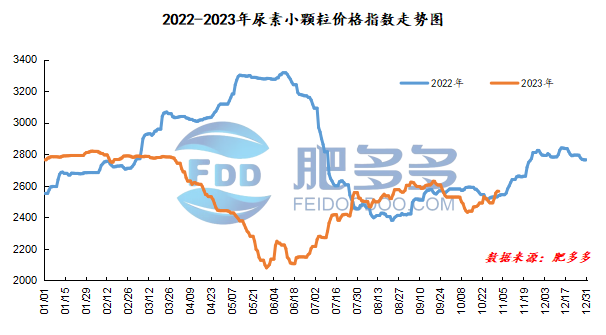

Daily Review of Urea: Resistance among industry operators appears when prices continue to rise (November 2)

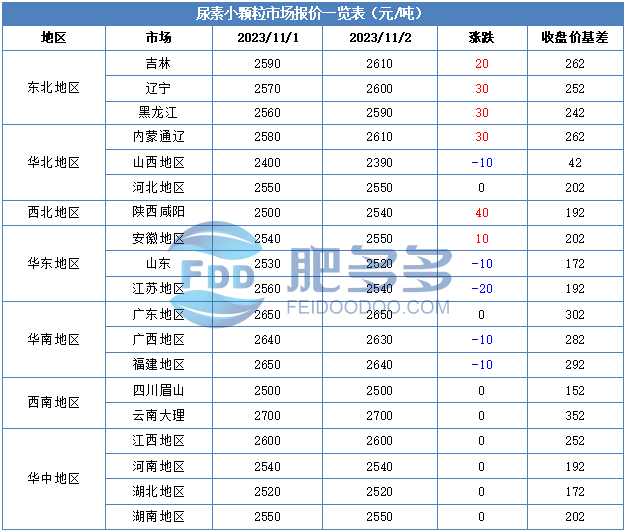

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on November 2 was 2,570.91, up 5.32 from yesterday, up 0.21% month-on-month, and up 1.27% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2326, the highest price is 2357, the lowest price is 2313, the settlement price is 2338, and the closing price is 2348. The closing price is 3,300%, and the month-on-month increase. The daily fluctuation range is 2313-2357; the basis of the 01 contract in Shandong is 172; the 01 contract has increased its position by 3572 lots today, and so far, the position is 370038 lots.

Spot market analysis:

Today, the rise in urea prices in China has slowed down. After several consecutive days of rising, the downstream is currently cautious and the factory has received a large number of orders in the early stage. Currently, prices are mainly supported.

Specifically, prices in Northeast China rose to 2,570 - 2,620 yuan/ton. Prices in North China rose to 2,390 - 2,620 yuan/ton. Prices in Northwest China rose to 2,540 - 2,550 yuan/ton. Prices in Southwest China are stable at 2,480 - 2,800 yuan/ton. Prices in East China fell to 2,500 - 2,570 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,500 - 2,680 yuan/ton, and the price of large particles rose to 2,550 - 2,680 yuan/ton. Prices in South China fell to 2,620 - 2,680 yuan/ton.

Market outlook forecast:

On the supply side, under the dual influence of Shanxi's production restriction policy and equipment maintenance in some areas, Nissan has declined slightly recently, but the overall inventory is still at a medium high level. In addition, the company's total inventory continues to decrease. At this stage, company inventories are low and spot supply is tight. In terms of manufacturers, the transaction of new orders by manufacturers is gradually slowing down. However, supported by the large number of orders received in the early stage, the factory's mentality is firm, and the factory quotations are stable and slightly rising. In terms of demand, it is currently in the off-season of agriculture, but there is still a certain demand for short reserves this month. Judging from the current high price, market purchases are relatively limited, and the follow-up of short reserves is slow. Industrial demand is still dominated by just-needed procurement. Recently, compound fertilizer factories in Northeast China have shown signs of starting operation, and the demand for urea will increase.

On the whole, the current market supply is declining and demand is increasing. With the support of manufacturers, it is expected that the urea market price will fluctuate and consolidate in a short period of time.