[Natural Rubber]: Rubber Weekly Review (November 30)

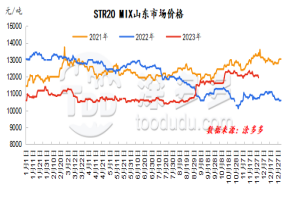

Figure 1: Shandong market price of STR20 MIX Figure 2: Zhejiang market price of ordinary bulk imported from Thailand

dry rubber

Natural rubber market prices fell within a narrow range this week. Recently, the volume of imported rubber arriving in Hong Kong may continue to increase, while the demand side has gradually entered the off-season at the end of the year. The demand for terminal replacement has weakened. The cumulative inventory of China's downstream all-steel tire enterprises has dropped, and the pressure on goods delivery and sales has gradually increased. Purchasing sentiment has declined. In turn, there is insufficient driving force to drag the market up, but in terms of supply. Major production areas in Southeast Asia still have the impact of rainfall in the near future, and glue output has been limited. Chinese production areas are approaching the cutting suspension period. The purchase prices of raw materials have performed strongly, and there is still support at the bottom of rubber prices. There is limited room for overall rubber prices to fall.

natural latex

China's concentrated milk offer remained relatively strong this week. At present, the fundamental supply and demand support of natural rubber is insufficient, suppressing bullish confidence in the market. The futures market fluctuates downward. The market's cautious wait-and-see attitude has increased. The enthusiasm of downstream product companies for inquiries and buying has declined. Some are willing to save on bargain hunting to replenish the stock. Negotiations on price reduction are the main focus. However, the US dollar offers from the processing factory are firm, and the spot supply in the sales area is not under pressure, and natural latex holders have limited willingness to lower prices.

Market outlook forecast:

1、国外产区降雨天气或存缓和预期,季节性上量阶段,原料价格支撑预期走弱;

2、预计下周期轮胎样本企业产能利用率或将下滑;

3、中国青岛库存量或存去库趋势,高库存压力有所缓和;

4、汇率、美联储加息等。