[Natural Rubber]: Rubber Weekly Review (January 18)

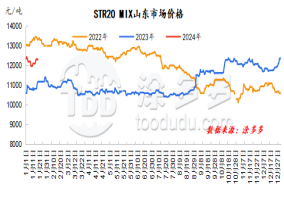

Figure 1: Shandong market price of STR20 MIX Figure 2: Zhejiang market price of ordinary bulk imported from Thailand

dry rubber

Natural rubber market prices adjusted within a narrow range this week. After the recent suspension of cutting in China's production areas, overseas northeastern Thailand and Vietnam's production areas have successively entered the season of cutting and production reduction in the middle and late of this month. As the main supply, the output in the southern part of Thailand's production areas also fell short of expectations. There are tightening expectations on the supply side, and raw material prices are easy to rise but hard to fall. The supply side is favorable to support the narrow rise in rubber prices; while downstream demand is slightly tired. As the Spring Festival holiday approaches, actual digestion is relatively limited. On the whole, the current natural rubber market lacks obvious market guidance, and the fundamentals coexist or operate in shock. In the short term, it is expected that the natural rubber market will lack obvious driving forces or be dominated by shocks.

natural latex

This week, China's concentrated milk offers rose within a narrow range. The price of glue in Thailand's production areas rose more than expected. The raw material market is prone to rise but not fall. The price of processing plants 'cargo offers is firm at a high level. The spot supply in the sales area is low, and the internal and external markets are upside down. Traders mainly offer prices and increase prices, and some are reluctant to sell. Guided by the "buy up" sentiment of downstream product companies, the inquiry atmosphere has warmed up, and appropriate amounts of buying are made to support market prices to explore.

Market outlook forecast:

1、国外产区原料产出收紧预期明显,成本支撑维持高位;

2、预计下周期轮胎样本企业开工率或存小幅走低预期;

3、中国青岛库存量或存去库趋势,高库存压力有所缓和;

4. Exchange rate, Federal Reserve interest rate hikes, etc.