[Natural Rubber]: Rubber Weekly Review (November 16)

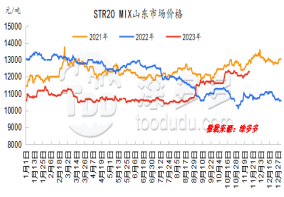

Figure 1: Shandong market price of STR20 MIX Figure 2: Zhejiang market price of ordinary bulk imported from Thailand

dry rubber

Natural rubber market prices rose within a narrow range this week. The rubber surface fluctuated higher, and the overall supply of natural rubber in the main producing areas of Southeast Asia showed a seasonal increase. The peak season for cutting was conducive to the release of raw materials. However, the market's concerns about the supply of raw materials in Thailand's producing areas began to materialize, and raw material prices still remained high. Yunnan, China The production areas of China have gradually entered the cut-off period. The purchase prices of raw materials have performed firmly, and there is still support at the bottom of rubber prices. Downstream foreign trade orders have shrunk, finished product inventories have accumulated, demand for natural rubber has weakened, and there is insufficient momentum to continue to rise. Combined with the arrival of imported rubber in the port may continue to increase. The expectation of domestic standard rubber in Qingdao Gangkou District is strong. The total inventory removal in Qingdao has slowed down, and upward pressure on prices has increased.

natural latex

China's concentrated milk offers are consolidating at a high level this week. Some areas of the main producing areas at home and abroad are still experiencing heavy rain, curbing the increase in raw material glue, maintaining a high level of costs, and futures trading fluctuates upwards, which has boosted market confidence to a certain extent. When the supply of spot volume in the sales area is relatively limited, traders are reluctant to sell, mainly increasing prices and shipping. Downstream product companies enter the market cautiously and wait and see, and follow up on demand. The focus of market negotiations on real orders has increased slightly.

Market outlook forecast:

1、中国外产区降雨天气或存缓和预期,季节性上量阶段,原料价格支撑预期走弱;

2、预计下周期轮胎样本企业产能利用率延续差异化走势;

3、中国青岛库存量或存去库趋势,高库存压力有所缓和;

4、汇率、美联储加息等。