92,787

November 13, 2023, 2:46 PM

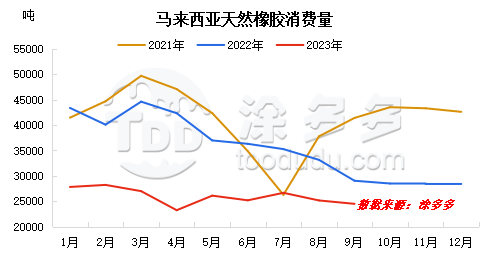

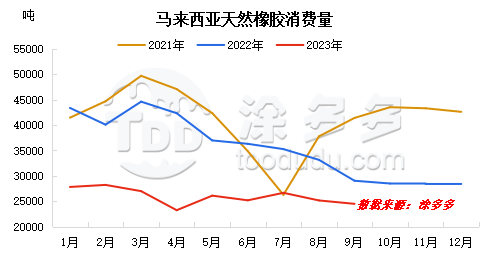

In September 2023, Malaysia's natural rubber consumption was 24500 tons, 2.65 per cent lower than in August and 15.66 per cent lower than the same period last year. From the trend of consumption in the past three years, the overall consumption of natural rubber in Malaysia in 2023 is at a three-year low, and the overall fluctuation is relatively limited. Strong milk consumption accounts for the largest proportion of natural rubber consumption in Malaysia, and the first strong milk consumption is glove consumption. From this data, it is not difficult to see that the overall consumption of Malaysian glove industry is relatively limited, and the overall capacity is still in a state of relative excess.

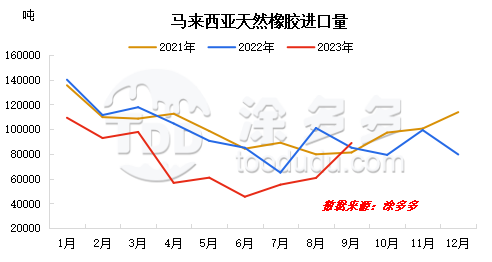

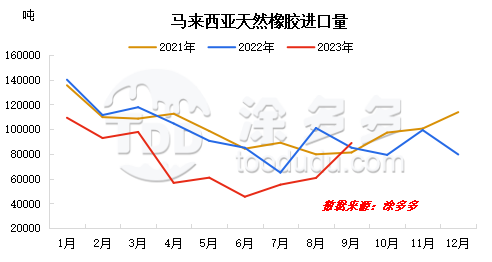

In September 2023, Malaysia imported 88800 tons of natural rubber, an increase of 28200 tons over the previous month, an increase of 46.59% from the previous month, and a year-on-year increase of 4.46%. The cumulative import volume from January to September was 670400 tons, down 26.72% from the same period last year. As a major consumer of natural rubber latex in the world, Malaysia maintains a relatively high demand for natural rubber latex, but its self-production is difficult to meet its own needs, so it is highly dependent on foreign raw materials. from its consumption, its natural rubber import should remain relatively weak in September, but it is not difficult to see from the above picture. Malaysia's natural rubber imports have maintained a narrow upward trend for two months in a row.

From the perspective of subdividing the imported varieties of natural rubber in Malaysia, the import of natural rubber latex still maintained a relatively weak state and did not improve, and the main improved varieties were tobacco, standard rubber and other dry rubber. The reason for this is that, on the one hand, with the rise of natural rubber in C ô te d'Ivoire in recent years, Malaysia has been provided with low-cost raw material processing students SMR20# and SMR10# for export, and imports from C ô te d'Ivoire can account for about 30% of total imports in 2022. On the other hand, the planting area of Malay rubber trees has begun to decrease in recent years. At this stage, many workers go out to work, rubber farmers are greatly reduced, and there is a shortage of workers, which is unable to meet the tapping work, and the tapping efficiency is not high. Malaysia's own output has been affected to a certain extent, in order to maintain the normal operation of local rubber factories, it has also supported an improvement in Malaysian natural rubber imports.

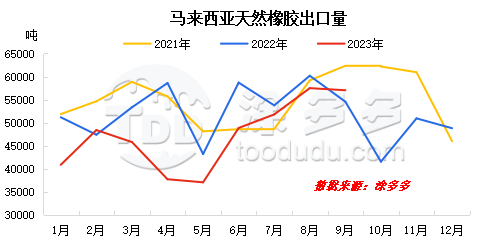

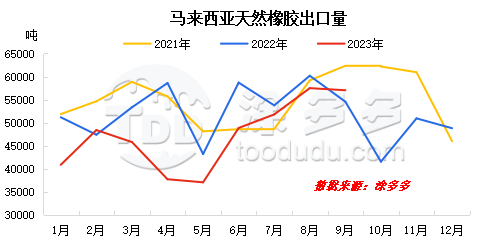

In September 2023, Malaysia's natural rubber exports reached 57000 tons, down 500 tons from the previous month, down 0.8% from the previous month, up 4.56% from January to September, down 11.64% from January to September. Malaysia's natural rubber exports shrank slightly in September. Malaysia, once the world's third largest natural rubber producer and exporter after Thailand and Indonesia, is in a relatively weak position in 2023 compared with 2022. In recent years, its export share has been surpassed by other rubber-producing countries, and the low yield of rubber upstream planting industry is the main reason for the decrease. In recent years, the increase in the area of new species and replanting in Malaysia is small, the aging of rubber forest is relatively serious, and there is a serious shortage of tapping labor. Even if the price center of natural rubber has shifted upward, it is difficult to reverse the downward trend of per unit yield and cutting rate. Then the possibility of a sharp rebound in production in the future is low, and the trade pattern of processing and re-export of supplied materials will continue. Malaysia has also transformed from a natural rubber exporter to a consumer.