90,189

January 29, 2024, 4:42 PM

Analysis of natural rubber market price on January 29

index

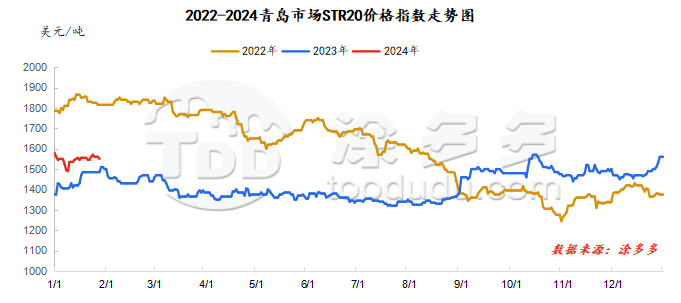

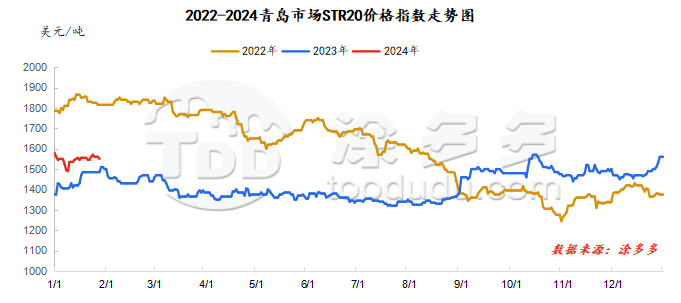

On January 29, the STR20 price index of natural rubber in the Qingdao market was US$1550/ton, down US$10/ton from the previous trading day, or 0.64%.

market analysis

futures market

|

date

|

Previous period: RU Futures

|

|

main contract

|

closing price

|

|

opening price

|

Low-end price

|

High-end price

|

closing price

|

RU01

|

RU05

|

RU09

|

|

January 29

|

13630

|

13470

|

13740

|

13560

|

14660

|

13560

|

13685

|

|

January 28

|

13740

|

13650

|

13770

|

13665

|

14765

|

13665

|

13790

|

|

rise and fall

|

-110

|

-180

|

-30

|

-105

|

-105

|

-105

|

-105

|

|

date

|

Previous period energy: NR futures (closing price)

|

|

NR main force

|

NR01

|

NR05

|

NR09

|

|

January 29

|

11125

|

11500

|

11250

|

11410

|

|

January 28

|

11195

|

11500

|

11320

|

11400

|

|

rise and fall

|

-70

|

0

|

-70

|

10

|

spot market

Supply:

Foreign countries: The production situation in southern Thailand has been affected, which supports raw materials to remain firm to a certain extent and strong cost support.

China: China's production areas have entered a cut-off period, and raw material prices are not available.

|

price type

|

January 26

|

January 29

|

rise and fall

|

units

|

|

raw material prices

|

Thailand

|

glue

|

64.5

|

64.8

|

0.3

|

baht/kg

|

|

cup glue

|

50.35

|

50.59

|

0.24

|

baht/kg

|

|

Yunnan

|

Glue (into the dry glue factory)

|

--

|

--

|

--

|

Yuan/ton

|

|

rubber block

|

--

|

--

|

--

|

Yuan/ton

|

|

Hainan

|

Glue (into the dry glue factory)

|

--

|

--

|

--

|

Yuan/ton

|

|

Glue (Jinnong Dairy Factory)

|

--

|

--

|

--

|

Yuan/ton

|

Demand: At present, some semi-steel tire companies are affected by environmental factors and have limited start-up. Most companies still maintain high levels of operation when starting operations. The overall orders of the company are sufficient. However, orders before the festival are delivered in a centralized manner, and production does not offset the overall situation. The overall inventory shortage still exists. The sales pressure of all steel tire companies has not decreased. Some companies have entered the pre-festival finishing work, and the overall inventory is high.

Futures spot price list

|

price type

|

January 26

|

January 29

|

rise and fall

|

units

|

|

price of finished products

|

Shandong

|

China All Latex

|

12833

|

12833

|

0

|

Yuan/ton

|

|

Qingdao

|

Thailand No. 20 standard glue

|

1560

|

1550

|

-10

|

us dollars/ton

|

|

Qingdao

|

Thailand No. 20 mixed glue

|

12380

|

12300

|

-80

|

Yuan/ton

|

|

Ningbo

|

Hainan

|

10900

|

10900

|

0

|

Yuan/ton

|

|

Ningbo

|

Thailand Non-Yellow Bulk

|

12250

|

12350

|

100

|

Yuan/ton

|

|

the current price difference

|

Main force-Thailand No. 20 mixed glue

|

1285

|

1260

|

-25

|

Yuan/ton

|

|

Main force-China All Latex

|

832

|

727

|

-105

|

Yuan/ton

|

|

relevant exchange rate

|

us dollar against the RMB

|

7.1931

|

7.1986

|

0.0055

|

Yuan

|

|

Thai Baht to RMB

|

0.2054

|

0.2059

|

0.0005

|

Yuan

|

market outlook

After China's production areas stopped cutting, the peak supply period in Thailand has come to an end, overseas supply is in a seasonal contraction, raw material prices are prone to rise but not fall, and expectations for a decline in the volume of standard rubber arriving in Hong Kong are strong. The downstream tire factory is approaching the Spring Festival holiday. After the factory's raw material reserve period, demand is expected to decline, or the upward trend of rubber prices will be limited. However, raw material prices continue to rise, and there is still strong support below the cost end. It is expected that the natural rubber market will fluctuate around this line.