90,002

October 31, 2023, 4:28 PM

Analysis of natural rubber market price on October 31

index

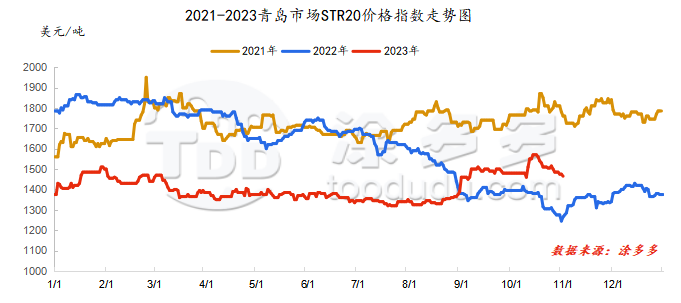

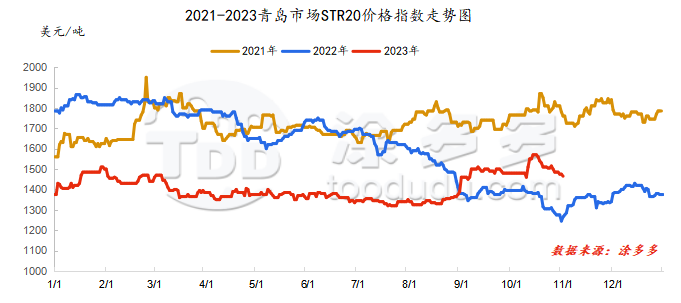

On October 31, the STR20 price index of natural rubber in the Qingdao market was US$1465/ton, down US$10/ton from the previous trading day, or 0.68%.

market analysis

futures market

|

date

|

Previous period: RU Futures

|

|

main contract

|

closing price

|

|

opening price

|

Low-end price

|

High-end price

|

closing price

|

RU01

|

RU05

|

RU09

|

|

October 31

|

14225

|

14040

|

14260

|

14175

|

14175

|

14225

|

14225

|

|

October 30

|

14460

|

14110

|

14475

|

14205

|

14205

|

14240

|

14230

|

|

rise and fall

|

-235

|

-70

|

-215

|

-30

|

-30

|

-15

|

-5

|

|

date

|

Previous period energy: NR futures (closing price)

|

|

NR main force

|

NR01

|

NR05

|

NR09

|

|

October 31

|

10830

|

10830

|

10980

|

11150

|

|

October 30

|

10860

|

10860

|

11075

|

11150

|

|

rise and fall

|

-30

|

-30

|

-95

|

0

|

spot market

Supply:

Foreign countries: Rainfall weather in foreign production areas has eased, some areas have begun to increase within a narrow range, and a few areas still have the impact of rainfall, and raw material prices have begun to fall within a narrow range.

China: Weather conditions in China's production areas have returned to normal, raw material output has also gradually recovered, and raw material prices have been relatively firm.

|

price type

|

October 30

|

October 31

|

rise and fall

|

units

|

|

raw material prices

|

Thailand

|

glue

|

53.9

|

53.9

|

0

|

baht/kg

|

|

cup glue

|

45.8

|

45.05

|

-0.75

|

baht/kg

|

|

Yunnan

|

Glue (into the dry glue factory)

|

11700

|

11700

|

0

|

Yuan/ton

|

|

rubber block

|

9800

|

9800

|

0

|

Yuan/ton

|

|

Hainan

|

Glue (into the dry glue factory)

|

12800

|

12800

|

0

|

Yuan/ton

|

|

Glue (Jinnong Dairy Factory)

|

12900

|

12800

|

-100

|

Yuan/ton

|

Demand: It is understood that the capacity utilization rate of all-steel tire enterprises is basically stable. Near the end of the month, foreign trade shipments are mainly shipped, domestic shipments are relatively scarce, and the overall inventory is differentiated. The inventory of some small-scale enterprises has basically increased to regular levels. Some enterprises have not yet made up for the shortage due to large gaps in the early stage. In terms of the market, the overall shipment performance of the replacement market is average. The overall inventory of agents is relatively high and sufficient. Downstream shipments are relatively slow and the sentiment for buying goods is not high. They are cautiously bearish on the future outlook.

Futures spot price list

|

price type

|

October 30

|

October 31

|

rise and fall

|

units

|

|

price of finished products

|

Shandong

|

China All Latex

|

13000

|

12950

|

-50

|

Yuan/ton

|

|

Qingdao

|

Thailand No. 20 standard glue

|

1475

|

1465

|

-10

|

us dollars/ton

|

|

Qingdao

|

Thailand No. 20 mixed glue

|

12070

|

12070

|

0

|

Yuan/ton

|

|

Ningbo

|

Hainan

|

9900

|

9800

|

-100

|

Yuan/ton

|

|

Ningbo

|

Thailand Non-Yellow Bulk

|

10650

|

10650

|

0

|

Yuan/ton

|

|

the current price difference

|

Main force-Thailand No. 20 mixed glue

|

2135

|

2105

|

-30

|

Yuan/ton

|

|

Main force-China All Latex

|

1205

|

1225

|

20

|

Yuan/ton

|

|

relevant exchange rate

|

us dollar against the RMB

|

7.3359

|

7.3349

|

-0.001

|

Yuan

|

|

Thai Baht to RMB

|

0.2071

|

0.207

|

-0.0001

|

Yuan

|

market outlook

Recently, as precipitation in Southeast Asian producing areas has eased, raw material increase expectations have been strong, purchase prices have begun to fall within a narrow range, and cost support has weakened. However, raw material and spot prices in foreign producing areas will remain high in the short term, which still provides support for prices. On the downstream side, the overall shipment performance of the replacement market is average. The overall inventory of agents is relatively high and sufficient. The downstream shipment is relatively slow and the sentiment for buying goods is not high. It is cautiously bearish on the future outlook. In the short term, the natural rubber market may show a volatile and weak trend.