When will the turning point in the ethanol market appear?

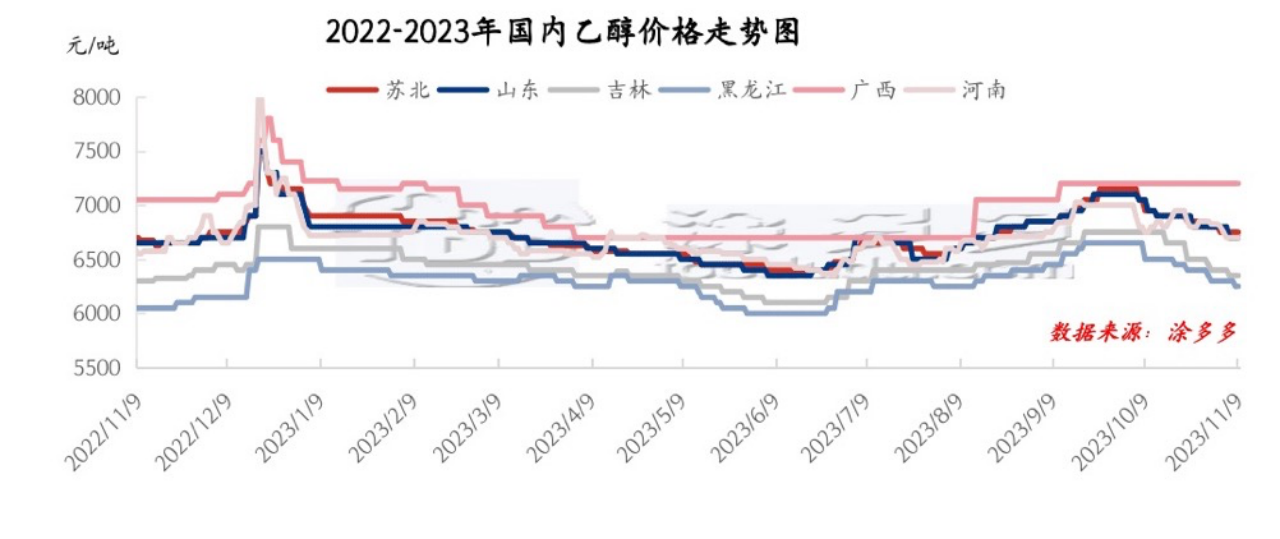

China's ethanol market started a downward channel in October. The supply in the main producing areas was relatively sufficient, and the downstream demand was average. The price of raw material corn continued to weaken to a low point after the supply increased, and the cost was negative. The market's bearish mentality has intensified, while downstream purchases are limited, and purchases are basically maintained just in need. After downstream demand for fuel ethanol weakened, companies adjusted their production pattern and increased edible ethanol production. Under the influence of a number of negative factors, ethanol prices continued to weaken. As of press time, China's ethanol price in Heilongjiang is 6,200 - 6,400 yuan/ton, down 400 yuan/ton from September 28. The price of general ethanol in Jilin is 6,300 - 6,400 yuan/ton, down 400 yuan/ton from September 28. The price of premium ethanol in Henan is 6700 yuan/ton, down 300 yuan/ton from September 28. The price of general ethanol in East China is 6750 yuan/ton. It was 400 yuan/ton lower than on September 28. Currently, due to the impact of snowfall, freight rates have increased slightly. The freight rates from a factory in Heilongjiang to a terminal factory in Shandong have increased by 30 yuan/ton.

When will the ethanol market break the continued weakening trend?

Cost aspect: The price of raw material corn continues to weaken, and the price has fallen to a low level. Farmers are reluctant to sell at low prices. After the temperature drops, it is conducive to the preservation of grain on the ground. The prices of chemicals and feed that need to be purchased have bottomed out and rebounded. The price of by-product ddgs has also bottomed out with the price of corn. Although the cost side has rebounded a little, overall support is limited. If corn prices rise sharply, the cost side is expected to support the upward trend of ethanol prices.

However, judging from the company's production profit situation: although corn prices are currently weakening, there is still profit space for corn ethanol production. If there is a possibility of weakness under the positive shipping mentality of enterprises, there are currently rumors in the market that the cost of corn ethanol in Northeast China is below 6000 yuan/ton. If it is true, there is room for decline.

Affected by the high cost pressure of cassava ethanol in East China, the overall start-up has dropped significantly. Only a few major producers and companies with downstream supporting equipment have started operating normally, and other lines have been shut down. The amount of corn ethanol purchased by East China from Northeast China has increased. It will benefit corn ethanol shipments in Northeast China. However, the recent snowfall has been relatively concentrated, and the amount of snowfall is large. High-speed closures and transportation restrictions have resulted in poor arrival of goods in the northeast, and the shipment of some local sources is still good. After the short-term snowfall ended, goods from Northeast China flowed out, and logistics prices fell, impacting other markets.

Start-up: Short-term coal-based ethanol start-up has increased, and shipments of fuel ethanol are limited due to low downstream demand. The fuel ethanol market is unlikely to improve significantly. Enterprises are more enthusiastic about producing edible ethanol than fuel ethanol, and edible output has increased. Although cassava ethanol has started to decline due to high production costs, corn ethanol in Northeast China has maintained normal production and sufficient supply. Some large factories in Henan have plans to resume production in the short term. With the frequent snowfall in Northeast China and rising freight rates, it is possible for companies to adjust ex-factory prices in the later period.