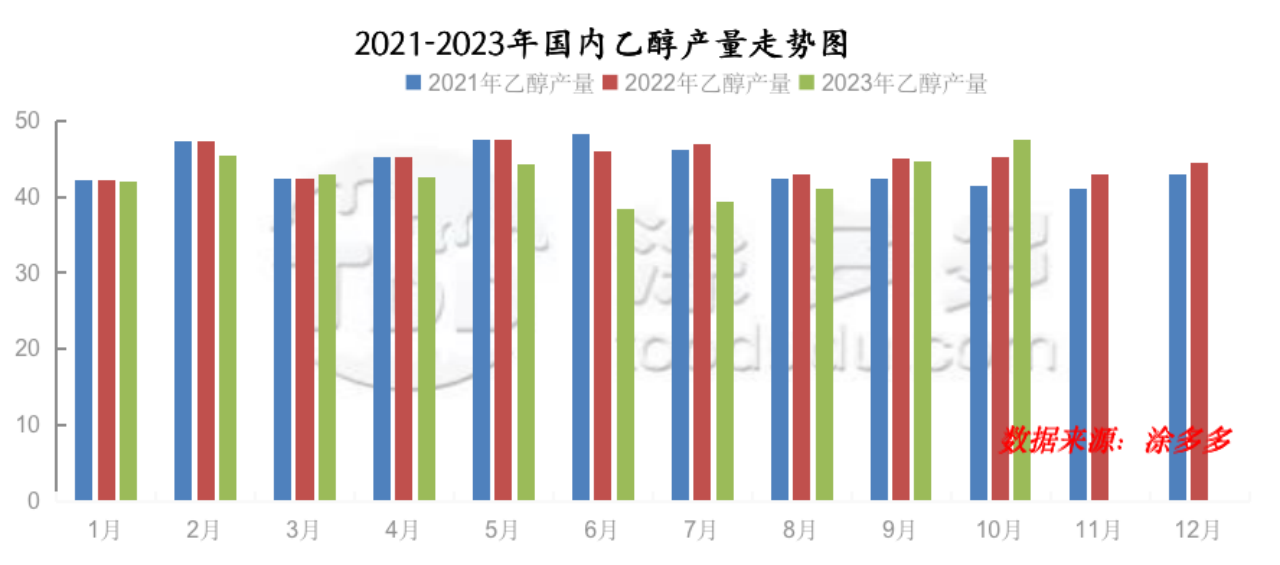

Analysis and forecast of China's ethanol supply in October 2023

In October 2023, China's edible and industrial ethanol output was about 475,500 tons. Edible ethanol output increased, and coal-based ethanol output declined slightly. Fuel ethanol production declined. Fuel ethanol production in October was 342,200 tons, down 20,800 tons from the previous month. Among them, corn ethanol started at 77.36% in Northeast China and the output was 267,100 tons, an increase of 79,100 tons from the previous month. Cassava ethanol started at 35.27% in East China, and the output was around 87,700 tons, a decrease of 9,900 tons from the previous month. Coal ethanol production in October was around 23,200 tons, a decrease of 30,000 tons from the previous month.

As of the end of the month, products were shipped around No. 9 of the Phase 2 plant in Hongzhan Laha in Heilongjiang in October, and Huanan stopped from October 8 to October 22, and the food output increased around the middle of the year. The Wanli Runda plant was in normal production this month, but mainly based on fuel, and part of it was edible; COFCO Zhaodong was in normal production, mainly based on fuel; the Luobei plant was in normal operation, Friendship was shut down, and Shenglong was producing. Fuyu Huihai Production. Jilin Tianyu produced normally and Fukang produced normally; Dongfeng put into production and Xintianlong operated normally. Ruiyang, Chifeng, Inner Mongolia, was in normal production this month, Zhalantun was in normal production this month. After a short stop in Shuntong, the unit returned to normal, and the Jietainuo unit in Inner Mongolia was put into production. Zhongke Green produces normally. Lianhai production and Maibohui units in eastern and southern Jiangsu areas were shut down, Changxing production was normal until the end of the month, Huaying production in northern Jiangsu area was reduced, Longhe production was normal, Luomeite production was normal, Guannan was shut down, Dongcheng was shut down, Jin Changlin was shut down, Guohua was shut down, Su Chun was shut down, Shandong Fulaichun was shut down, Zhenlong was shut down, Yingxuan, Zhongyu, Guan County Xinrui and Ququ were normal, and Jinyimeng was normal. Anhui COFCO mainly uses fuel. The unit was shut down in Wuhe Spring and the unit was shut down for a short time in late Wanshen. At the premium factory in Mengzhou, Henan Province, the thick source unit was shut down on the evening of October 26. The coal ethanol load dropped, two companies 'units were shut down, and some units resumed production in late January. In terms of fuel ethanol: SDIC's Jidong and Tieling plants were in normal production, and SDIC Helen resumed after a short stop for one week. Liaoyuan Jufeng stopped. Hongzhan reduced fuel production. Wanli and COFCO plants are in normal production. Henan Tianguan fuel production is normal. Jilin fuel production is normal.

It is expected that the start of cassava ethanol in East China will drop significantly in November, with high costs, weakening ethanol prices, and serious production losses for enterprises. Subsequent raw materials will wait for the price of new cassava to be put on the market. In November, the Longhe 100,000 tons/year ethanol plant and Changxing 100,000 tons/year ethanol plant shutdown plan. In terms of corn ethanol: Northeast China maintained stable output. In December, some small factories had plans to start up, and others maintained normal production. After the maintenance of the Houyuan plant in Mengzhou, Henan Province, the output increased. In terms of coal-based ethanol: The northwest factory has plans to start up, and the output of coal-based ethanol has increased significantly. In the later period, Anhui Tanxin and Baling Petrochemical have plans to produce ethanol, a byproduct of caprolactam.