PVC: Futures reduced their positions and left the futures price rose. The Ministry of National Security guarded financial security, and the spot market increased slightly.

PVC futures analysis: November 3 V2401 contract opening price: 6088, highest price: 6184, lowest price: 6078, position: 798896, settlement price: 6141, yesterday settlement: 6077, up:, daily trading volume: 910746 lots, precipitated capital: 3.452 billion, capital outflow: 139 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 11.2 |

Price 11.3 |

Rise and fall |

Remarks |

|

North China |

5780-5840 |

5830-5870 |

50/30 |

Send to cash remittance |

|

East China |

5910-5970 |

5990-6050 |

80/80 |

Cash out of the warehouse |

|

South China |

5900-5950 |

5950-6000 |

50/50 |

Cash out of the warehouse |

|

Northeast China |

5700-5920 |

5700-5920 |

0/0 |

Send to cash remittance |

|

Central China |

5860-5870 |

5900-5920 |

40/50 |

Send to cash remittance |

|

Southwest |

5650-5800 |

5720-5850 |

70/50 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices rose slightly, the market atmosphere is slightly better. Compared with the valuation, North China rose 30-50 yuan / ton, East China 80 yuan / ton, South China 50 yuan / ton, Northeast China stable, Central China 40-50 yuan / ton, Southwest China 50-70 yuan / ton. The ex-factory price of upstream PVC production enterprises has been raised by 50-70 yuan per ton, including simultaneous price increases in remote warehouses, individual increases in ethylene enterprises, and some enterprises still wait and see. The strong operation of futures led to the active quotation in the spot market, and the prices in various regions followed the rise. After the futures price went up, the spot price offer advantage disappeared, but there were still quotations, including 01 contract in East China-(150), 01 contract in South China-(100), 01 contract in North China-(500), 01 contract in Southwest China-(300). Point price is only for reference and there is no transaction advantage. Traders mainly ship goods at one price, and there are certain transactions at lower purchase prices, but with the rise of futures, intraday traders' quotations are tentatively raised, but the transaction is blocked after the rise.

Futures point of view: PVC2401 contract night trading small shock upward, intraday there is a certain increase. After the start of morning trading, the futures price rose further, the high point refreshed the previous high after the National Day, and the afternoon price as a whole ran in a relatively high and narrow range to the end. 2401 contracts range from 6078 to 6184 throughout the day, with a price difference of 106. 01 contracts reduced their positions by 43883 positions and 798896 positions so far. The 2405 contract closed at 6284, with 116637 positions.

PVC Future Forecast:

Futures: & the operation of the nbsp; PVC2401 contract price refreshes the pre-operation high of 6184 after the National Day, and the fluctuation range of the futures price in today's trading day expands to more than 100 points, changing the trend of narrow-band operation of the depressed horizontal market, the fluctuation of the futures price and the direction are more from the stimulation of the news. The technical level shows that the three tracks of the Bolin belt (13, 13, 2) are all upward, and the KD line at the daily level shows a golden fork trend again. Recently, the market has been in the state of reducing positions and leaving the market, and today it has reduced more than 43000 positions. It is more obvious for funds to leave the market, and their positions continue to decline. In the short term, excluding the news stimulus, we think that there is some pressure on the operation of the futures price, and observe the performance of the 6200 mark.

Spot: the two cities today showed a slight upward trend, some areas of the spot market feedback inquiry activity increased, but some areas reported that the spot market is less willing to rise, especially the downstream products enterprises have obvious psychological resistance to high prices. First of all, at present, there are not many variables on the supply and demand level of PVC, and the price increases in the two cities are mainly from the stimulation of the news side. Ministry of National Security: national security organs should put prevention and resolution of financial risks in a more important position, actively participate in the construction of the national security system in economic, financial and other fields, and be a firm guardian of financial security. In the outer disk, international oil prices rose more than 2.0%, ending a three-day decline as the Fed left its benchmark interest rate unchanged and risk appetite returned to financial markets. At the same time, the conflict in the Middle East continues to affect oil prices. On the whole, the spot market of PVC is slightly stronger in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 11.2 |

Price 11.3 |

Rate of change |

|

V2401 collection |

6088 |

6173 |

85 |

|

|

Average spot price in East China |

5940 |

6020 |

80 |

|

|

Average spot price in South China |

5925 |

5975 |

50 |

|

|

PVC2401 basis difference |

-148 |

-153 |

-5 |

|

|

V2405 collection |

6204 |

6284 |

80 |

|

|

V2401-2405 closed |

-116 |

-111 |

5 |

|

|

PP2401 collection |

7599 |

7695 |

96 |

|

|

Plastic L2401 collection |

8153 |

8235 |

82 |

|

|

V--PP basis difference |

-1511 |

-1522 |

-11 |

|

|

Vmure-L basis difference of plastics |

-2065 |

-2062 |

3 |

|

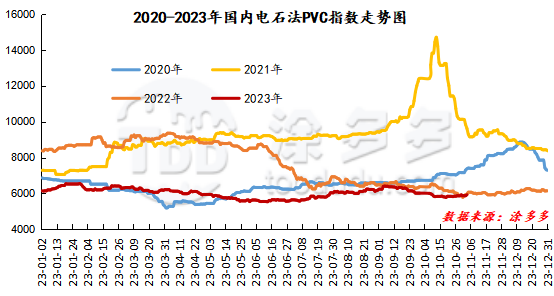

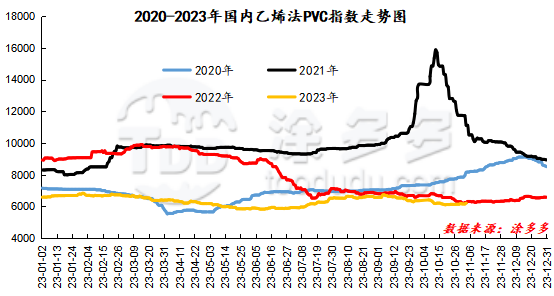

China PVC Index: according to Tuduoduo data, the spot index of China calcium Carbide PVC rose 54.09, or 0.921%, to 5927.41 on November 3. The ethylene method PVC spot index was 6212.48, up 55.67, or 0.904%. The calcium carbide index rose, the ethylene index rose, and the ethylene-calcium carbide index spread was 285.07.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

11.2 warehouse orders |

11.3 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

843 |

843 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

402 |

402 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

351 |

351 |

0 |

|

|

Zhenjiang Middle and far Sea |

351 |

351 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,417 |

2,417 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,343 |

1,343 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,350 |

1,350 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

9,474 |

9,474 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,584 |

2,584 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,162 |

3,162 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

274 |

274 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

31,016 |

31,016 |

0 |

|

Total |

|

31,016 |

31,016 |

0 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.