[Natural Rubber]: Rubber Weekly Review (November 9)

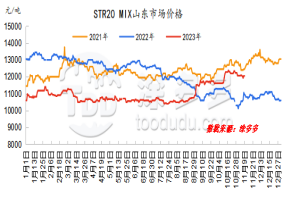

Figure 1: Shandong market price of STR20 MIX Figure 2: Zhejiang market price of ordinary bulk imported from Thailand

dry rubber

Natural rubber market prices fell within a narrow range this week. Macro Global Manufacturing PMI for October It has dropped significantly from the previous month, showing signs of cooling down on the global economy. Recently, as precipitation in Southeast Asian producing areas has eased, raw material increase expectations have been strong, purchase prices have begun to fall within a narrow range, and cost support has weakened. On the downstream side, the operating rate of most all-steel tires remained high. First-line brands increased production in replacement markets and supporting markets. Foreign trade orders fell slightly month-on-month. The overall inventory of small-scale enterprises showed an increase. Sales pressure gradually increased, and the margin of demand weakened. As the arrival of standard rubber in Hong Kong gradually increases, natural rubber stocks are still expected to accumulate, and the fundamental negative factor has dragged down short-term rubber prices to fluctuate and weaken.

natural latex

This week, China's concentrated milk offers fell within a narrow range. At present, although weather disturbances in major production areas in Southeast Asia have decreased, marginal supply pressure on natural rubber is gradually increasing, and raw material prices are expected to weaken, it will still take time to increase raw materials in the short term. As a result, raw material prices are still at a relatively high level, and spot prices still exist. There is certain support. From the downstream perspective, product companies have not had strong orders for finished products, and they are not very enthusiastic about obtaining raw materials. Small orders have continued to need to be replenished, and trading in the natural latex spot market is deadlocked.

Market outlook forecast:

1、中国外产区降雨天气或存缓和预期,季节性上量阶段,原料价格支撑预期走弱;

2、预计下周期轮胎样本企业产能利用率小幅波动;

3、中国青岛库存量或存去库趋势,高库存压力有所缓和;

4、汇率、美联储加息等。