), South China 01 contract-(50-100), North 01 contract-(450-550), Southwest 01 contract-(300). On the whole, although the spot market has gone up, the actual single feedback is not enough, and the real single is mainly based on negotiation, so it is still difficult to close a deal at a high price. Downstream procurement enthusiasm is not high, the spot market trading atmosphere is weak.

Futures point of view: PVC2401 contract night trading opened in a narrow range, the volatility range of the futures price is small. The price rose slightly after the start of morning trading and finished at that point after breaking the 6100 mark in the afternoon. 2401 contracts range from 6047 to 6120 throughout the day, with a spread of 73. 01. The contract reduced its position by 21153 positions and has held 874792 positions so far. The 2405 contract closed at 6214, with 107327 positions.

PVC Future Forecast:

Futures: & the operation of nbsp; PVC2401 contract futures continues to show a slight upward trend of reducing positions, and the turnover is still flat, of which 25.5% is more flat than 24.8%. Futures prices have been rising slightly from the low of 5858 recently, closing higher at the end of the week and showing a rising trend for three consecutive days. The technical level shows that the opening of the third track of the Bolin belt (13, 13, 2) diverges, the high point of the futures price continues to approach the upper track position, and the daily KD line and MACD line show an obvious golden fork trend. The current mode of operation of the futures price may continue to be maintained, and continue to observe the operating range between the middle and upper tracks in the short term, especially the performance in the range of 6100-6200.

Spot aspect: The guidance from the policy news side made the commodities during the week show a certain trend of stopping falling and rebounding. In the PVC plate, the current upward range of futures has broken through the 6100 mark, and the spot market price has also shown a mode of small push, but from the port of demand, the actual follow-up is not enough, and the October market shows an obvious state of weak peak season and off-season. The post-holiday market showed a downward trend of short jump under the guidance of the bearish factors of the outer disk, which has been running low, and the two cities are up slightly near the end of the month under the stimulus of the policy. At present, there are still few variables in the supply and demand level, and the fundamental factors of PVC have little impact on the prices of the two cities. Therefore, although the current two cities have pushed up, but the pressure above is also gradually obvious. In the outer disk, oil prices fell more than $2, and the higher-than-expected increase in US crude oil inventories indicates a slowdown in US demand. Overall, in the short term, the spot market of PVC still shows a slightly stronger trend of adjustment.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 10.26 |

Price 10.27 |

Rate of change |

|

V2401 collection |

6088 |

6112 |

24 |

|

|

Average spot price in East China |

5885 |

5915 |

30 |

|

|

Average spot price in South China |

5925 |

5965 |

40 |

|

|

PVC2401 basis difference |

-203 |

-197 |

6 |

|

|

V2405 collection |

6188 |

6214 |

26 |

|

|

V2401-2405 closed |

-100 |

-102 |

-2 |

|

|

PP2401 collection |

7479 |

7599 |

120 |

|

|

Plastic L2401 collection |

8050 |

8159 |

109 |

|

|

V--PP basis difference |

-1391 |

-1487 |

-96 |

|

|

Vmure-L basis difference of plastics |

-1962 |

-2047 |

-85 |

|

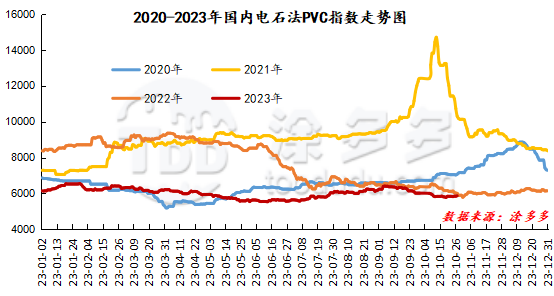

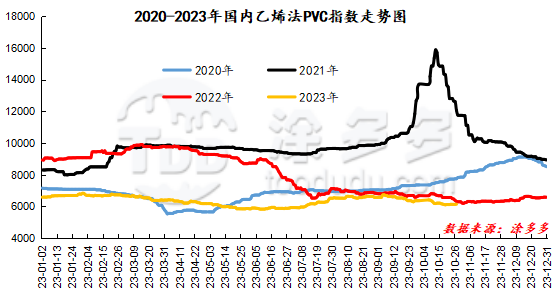

China PVC Index: according to Tuduoduo data, China calcium Carbide PVC spot Index rose 21.27% to 5868.05 on October 27th, an increase of 0.364%. The ethylene method PVC spot index was 6142.56, up 7.66, with a range of 0.125%. The calcium carbide index rose, the ethylene index rose, and the ethylene-calcium carbide index spread was 274.51.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

10.26 warehouse orders |

10.27 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

843 |

843 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

402 |

402 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

351 |

351 |

0 |

|

|

Zhenjiang Middle and far Sea |

351 |

351 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,417 |

2,417 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,343 |

1,343 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,329 |

1,329 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

9,374 |

9,374 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,844 |

1,844 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,162 |

3,162 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

274 |

274 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

30,155 |

30,155 |

0 |

|

Total |

|

30,155 |

30,155 |

0 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.